Managing your finances can be a daunting task, but with the help of the 50/20/30 budget rule, it can become much simpler. Popularized by U.S. Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan, this rule divides your after-tax income into three categories of spending: 50% on needs, 30% on wants, and 20% on savings.

By following this intuitive and straightforward rule, you can create a reasonable budget that you can stick to over time, helping you to meet your financial goals. The 50/20/30 rule is designed to help individuals balance paying for necessities while being mindful of long-term savings and retirement, making it an effective template for managing your money.

50%: Needs

To ensure you are meeting your basic survival needs, it is recommended that you allocate 50% of your after-tax income towards necessities. This includes expenses such as rent or mortgage payments, car payments, groceries, insurance and health care, minimum debt payments, and utilities. If you find yourself spending more than 50% on needs, it may be necessary to cut back on wants or downsize your lifestyle. Consider options such as carpooling or taking public transportation, cooking at home more often, or moving to a smaller home or more modest car. By prioritizing your needs, you can ensure that you are meeting your basic living expenses without overspending.

30%: Wants

When it comes to your spending, wants are all the things that you don’t necessarily need, but that make life more enjoyable. This category includes optional expenses like going out to eat, attending sporting events, and traveling for leisure. It also includes upgrade decisions, such as buying a more expensive steak or purchasing a luxury car.

Examples of wants include new clothes or accessories, tickets to events, vacations, and the latest electronic gadgets. If you find that you’re spending too much on wants, it may be worth reevaluating your priorities and finding ways to cut back.

When it comes to wants, it’s important to find a balance between enjoying life and being financially responsible. You can still indulge in your wants, but it’s important to do so within your means. Consider setting a budget for your wants and sticking to it, or finding ways to enjoy the things you love without spending as much money.

20%: Savings

Allocating 20% of your net income to savings and investments is a sound financial strategy. It is recommended that you keep at least three months’ worth of emergency savings in case of unexpected events such as job loss or medical emergencies. Once you have established your emergency fund, focus on saving for retirement and meeting other long-term financial goals.

There are various ways to save and invest your money, including:

- Creating an emergency fund

- Making IRA contributions to a mutual fund account

- Investing in the stock market

- Setting aside funds to buy physical property for long-term holding

- Making debt repayments beyond minimum payments

If you ever need to use your emergency funds, it is important to prioritize replenishing the account with additional income. By following these practices, you can ensure a secure financial future for yourself.

Importance of Savings

Savings play a crucial role in achieving financial stability and security. The 50-20-30 rule is a helpful guideline to manage your after-tax income, with a focus on creating an emergency fund and saving for retirement. By prioritizing an emergency fund, you can be prepared for unexpected expenses, such as job losses or medical emergencies. Once the emergency fund is established, it’s important to continue replenishing it.

Saving for retirement is also essential, especially as people are living longer. By calculating how much you will need for retirement and starting to save at a young age, you can ensure a comfortable retirement. It’s never too early to start saving, and even small contributions can add up over time.

Despite the high levels of debt in the United States, it’s important to prioritize savings to achieve financial stability and security. By following the 50-20-30 rule and focusing on emergency funds and retirement savings, you can take control of your finances and secure your future.

Benefits of the 50/30/20 Budget Rule

Following the 50/30/20 rule can provide numerous benefits for your financial well-being. Here are some of the advantages you can expect:

- Ease of Use: The 50/30/20 rule provides a simple and easy-to-understand framework for budgeting. You can allocate your income without the need for complex calculations, making it accessible for even the least financially-savvy individuals.

- Achieve Financial Balance: By using a budget, you can manage your money in a balanced way. You can ensure that your essential expenses are covered, have money for discretionary spending, and actively save for the future. This way, you can save for your future, meet your current needs, and still have some fun with your finances.

- Prioritize Essential Expenses: The 50/30/20 rule ensures that you prioritize your fundamental needs without overspending or taking on excessive debt. By allocating half of your budget towards essential expenses, you can guarantee that your basic needs are met.

- Emphasize Saving Goals: Allocating 20% of your income to savings can help you establish an emergency fund, prepare for retirement, pay off debt, invest, or pursue other financial goals. Consistently saving this amount can help you build sound financial practices and create a safety net for unforeseen costs or future goals.

- Promote Long-Term Financial Security: By continuously setting aside 20% of your income for savings, you prioritize your financial future. This savings can help you accumulate wealth, meet long-term financial objectives, and provide financial security for you and your family in the short or long-term.

Remember that the 50/30/20 rule can be applied by anyone, regardless of income. However, it’s important to note that those with lower income or living in areas with a higher cost of living may need to adjust these percentages accordingly. By following these guidelines, you can achieve financial stability and security for your future.

How to Adopt the 50/30/20 Budget Rule

Track Your Expenses

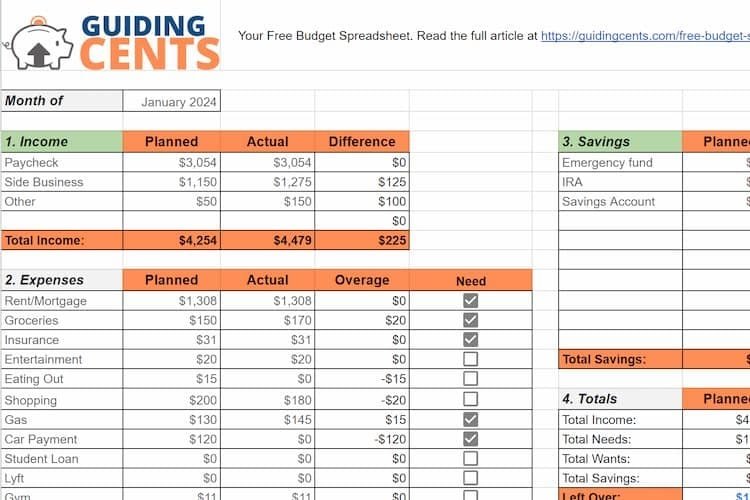

To effectively adopt the 50/30/20 budget rule, it is important to track your expenses. This will help you understand your spending habits and determine how well they adhere to the 50/30/20 breakdown. You can achieve this by classifying your expenses into needs, wants, and savings for a month or two. This will give you a clear picture of how far off your budget you are starting from. You can easily track your expenses using spreadsheet solutions such as Microsoft Excel.

Understanding Your Income

Understanding your income is key to adopting the 50/30/20 budget rule. You need to know your gross income and net income, as federal income taxes reduce what you take home. Knowing what you earn and what hits your bank account each pay period will help you establish the correct budget amounts for the three categories.

Identify Your Critical Costs

Identifying your critical costs is crucial when adopting the 50/30/20 budget rule. These costs include non-negotiable expenses such as rent or mortgage payments, utilities, groceries, transportation expenses, insurance premiums, and debt repayments. Since these expenses may take up the largest portion of your budget, it’s important to be mindful of them. You have the least amount of flexibility once you commit to these expenses. For instance, locking into a rental agreement may require a six-month or 12-month requirement.

Automate Your Savings

Automating your savings is a great way to simplify the process. You can set up monthly automated payments from your checking account to your investment or savings accounts. This guarantees that your funds increase steadily without requiring manual labor. Automating your savings also makes it easier to regularly review your budget to ensure it aligns with your lifestyle and financial objectives as there is less administrative burden to manage your savings.

Maintain Consistency

To successfully adopt the 50/30/20 budget rule, consistency is key. Stick to your spending strategy over time and resist the urge to go over budget or depart from your percentage allocations. Like any other form of budget, this plan is often most successful when there are clear guidelines that can be leveraged every month. Be mindful to reset your spending limits each month and strive to maintain consistency from one period to the next.

Example of the 50/30/20 Budget Rule

If you are looking for a simple and effective way to manage your finances, the 50/30/20 budget rule can be a great option. This budgeting method suggests allocating 50% of your after-tax income to essential expenses, 30% to discretionary expenses, and 20% to savings and debt repayment.

To apply this rule, start by tracking your expenses for a month. Use a budgeting app to automatically categorize your expenses into needs, wants, and savings. Then, calculate your monthly after-tax income, which will serve as the basis for allocating your budget.

For example, if your after-tax income is $3,500 per month, you would allocate $1,750 (50%) to cover your essential expenses like rent, utilities, groceries, transportation, and student loan payments. You would then allocate $1,050 (30%) to discretionary items like dining out, entertainment, and clothing. Finally, you would allocate $700 (20%) each month to retirement and savings.

Once you have set up your budget, it is important to remain disciplined and consistent. Consider setting up an automatic transfer from your checking account to your savings account on your payday to make saving effortless.

As your income or expenses change, it is important to reevaluate your budget and adjust as needed. For example, if you are promoted and your income increases, you may want to allocate more to savings or discretionary expenses. If you find that your transportation expenses are higher than expected, you may want to consider carpooling or using public transportation to reduce costs.

By following the 50/30/20 budget rule and regularly evaluating your progress toward your goals, you can take control of your finances and prioritize your financial well-being.

Related content:

- Strategies for Savings and Investing in a Volatile Market

- Is It Better to Buy a New or Used Car?

- 10 Ways To Get Out Of Debt This Year: Expert Tips

- Easy Ways To Earn Free Amazon Gift Cards

- How Much You Really Need to Be Financially Independent?

Can You Adjust the Percentages in the 50/30/20 Rule to Fit Your Needs?

Yes, you have the flexibility to modify the percentages in the 50/30/20 rule to better suit your financial goals and circumstances. For instance, if you live in an area with a higher cost of living, you may need to allocate more than 50% towards necessities. Alternatively, if you have ambitious retirement saving goals, you may need to adjust the 20% towards savings and investments. Remember, the 50/30/20 rule is a guideline, and you can modify it to fit your unique needs.

Should You Include Taxes in the Calculation of the 50/30/20 Rule?

The 50/30/20 rule usually excludes taxes since it focuses on allocating income after taxes. It’s important to consider your after-tax income when applying the rule. If you choose to factor in taxes, make sure to use gross income and accurately forecast your taxes.

How to Budget Effectively with the 50/30/20 Rule

To successfully budget with the 50/30/20 rule, you need to keep track of your expenses, prioritize necessary expenses, be mindful of your wants, and consistently allocate savings or debt repayment within the designated percentage.

| Category | Percentage |

|---|---|

| Essential Needs | 50% |

| Wants | 30% |

| Savings/Debt Repayment | 20% |

- Keep track of all your expenses

- Prioritize your essential needs such as housing, food, utilities, and transportation

- Be mindful of your wants and allocate 30% of your budget towards them

- Allocate the remaining 20% towards savings or debt repayment

- Regularly evaluate your spending and adjust accordingly

Can You Use the 50/30/20 Rule for Long-Term Goals?

Yes, you can use the 50/30/20 rule to save for long-term goals. Set aside a portion of the 20% for savings specifically for your long-term goals, such as a down payment on a house, education funds, or investments. This rule is designed to help you prioritize your savings goals.

The Bottom Line

Following the 50-20-30 rule can give you a clear plan for managing your after-tax income. By limiting your wants to 30%, you can allocate more funds towards important areas such as emergency savings and retirement. It’s important to enjoy life, but having a plan and sticking to it will help you cover your expenses and save for retirement while doing the things that make you happy. Remember, unexpected expenses can arise at any time, so having emergency savings is crucial. By following this rule, you can ensure that you’re taking care of your finances while still enjoying life to the fullest.

Recent Posts

Experian Boost is a free credit-building tool that can help improve your credit score. It works by allowing you to add positive payment history for bills that are not traditionally reported to credit...

In today's society, many individuals are realizing that the traditional path of going to school, getting a job, and saving for retirement may not lead to the fulfilling life they desire. They may...