As many people already know, John Bogle, or Jack as he preferred to be called, is one of the legendary all time investors and he actually created the Index Fund. He is the founder of Vanguard in 1975, which was the first discounted service for personal investors.

Warren Buffet is stated as saying, “Bogle has done more for the individual investor than just about anybody in history.”

Although Jack Bogle passed in 2025, his philosophy and amazingly strong portfolio strategy lives on. One significant thing about Jack is he dedicated his life to ensure it was the individual investor, not the corporation, that took home the grand share of profit.

You’re about to see his 2021 portfolio. How can I show it to you if he’s not with us anymore? Because his portfolio strategy didn’t really change over time and was solid as a rock.

The big debate has always been how much in bonds and how much in stocks.

Jack’s portfolio would be 100% in stocks for maximum returns, and he would be in the Index Fund VTSMX. The ETF version is VTI. Over the long term it will outperform the split against bonds.

Now lets take a look at how VTI has performed over the past ten years. Wow, as you can see it’s pretty much 200% as the arrow points to the 199.59%. That’s an average of 20%.

Bear in mind the historical average of the S&P 500 performance is closer to 10%. So US Stocks are outperforming that average.

As you age Jack mentioned having about 50% in stocks and 50% in bonds. Investopedia mentions Jack advocating a mixture of bonds being a split between intermediate bonds and inflation bonds.

Also, as a bonus, lets see below how to get to the one million dollar mark using his founded Low-fee Index Fund investing strategy.

Fees can kill your gains. That was one of the big quarrels Jack Bogle had with Mutual Funds and other strategies before he invented low fee and Index Fund investing.

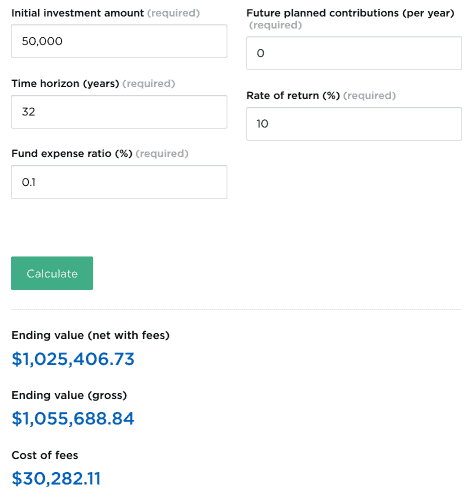

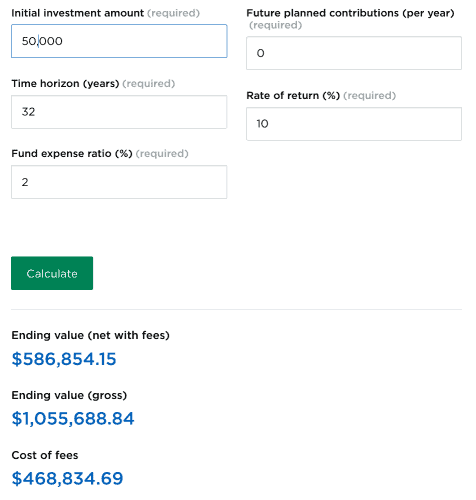

Take this example of the huge importance of expenses in your fund. Here is an eye-watering example of how just small fees steal your wealth by killing your gains.

Lets use $50,000 as the initial investment. Over the 32 year period with the 0.1% fees you would become a millionaire. On the other hand with the 2% fee you would only have $586.854.15.

As you clearly see in the above example, fees are a major deterrent. We see the amount lost due to fees is 44%. Even though this small little 2% seems insignificant, it has taken 44% of your total fund.

Everyone reading this needs to dig into their funds and find out exactly where your pension money is being invested.

Also, do you know the exact breakdown of all the fees you are paying in your current pension?

There are tens of thousands of people worldwide who are putting away pension money and they have no idea what they are being charged or where the money is going.

If I can do one thing it would be to carry on Jack Bogle’s work of helping people understand they don’t need to pay fees these toxic funds are taking.

“Don’t Do Something, Just Stand There”

Jack Bogle

I love this above quote and basically what Jack is saying is, when things seem uncertain, when things are going bad in the economy and market, 99 out of 100 times the best thing you can do is nothing, and just keep adding to your index fund.

Recent Posts

Experian Boost is a free credit-building tool that can help improve your credit score. It works by allowing you to add positive payment history for bills that are not traditionally reported to credit...

In today's society, many individuals are realizing that the traditional path of going to school, getting a job, and saving for retirement may not lead to the fulfilling life they desire. They may...