Are you interested in investing in international stocks?

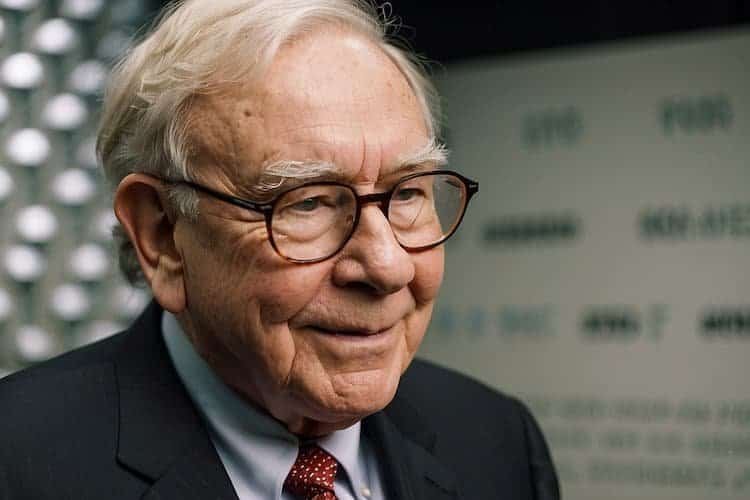

Warren Buffett’s recent investment in Japanese companies may be a sign that the Asian region is ready to take off. With lower inflation rates and solid economic growth forecasts, the region could produce standout returns compared to US and EU stocks.

Investing through exchange traded funds (ETFs) can provide exposure to the entire theme and access to stocks not traded in US markets. Consider funds like the Ishares Japan ETF, Ishares South Korea ETF, Vanguard Pacific Stock Index Fund, Ishares Emerging Markets Asia Fund, and Chinese stocks and ETF choices. Diversifying your portfolio with international stocks can help smooth out returns and potentially provide upside potential.

Key Takeaways

- Warren Buffett’s investment in Japanese companies may indicate a potential opportunity for investors in the Asian region.

- ETFs can provide exposure to international stocks and diversify your portfolio.

- Lower inflation rates and solid economic growth forecasts in the Asian region could produce standout returns compared to US and EU stocks.

Warren Buffett’s Investment in Japanese Companies

Warren Buffett has made a big bet on Japanese companies, investing over 17 billion in stocks of the country’s top five trading houses, namely Itochu, Marubeni, Mitsubishi, Mizuho, and Sumitomo corporations. These companies have become the Japanese equivalent of Berkshire Hathaway, holding significant investments in companies across various sectors of the economy, from logistics to real estate, aerospace, EV, and renewable energy.

Buffett’s investment in these companies is a testament to his confidence in the Japanese economy, and he has increased his stake even further, owning almost 10 percent on average of these trading houses. These trading houses have thousands of subsidiaries and companies, giving them a unique insight into the overall economy, which fits well with Berkshire’s strategy of owning investments across utilities, railroad, financial, and insurance.

Investing in Japanese companies presents an opportunity for Main Street investors to diversify their portfolios and potentially smooth out their returns from a stock crash in the US. The iShares Japan ETF (EWJ) is a great option for investors looking to gain exposure to the Japanese market. The fund holds shares of 237 large and mid-sized companies across the Japanese market and pays a 0.9% dividend yield.

The Japanese market is an industrials-heavy market, complementing US holdings that are more tech-focused. The fund offers exposure to some of the biggest companies in the world, including Toyota, Sony, and Mitsubishi, along with many stocks not otherwise available to US investors, including all five of the trading houses that Buffett is investing in.

Inflation rates across developed Asia are lower than in the US and Europe, making the region a potentially standout performer compared to US and EU stocks over the next year. Morgan Stanley estimates that disinflation in the region is well underway, and inflation is expected to be within target ranges for 80% of the region within the next three months, boosting forecasts for already solid economic growth in the area.

Asian Region Investment Prospects

If you’re looking to diversify your portfolio and potentially benefit from the growth prospects of the Asian region, there are several investment options worth considering. Warren Buffett’s recent investment in Japanese companies suggests that the region could be ready to take off.

Inflation rates across developed Asia are lower than in the US and Europe. China is already lowering its interest rates, with South Korea and Japan expected to start cutting rates soon. This is because most of the region avoided the massive pandemic stimulus that we saw in the US or Europe, leaving the countries in much better fiscal shape with lower inflation rates.

Morgan Stanley estimates that disinflation in the region is well underway, and inflation is expected to be within target ranges for 80% of the region within the next three months. This could boost forecasts for already solid economic growth in the area.

One way to invest in the Japanese market is through exchange-traded funds (ETFs) like the iShares Japan ETF (EWJ), which is up 15% this year. The fund holds shares of 237 large and mid-sized companies across the Japanese market and pays a 0.9% dividend yield. The Japanese market is more industrials-heavy, with exposure to financials and healthcare, complementing your US holdings.

Another option is the iShares South Korea ETF (EWY), which targets large and mid-sized companies holding shares of 103 stocks in the Korean market. This is a tech-heavy fund, with 37% of the portfolio in tech stocks. The stocks trade for an average of just 9.5 times on a price-to-earnings basis, less than half as expensive as US stocks.

For broader exposure to the entire Asian region, you can consider the Vanguard Pacific Stock Index Fund (VPL) or the iShares Asia 50 ETF (AIA). The Pacific fund gives you broad exposure through 2400 stocks and even some Australian exposure, while the Asia fund holds 50 stocks and has nearly 40% invested in China.

For exposure to emerging markets in the region, the iShares Emerging Markets Asia Fund (EEMA) is worth considering. The fund holds exposure to 985 stocks across the region, with a focus on tech stocks, financials, consumer, and communication services.

Finally, for exposure to Chinese stocks, you can consider the iShares MSCI China ETF (MCHI), the iShares China Large Cap ETF (FXI), or the SPDR S&P China ETF (GXC). The GXC ETF is our preferred option due to its better diversification and higher dividend yield.

Overall, investing in the Asian region could be a way to diversify your portfolio and potentially benefit from solid economic growth prospects. Consider these ETF options to gain exposure to the region.

Inflation Rates in Developed Asia

Inflation rates across developed Asia are lower than in the US and Europe. While the US inflation has come down, the FED is still raising interest rates, trying to slow the economy and prices. Europe is still battling out of control inflation and will have to continue to raise rates. In contrast, most of the Asian region avoided that kind of massive scale pandemic stimulus that we saw here in the United States or in Europe. That’s left the countries in much better shape fiscally and with much lower inflation and better able to cut rates to support growth.

China is already lowering its interest rates, with South Korea and Japan expected to start cutting rates much sooner than other developed nations. Morgan Stanley estimates disinflation in the region is well underway and expects inflation to be within target ranges for 80 percent of the region within the next three months. That could boost forecasts for already solid economic growth in the area.

Japan, in particular, has seen decades of low inflation and even deflation, and is welcoming a little higher prices, so it’s likely to stay accommodative on its monetary policy and supportive of economic growth.

Forecasted Economic Growth in Asia

Looking at the data, it appears that the Asian region could produce a standout return versus U.S and EU stocks over the next year. Inflation rates across developed Asia are lower than in the US and Europe, while China is already lowering its interest rates with South Korea and Japan expected to start cutting rates much sooner than other developed nations.

Most of the region avoided the massive scale pandemic stimulus that we saw in the United States or in Europe, leaving the countries in much better shape fiscally and with much lower inflation, making them better able to cut rates to support growth. Morgan Stanley estimates disinflation in the region is well underway and expects inflation to be within target ranges for 80 percent of the region within the next three months, which could boost forecasts for already solid economic growth in the area.

According to the data, while the U.S is expected to slide for the rest of the year, with the hope of rebounding in 2024, the Euro area is expected to crawl along at less than half a percent, while most Asian economies are expected to post one percent or higher growth. This highlights the potential for investing in Asian markets, which could provide an excellent opportunity for investors looking to diversify their portfolios.

Investing in exchange-traded funds (ETFs) that hold stocks from the region or a specific country is an easy way to gain exposure to the entire theme. The iShares Japan ETF (EWJ) and the iShares South Korea ETF (EWY) are two such funds that can provide exposure to the Japanese and Korean markets, respectively. The Vanguard Pacific Stock Index Fund (VLP) and the iShares Asia 50 ETF (AIA) are two other funds that give exposure across the entire theme.

Overall, the data suggests that investing in Asian markets could be a wise choice for investors looking to diversify their portfolios and take advantage of the potential for standout returns.

Investing in International Stocks

If you are looking to diversify your investment portfolio, international stocks could be a great option. Warren Buffett has recently made a big bet in Japanese companies, which could be a sign that the Asian region is ready to take off. In fact, there is a reason to believe that the entire Asian region could produce a standout return versus U.S and EU stocks over the next year.

One easy way to invest in international stocks is through exchange-traded funds (ETFs) that hold stocks from a specific country or region. For example, the iShares Japan ETF (EWJ) holds shares of 237 large and mid-sized companies across the Japanese market, including the top five trading houses that Berkshire Hathaway has invested in.

Another option is the iShares Asia 50 ETF (AIA), which holds 50 stocks across the entire Asian region. However, the Vanguard Pacific Stock Index Fund (VPL) could be a better choice for diversification and ex-China Asia strategy, as it holds 2400 stocks and even some Australian exposure.

It’s worth noting that foreign stocks generally trade much more cheaply than U.S stocks, with the Japanese market trading at just 14.6 times its earnings reported by the companies. Additionally, international stocks can help you smooth out your returns from a stock crash in the U.S, as having just five or ten percent of your money in international stocks can be beneficial.

While investing in international stocks can offer great potential, it’s important to do your due diligence and research before making any investment decisions. Make sure to compare the stocks in a fund with your own portfolio to avoid any overlap in a sector or a stock.

Investing Through Exchange Traded Funds

If you’re looking to invest in the Japanese market, the iShares Japan ETF (EWJ) is a great option. This ETF holds shares of 237 large and mid-sized companies across the Japanese market, including all five of the trading houses that Warren Buffett is buying. The fund pays a 0.9% dividend yield and trades for a price of just 14.6 times its earnings reported by the companies, which is a 27% discount to the price of 20 times earnings for stocks in the S&P 500.

Learn more about ETFs and their advantages here.

For exposure to the South Korean market, the iShares South Korea ETF (EWY) is a strong fund for growth investors. This ETF holds shares of 103 large and mid-sized companies across the Korean market, including familiar names like Samsung and LG. The fund trades for an average of just 9.5 times on a price-to-earnings basis, which is less than half as expensive as U.S. stocks.

If you’re looking for exposure across the entire Asian region, the Vanguard Pacific Stock Index Fund (VPL) is a great option. This ETF gives you broad exposure through 2,400 stocks and even some Australian exposure. Many of the stocks you saw in the country-specific funds like Samsung, Toyota, and Sony are also included in this fund.

For exposure to emerging markets in Asia, the iShares Emerging Markets Asia Fund (EEMA) is a good option. This ETF holds shares of 985 companies across the region, including tech stocks, financials, consumer, and communication services.

When it comes to investing in Chinese stocks, the SPDR S&P China ETF (GXC) is a great option. This ETF holds shares of 950 companies and has slightly better sector diversification than the other Chinese ETFs. It also has a higher dividend yield and a lower expense fee compared to the other options.

If you’re looking for exposure to the Japanese market, the iShares Japan ETF (ticker: EWJ) is a great option to consider. This ETF holds shares of 237 large and mid-sized companies across the Japanese market, including the top five trading houses that Warren Buffett has been investing in. With a year-to-date return of 15%, the fund also pays a 0.9% dividend yield.

One of the benefits of investing in foreign stocks is the potential for cheaper valuations, and the EWJ is no exception. The fund trades at a price-to-earnings ratio of just 14.6 times its earnings reported by the companies, which is a 27% discount to the price of 20 times earnings for stocks in the S&P 500.

The Japanese market is more heavily weighted towards industrials, financials, and healthcare, which can complement your U.S holdings. The fund also includes many stocks not otherwise available to U.S investors, including all five of the trading houses that Buffett is investing in.

To get a closer look at the stocks in the fund, you can check out the holdings in the menu. This will show you the top 10 largest positions, and you can also download a list of all the holdings to compare with your own portfolio.

Overall, the iShares Japan ETF is a solid option for investors looking to gain exposure to the Japanese market and diversify their portfolio.

Get The Latest Issue Of The Guiding Cents Newsletter Sent Straight To Your Inbox

Join 97,000+ getting mind knowledge every Saturday morning while reading, you’ll learn a bit about life & business too. Just click the button to go to the signup page which opens in a new tab.

If you’re looking for an ETF that focuses on South Korea, the iShares South Korea ETF (ticker EWY) might be a good option to consider. This ETF holds shares of 103 large and mid-sized companies in the Korean market, with a focus on IT stocks. In fact, 37% of the fund is invested in tech stocks, making it a strong choice for growth investors.

One of the advantages of investing in foreign stocks is that they often trade at lower valuations than US stocks, and the EWY is no exception. The stocks in this fund trade for an average of just 9.5 times earnings, which is less than half as expensive as US stocks. Additionally, inflation in Korea is coming down fast, already at 2.7% annualized, and likely to be at the central bank’s target of 2% by the end of the year.

While Samsung dominates the Korean market and accounts for 23% of the fund’s holdings, the ETF is market-weighted, so you’ll still get exposure to a variety of other companies and sectors. And with GDP forecasts for Korea being the weakest in the region, it’s likely that stimulus will come sooner rather than later, which could mean a big upside surprise for these stocks.

Overall, the iShares South Korea ETF could be a good choice for investors looking to diversify their portfolio with exposure to the Korean market and IT sector.

Vanguard Pacific Stock Index Fund is an excellent choice for investors looking for broad exposure to the Pacific region. With a low expense ratio of just 0.08%, this fund is an affordable way to invest in over 2,400 stocks from countries like Japan, Australia, and South Korea.

One of the benefits of this fund is its ex-China strategy, which means it does not invest in Chinese stocks. This may be appealing to investors who are wary of the risks associated with investing in China, such as regulatory uncertainty and geopolitical tensions.

The fund is heavily weighted towards industrials, financials, and consumer discretionary sectors, which complement well with US holdings that are more tech-focused. Some of the top holdings in the fund include Toyota, Samsung, and BHP.

Another advantage of this fund is its strong dividend yield of 2.6%, which can provide income for investors. However, it’s important to note that the Pacific region can be volatile, and investors should be prepared for potential ups and downs in the market.

Overall, Vanguard Pacific Stock Index Fund is a solid choice for investors looking for exposure to the Pacific region. Its low expense ratio, ex-China strategy, and diversified holdings make it a great addition to any portfolio.

If you’re looking for exposure to the entire theme of emerging markets in Asia, the iShares Emerging Markets Asia Fund (EEMA) is worth considering. With 985 stocks across the region, this ETF offers a broad range of investments, including tech stocks, financials, consumer goods, and communication services.

While the fund is heavily invested in China, it also includes stocks from Thailand, Indonesia, and India. As of August 2023, the fund has a price-to-earnings ratio of 14.6, which is a 27% discount to the price of 20 times earnings for stocks in the S&P 500. This makes it an attractive option for those looking for cheaper investments.

The iShares Emerging Markets Asia Fund has a relatively low expense ratio of 0.49%, making it an affordable option for investors. The fund also pays a dividend yield of 2.3%, which is higher than the yield of the S&P 500.

Overall, the iShares Emerging Markets Asia Fund is a solid choice for investors looking for exposure to emerging markets in Asia. With a diverse range of investments and a relatively low expense ratio, this ETF offers a good balance of risk and reward.

Chinese Stocks and ETF Choices

If you are looking to invest in Chinese stocks, there are several ETF choices available to you. Warren Buffett’s recent investment in Japanese companies has caused a stir in the market, but China is also worth considering. The Chinese economy is currently out of lockdowns and is on the upswing, making it an attractive market for investors.

You can choose from three ETF options for investing in Chinese stocks: iShares MSCI China ETF (MCHI), iShares China Large-Cap ETF (FXI), and SPDR S&P China ETF (GXC). The MCHI fund is better diversified across 645 stocks and has slightly better sector diversification, though it is still heavily invested in financials. The FXI fund only holds shares of 50 companies and is much more concentrated in just three sectors, with a heavy focus on state-owned banks. The GXC fund, on the other hand, has shares of 950 companies and a sector breakdown that is very close to the MCHI fund, but with a slightly higher dividend yield.

When investing in Chinese stocks, it is important to keep in mind that the Chinese market is in a far different position than most other countries. While the economy is flatlining, it is just out of its lockdowns and on the upswing. It is crucial to do your research and choose the ETF that best fits your investment goals and risk tolerance.

Investing in Chinese stocks can be a great way to diversify your portfolio and take advantage of the growth potential in the region. With the right ETF choice, you can gain exposure to a wide range of Chinese companies, including tech, financials, and healthcare.

Recent Posts

Experian Boost is a free credit-building tool that can help improve your credit score. It works by allowing you to add positive payment history for bills that are not traditionally reported to credit...

In today's society, many individuals are realizing that the traditional path of going to school, getting a job, and saving for retirement may not lead to the fulfilling life they desire. They may...