I created a monthly budget spreadsheet that is easy to use and incorporates the 50/30/20 budgeting rule.

This rule suggests that you allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

My spreadsheet is also inspired by the Japanese budgeting method called Kakeibo.

In this article, I’ll explain the philosophy behind my monthly budget spreadsheet and provide step-by-step instructions for using it. Whether you’re new to budgeting or looking for a simpler way to track your finances, this spreadsheet can help you take control of your money.

Free Budget Spreadsheet: The Ultimate Tool for Managing Your Finances

Key Takeaways

- Use the 50/30/20 budgeting rule to allocate your income to necessities, discretionary spending, and savings/debt repayment.

- My monthly budget spreadsheet is easy to use and based on the Kakeibo budgeting method.

- By using this spreadsheet, you can take control of your finances and achieve your financial goals.

50/30/20 Monthly Budget Template

50/30/20 Budgeting Explained

I find the 50/30/20 budgeting method to be a practical and effective way to manage my finances. This budgeting strategy involves dividing your income into three categories: needs, wants, and savings. The 50/30/20 budgeting method is easy to understand and remember, making it a popular choice for many people. You can open the spreadsheet by making a copy that you can edit in Google Sheets by clicking here>. Once you click the link you will want to select Make a copy like the image shows below.

The 50/30/20 budget works as follows:

- 50% for needs: This category includes essential expenses such as rent, groceries, and utilities, as well as non-negotiable costs like insurance premiums or car payments.

- 30% for wants: This category includes discretionary expenses like dining out, entertainment, and hobbies. It also includes expenses that are important to you, such as charitable donations or seasonal wardrobe updates.

- 20% for savings: This category includes putting money into an emergency fund, investing in retirement accounts, and saving for significant financial goals like a down payment on a car or house.

By using this budgeting method, you can create a spending plan that prioritizes your expenses. Instead of focusing on what you can’t spend, you’re telling yourself how much you can spend in each category. This perspective can make budgeting feel less restrictive and more empowering.

The 50/30/20 budgeting method is included in the Google Sheets budget template, which is an excellent tool for tracking your income and expenses. This template automatically calculates your remaining funds for the month, allowing you to monitor your spending and stay on budget.

To personalize the budget template, simply input your income and expenses into the designated categories. The template will do the rest, making it easy to see exactly where your money is going each month.

How to Create Your Personal Monthly Budget Template

Make a Copy of the Spreadsheet

To begin creating your personal monthly budget template, you need to make a copy of the spreadsheet. You can do this by going to File (and then select the blue button that says) Make a copy. This will allow you to save your own copy of the budget spreadsheet. If you prefer to use other applications like Microsoft Excel, you can also copy and paste the fields over into the Excel spreadsheet.

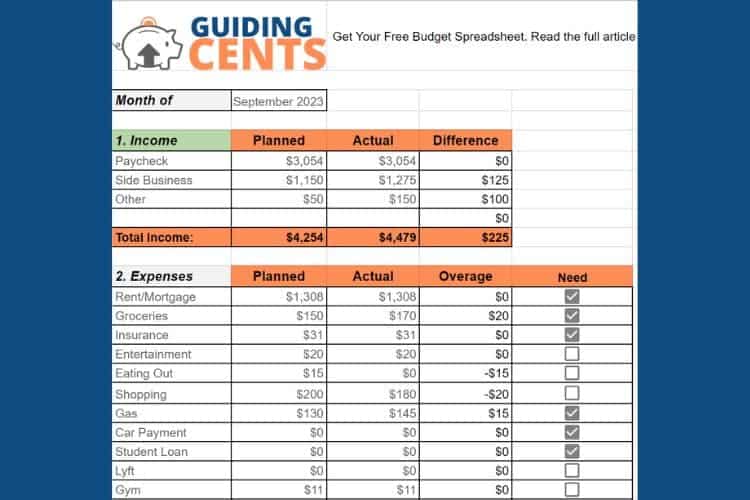

Enter Your Planned Income, Expenses and Savings Goals

Once you have your own copy of the budget spreadsheet, you need to enter your planned income, expenses, and savings goals. Fill in the blanks for your monthly expenses by putting your typical costs in the “Planned” column for each category. For necessary expenses like groceries, rent, and loan payments, check the “Need?” box. Leave the box unchecked for discretionary expenses like dining, shopping, and entertainment.

Enter Your Actual Spending at the End of the Month

At the end of the month, you need to enter your actual spending in the “actual” column. This will help you keep track of what you actually earn, spend, and save throughout the month. The difference field will automatically populate to show whether you are under or over your budget.

See How Your Budget Lines Up with the 50/30/20 Rule

After entering an entire month’s income, savings, and expenses, you can see how your budget lines up with the 50/30/20 rule. The “Totals” box will show the percentage of your income that you spent on necessities, “wants”, and savings. This will help you determine if you need to adjust your budget to meet your financial goals.

Creating your personal monthly budget template is an essential step towards achieving financial stability. By following these simple steps, you can easily track your expenses and savings goals. You may also like this article about how to set up a family budget.

Why You Should Budget Your Whole Income

Figuring Out Your Wants vs. Needs

When it comes to budgeting your income, it’s important to distinguish between your wants and needs. By categorizing your expenses as either a want or a need, you can ensure that you are allocating your money in a way that aligns with your priorities and financial goals.

To begin, you should split your income into three categories: needs, wants, and saving/debt repayment. Needs should make up 50% of your income and include essential expenses such as rent, groceries, and utilities. Wants should make up 30% of your income and include discretionary expenses such as dining out, entertainment, and travel. The remaining 20% of your income should be allocated towards saving and debt repayment.

It’s important to note that everyone’s wants and needs will differ based on their personal circumstances. For example, travel expenses may be considered a need for someone who travels frequently for work. It’s important to be flexible and adjust your budget as needed to reflect your unique situation.

By budgeting your entire income, you can ensure that every dollar is allocated towards a specific expense or goal. This can help you avoid overspending and ensure that you are making progress towards your financial objectives. Additionally, any leftover funds can be directed towards building an emergency fund, investing, or repaying debt.

Tips for Making the Most of Your Monthly Budget Template

Review Your Budget on a Monthly Basis

I find it helpful to review my budget at the beginning of each month. This allows me to ensure that the money I have allocated for each category is accurate and adjust my spending as needed. If there are any changes to my income or expenses, I make sure to update my budget right away.

Track Your Spending

To avoid overspending and save money, I log every purchase or bill payment in my budget spreadsheet. Checking the spreadsheet often helps me stay on track and make adjustments if necessary.

Check in Each Week

I make it a habit to check my remaining totals at the beginning of each week. This helps me identify areas where I might need to cut back and ensure that my income and expenses are accurate. It’s important to remember that a budget can only work if it’s based on accurate information.

Adjust as Needed

If my actual expenses turn out to be more or less than I estimated, I update my budget accordingly. If I have an unexpected expense that I didn’t budget for, I try to make adjustments to my spending. For example, if I overspend in one category for one month, I try to spend less in another.

Stay Positive

Sticking to a budget can be challenging, but it’s important to stay positive and remember that it’s about progress, not perfection. If I go over budget one month, I don’t let it discourage me. Instead, I do what I can to balance my spending and start fresh the next month.

Get my free monthly budget spreadsheet

I’m excited to offer my readers a free monthly budget spreadsheet downloadable by using the link in this article. It’s a great tool for managing your finances and staying on track with your goals. Simply open the spreadsheet and enter your income and expenses for the month. The spreadsheet will automatically calculate your total income, expenses, and savings. It’s easy to use and customizable to fit your specific needs. Download it now and start taking control of your finances!

How the 70 20 10 Budget Rule Works

If you would like to explore another very popular budgeting rule, then take a look at the article I wrote about how to implement the 70/20/10 rule.

Don’t Like Using a Spreadsheet? Try These Apps Instead

If you find that budget templates just don’t work for you, you might want to consider using an app instead. There are several budgeting apps available that can help you create a budget, track expenses, and monitor your cash flow. Here are three of my favorite budgeting apps:

Empower

Empower is a user-friendly budgeting app that allows you to link up your bank account and track your spending. The app provides easy-to-read charts that display your results. Additionally, Empower offers a variety of other features, such as calculators, a fee analyzer, and a retirement planner. The dashboard is comprehensive, and you can get the most out of it by revisiting it often.

PocketSmith

PocketSmith is an excellent beginner-friendly budgeting app and money management tool. It makes it easy to examine your spending habits and take a “big picture” view of your finances. One way PocketSmith helps you do this is with future forecasting. As you set up your next month’s budget, you can take a look at how small decisions impact your finances six months down the road. Then you can play around with budget categories and read reports to understand how you’re really spending your money.

You Need A Budget (YNAB)

YNAB is a more extensive solution that helps you create a zero-based budget. Zero-based budgeting requires you to give every dollar a job and take tracking your spending to the next level. To use this app, you’ll set some goals and log your transactions throughout the month. Then, YNAB’s reporting tools will help you monitor how you’re doing and show you your full financial picture. This is an especially great option for anyone focused on reducing their debt.

These three budgeting apps are just a few of the many options available. Be sure to check out my Best Budgeting Apps article for a comparison of these and other apps.

The Bottom Line

Creating a budget can be an overwhelming task, but it doesn’t have to be. By using my free monthly budget template, you can simplify the process and take control of your finances. With this tool, you can track your spending, identify areas where you can cut back, and set goals for saving and paying off debt. Start taking charge of your financial future today.

What Is Kakeibo And How Does It Work?

Kakeibo is a Japanese budgeting system that helps people manage their finances by tracking their income and expenses in a simple and structured way. The word “kakeibo” literally means “household financial ledger” in Japanese.

Kakeibo works by dividing your expenses into four categories: necessities, optional, culture, and unexpected. Each week, you write down your income and expenses in a notebook or on a spreadsheet, and allocate your expenses to these categories. You then review your spending at the end of the month and identify areas where you can cut back.

Kakeibo also encourages you to set financial goals and prioritize your spending accordingly. For example, you might decide to save a certain amount of money each month for a vacation or a down payment on a house, and adjust your spending in other areas to make sure you meet that goal.

Overall, kakeibo is a simple and effective way to take control of your finances and develop better money habits.

Recent Posts

Experian Boost is a free credit-building tool that can help improve your credit score. It works by allowing you to add positive payment history for bills that are not traditionally reported to credit...

In today's society, many individuals are realizing that the traditional path of going to school, getting a job, and saving for retirement may not lead to the fulfilling life they desire. They may...