What Is Discounted Cash Flow (DCF)?

Discounted cash flow (DCF) is a method used to estimate the value of an investment based on its expected future cash flows.

DCF analysis shows us how to figure out the value of an investment today by basing future projections of how much money it will generate later down the road.

Since most of the benefits of a stock or other other investment will not be seen until later down the road.

It answers the question: is one dollar in 4 years time worth as much as one dollar is today?

Some weighting should be allocated to future costs and benefits to reflect what management accountants call ‘The Time Value Of Money’.

This is why we use the discounted cash flow process to see the value of our investment in its related concept Net Present Value (NPV).

When we add each of the discounted cash flows up we produce the NPV of the investment.

This applies to both investors sinking money into financial investments, and for business owners looking to make changes to their businesses, like purchasing new equipment or space.

A discount rate is applied to future costs and benefits to reflect that present value.

Using a discounted cash flow (DCF) model to calculate the intrisic value of a stock is a mixture of art and science.

The mathematical part is of course pure science, yet finding the numbers to go into the formula is art.

The science behind the math says we measure the current value of a company.

Next apply a growth rate to calculate how much that value may increase over time as the company hopefully grows.

Lastly, apply a discount rate to account for any risk involved.

This can indicate how much the companies future growth is worth now.

So that’s how you estimate the intrisic value of a stock.

As stock prices constantly move as people buy and sell shares at different price levels it’s clear that every market participant has a different expectation of a stocks future performance and risk.

This holds true even with the DCF model we’re discussing. This is where we apply the art side of our formula.

Different expectations lead to different stock evaluation numbers.

If we have a stock with annual earnings of $5 per share, lets say one investor expects earnings to be conservative at 5% per year.

Lets say our second investor expects annual earnings to grow at 10% per year because they are in the mindset the companies new product will sell better than expected.

To think about it the difference between the two may not seem like much at first yet it is nearly a 60% difference.

As we just demonstrated a small change like the growth rate can make a huge difference over time.

The same is true of other variables. The discount rate for example would be one.

Just because valuation analysis is a mixture of science and art, does not mean you can’t make educated decisions.

Lets Recap How Discounted Cash Flow Works

The purpose of DCF analysis is to estimate the money an investor would receive from an investment, adjusted for the time value of money.

The time value of money assumes that a dollar today is worth more than a dollar tomorrow because it can be invested.

A DCF analysis is appropriate in any situation where a person is paying money in the present with expectations of receiving more money in the future.

All you need is some experience and support to go along with it. With these two in your corner you can learn to make reasonable assumptions.

When you decide to estimate a stocks value you can conduct an educated analysis along with it with confidence your estimate is built on a solid foundation.

What is the DCF Formula Used For?

The DCF formula is used to determine the value of a business or a security.

The DCF formula represents the value an investor would be willing to pay for an investment, given a required rate of return on their investment (the discount rate).

Here Are Some Other Examples Of Uses For The DCF Formula:

- To value an entire business

- To value a project or investment within a company

- To value a bond

- To value shares in a company

- To value an income-producing property

- To value the benefit of a cost-saving initiative at a company

- To value anything that produces (or has an impact on) cash flow

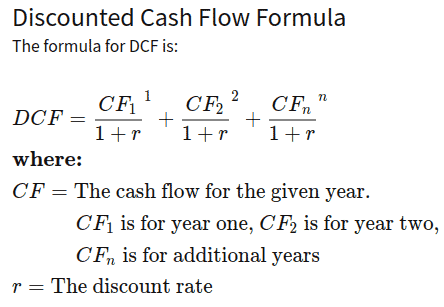

Discounted Cash Flow (DCF) Formula – Tutorial

Recent Posts

Experian Boost is a free credit-building tool that can help improve your credit score. It works by allowing you to add positive payment history for bills that are not traditionally reported to credit...

In today's society, many individuals are realizing that the traditional path of going to school, getting a job, and saving for retirement may not lead to the fulfilling life they desire. They may...