Misconceptions About Financial Independence.

With financial independence, there are many misconceptions that people have.

One of the biggest misconceptions is that earning a high salary is the key to achieving financial independence.

I want you to know that this is not entirely true. What really matters is not how much you earn, but how much you keep and invest.

A good example would be the famous boxing champion, Mike Tyson. He earned a whopping 495 million dollars in his career, but he reportedly spent 495,000 a month, which led to his bankruptcy. If someone earns $37,000 a year and spends only $13,000, they can save $24,000, which is two years of living expenses.

Another misconception is that financial independence is unattainable for most people. However, this is not true either. By calculating what you save as a percentage of your take-home pay, you can determine how long it will take you to achieve financial independence based on your current circumstances.

Mr. Money Mustache’s blog post, “The Shockingly Simple Math Behind Early Retirement,” provides a table that calculates how many years you need to work based on how much of your wage you save. For instance, if your take-home pay is 40k a year, and you invest 12,000 dollars a year, your saving rate is 25%, and you can achieve financial independence in 32 years.

It is also a misconception that the historical average return on the stock market is only 5%. While Mr. Money Mustache’s calculations use this conservative number, the historical average is actually 7%. It is recommended to invest in low-cost global index trackers instead of individual companies.

Furthermore, the relationship between savings rate and time to reach financial independence is not linear, but exponential. This means that if you spend all of your income every month, you will never retire unless you have help from a pension fund, lottery, or inheritance. On the other hand, if you are able to save 100% of your income, you are financially independent.

To achieve financial independence, it is important to track your spending and make it a game. Gamification can help with engagement, enjoyment, and execution. By tracking your progress and giving yourself rewards or forfeits, you can make the process more enjoyable and effective.

In summary, financial independence is attainable for anyone who is willing to save and invest. It is not about earning a high salary, but about what you keep and invest. By tracking your spending and making it a game, you can work towards achieving financial independence and living a life of freedom.

Realities of Financial Independence

Becoming financially independent is achievable in a relatively short period of time, even starting from scratch. It is not about earning a massive salary, but rather what you do with what you earn. Saving and investing are the keys to achieving financial independence.

To calculate how long it would take to become financially independent, one can calculate the percentage of their take-home pay that they save. Mr. Money Mustache has calculated how many years it would take to become financially independent based on the percentage of income saved. The calculations are based on the assumption of a 5% annual return on investment and living off 4% of investment gains while leaving 1% in the pot.

The national average saving rate in the UK is 2.9% per year, and in the US, it is 6.3%. People in the UK could retire in 77 years at that rate, while the US could retire in 61 years.

The connection between savings rate and financial independence time is not straightforward, it’s exponential. This means that by saving more, even just a little, can reduce the time it takes to become financially independent..

To achieve financial independence in a shorter period, one needs to increase their savings rate. For example, if one invests half of their income, they could retire in 70 years. If they invest three-quarters of their income, they could retire in seven years.

To increase savings, it is essential to track spending and reduce unnecessary expenses. Tracking every penny earned and spent helps to identify areas where expenses can be reduced. Applying gamification to this process can make it more engaging and enjoyable.

In summary, achieving financial independence is possible by saving and investing wisely. It requires tracking spending, reducing expenses, and increasing savings rates. With discipline and dedication, one can become financially independent in a relatively short period.

The Role of Savings and Investments

Financial independence is not about earning a massive salary, but rather about what you keep and how you manage it. It’s not what you earn, but what you save and invest that really matters. The key to achieving financial independence is to save and invest money wisely.

To become financially independent, you need to save and invest a certain percentage of your take-home pay. Mr. Money Mustache has calculated how many years it will take to reach financial independence based on your saving rate. For example, if you take home 40k a year after tax and you invest 12,000 dollars of that a year, your saving rate is 25 and you’ll be financially independent in 32 years.

If you spend all your money every month and never save, you can’t retire without help from a pension fund, lottery, or inheritance. This is because the relationship between savings rate and time to reach financial independence is exponential, not linear.

To retire early, you need to save and invest a significant portion of your income. For example, if you invest three-quarters of what you earn, you’ll retire in seven years. It’s important to track your spending and make it a game to reduce your expenses and increase your savings rate.

Investing in low-cost global index trackers is a great way to start investing in the stock market. The historical average return is seven percent, but even with inflation, you can expect a five percent return. You should live off four percent of your investment gains and leave one percent in the pot to ensure you don’t run out of money in retirement.

In summary, the key to achieving financial independence is to save and invest wisely. By tracking your spending, making it a game, and investing in low-cost index trackers, you can retire early and enjoy financial freedom.

Understanding the Shockingly Simple Math Behind Early Retirement

I learned about achieving financial independence in less than seven years from a blog post by Mr. Money Mustache titled “The Shockingly Simple Math Behind Early Retirement.” The key to financial independence is not earning a massive salary, but rather what you do with the money you earn. It’s not about how big your salary is, but how much you save and invest.

To calculate how long it will take you to achieve financial independence, you need to calculate what percentage of your take-home pay you save. Mr. Money Mustache has created a table that shows how many years you’ll need to work based on how much of your wage you save.

Assuming a 5% annual return in the stock market, and living off 4% of your investment gains while leaving 1% in the pot, you can calculate your path to financial independence. For example, if you take home £40k a year after tax and invest £10k of that a year, your saving rate is 25% and you’ll be financially independent in 32 years. If your take-home pay is £80k a year and you invest £4k a year, your saving rate is 5% and you could retire in 66 years.

However, the relationship between savings rate and time to reach financial independence is not linear, but rather exponential. If you’re spending all of your income every single month and never saving a penny, you’ll never retire unless you have help from a pension fund, the lottery, or an inheritance. On the other hand, if you’re able to save 100% of your income every single month, you’re financially independent.

Most of us exist somewhere in the middle. To retire in seven years, you need to invest three-quarters of what you earn. If you invest half of your income, you could retire in 70 years. By reducing your expenses, you can increase your savings rate and accelerate your path to financial independence.

To work towards financial independence, it’s important to track your spending and reduce your expenses. Applying gamification to this and other areas you want to improve can help with engagement, enjoyment, and execution. By making small changes and consistently tracking your progress, you can achieve financial independence and retire early.

Key Assumptions for Financial Independence

To become financially independent, it is crucial to understand that it’s not about earning a massive salary, but it’s about what you keep and how you invest it. Mr. Money Mustache, a well-known blogger, has calculated how many years one needs to work based on how much of their wage they save. The following are the key assumptions for financial independence:

- Winning 5% a year in the stock market even with inflation.

- Living off 4% of your investment gains and leaving 1% in the pot, meaning theoretically, you shouldn’t run out of money in retirement.

It is important to note that these assumptions are a bit conservative as the historical average is seven percent. However, one must invest in low-cost global index trackers rather than buying individual companies.

Furthermore, the relationship between savings rate and time to reach financial independence is not linear; it’s exponential. If you spend all of your income every single month and never save a penny, you’ll never retire unless you have help from a pension fund, the lottery, or an inheritance. On the other hand, if you’re able to save 100% of your income every single month, then you’re financially independent. Most of us exist somewhere in the middle, so it’s important to track your spending and make it a game to beat your previous records every month.

Current National Averages and Their Implications

The average saving rate in the UK is 2.9%, which means that people in the UK could retire in 77 years. In the US, the average saving rate is over twice as much at 6.3%, which means that people in the US could retire in 61 years. However, the relationship between savings rate and time to reach financial independence is not linear but exponential. This means that if you’re spending all of your income every single month and never saving a penny ever, you’ll never retire unless you have help from a pension fund, the lottery, or an inheritance.

Let’s take a closer look at some key milestones. If you quadruple the UK average to 10% and invest £200 a month, you can retire in 51 years. If you invest 25% of your salary or £500 a month, you’ll bring that down to 32 years. If you invest half of your income, you could retire in 70 years. And if you invest three-quarters of what you earn, you’ll retire in seven years.

The current national averages show that it’s not what you earn but what you save and invest that really matters. To become financially independent, you need to track your spending and reduce your expenses. Applying gamification to this and any other area you want to improve can help with engagement, enjoyment, and execution. By making it a game and tracking your progress, you can achieve your financial goals faster.

The Relationship Between Savings Rate and Time to Reach Financial Independence

Based on my research, the key to achieving financial independence is not about earning a high salary, but rather about saving and investing a significant portion of that income. By calculating what you save as a percentage of your take-home pay, you can determine how long it will take for you to become financially independent.

According to Mr. Money Mustache, a well-known financial blogger, the relationship between savings rate and time to reach financial independence is exponential, not linear. This means that the more you save, the faster you will reach financial independence.

For example, if you take home $2,500 a month after tax and invest 10% of that, or $200 a month, you could retire in 51 years. However, if you invest 25% of your salary, or $500 a month, you could retire in 32 years. If you invest half of your income, you could retire in 20 years, and if you invest three-quarters of what you earn, you could retire in just 7 years.

These numbers are based on some assumptions, including a 5% yearly return in stocks and using 4% of investment gains for living expenses, leaving the other 1% in the investment. However, these assumptions are conservative, as the historical average for the stock market is 7%.

To achieve a high savings rate, it’s important to track your spending and make it a game. By tracking every penny you earn and spend, you can become more mindful of your expenses and make appropriate changes. Applying gamification to this process can make it more enjoyable and engaging, and can help you achieve your financial goals faster.

In summary, the relationship between savings rate and time to reach financial independence is exponential, and by saving and investing a significant portion of your income, you can achieve financial independence faster.

By tracking your spending and making it a game, you can become more mindful of your expenses and achieve your financial goals more effectively.

One Mans Personal Journey Towards Financial Independence

Financial independence is not about earning a high salary, but about saving and investing wisely. After reading a blog post by Mr. Money Mustache in 2013, I discovered the “shockingly simple math behind early retirement.” This post showed me how to calculate how many years I would need to work based on my saving rate.

According to Mr. Money Mustache’s table, if I invest 75% of my income, I could retire in seven years. This seemed like an insane idea, but one person took on the challenge. He reduced his expenses to $1,000 a month by biking to work, making packed lunches, and scrutinizing every expense.

It’s also a great idea to start a side hustle and use that income to invest in an index fund or ETF.

Best Small Business Ideas for Women and Men

As a woman, starting a small business can be a great way to achieve financial independence and pursue your passions. This article will primarily focus on women, but there are ideas included that fit men as well.

The best business ideas for women and men are often those that align with their skills, interests, and values.

Whether you’re looking to start a business from scratch or invest in a franchise, there are plenty of options available to suit your needs. Keep in mind investing in a franchise opportunity is usually high investment.

Low investment high profit business ideas are particularly appealing to women and men who want to start a business without breaking the bank.

From online businesses to home-based opportunities, there are many low-cost options that can yield significant returns. With careful planning, research, and execution, women can turn their small business dreams into a profitable reality.

Key Takeaways

- Women can find success in small business by pursuing ideas that align with their skills, interests, and values.

- Low investment, high profit business ideas are a great option for women who want to start a business without a large financial commitment.

- With careful planning and execution, women can turn their small business dreams into a profitable reality.

Best Business Ideas for Women

As a woman entrepreneur, there are several business ideas that can be profitable with low investment. Here are some of the best business ideas for both women and men:

Online Business Ideas for Women

Online businesses are becoming more popular, especially since the pandemic hit. Women can start and manage an online business from home, which is convenient and cost-effective. Here are some online business ideas for women and men:

- Blogging: If you have a passion for writing, you can start a blog and monetize it through advertising, affiliate marketing, and sponsored content.

- E-commerce: You can sell products online through marketplaces like Amazon, Etsy, and eBay, or you can create your own e-commerce website.

- Virtual Assistant: You can provide administrative, technical, or creative assistance to clients remotely.

- Social Media Manager: Social media is only going to grow. You can manage social media accounts for both individuals and businesses. This includes creating content, scheduling posts, and analyzing data.

- Online Tutoring: You can teach a variety of subjects online to students of all ages.

- Web Design: If you have skills in web design and development, you can create and maintain websites for clients.

Overall, online businesses are a great option for women who want to start a business with low investment and high profit potential.

Low Investment High Profit Business Ideas

Business with Low Investment and High Profit

Starting a business with low investment and high profit is a dream for many entrepreneurs. Here are some business ideas that require minimal investment but have the potential for high returns:

- Social Media Management: Many small businesses struggle with managing their social media accounts. As a social media manager, you can offer your services to help them create and manage their social media presence. All you need is a computer and internet connection to get started.

- Content Writing: If you have a flair for writing, you can start a content writing business. Many businesses require regular content for their websites, blogs, and social media accounts. You can offer your writing services to them and charge per project or per word.

- Online Tutoring: With the rise of e-learning, online tutoring has become a lucrative business. You can offer your tutoring services in subjects you are proficient in, such as math, science, or languages. All you need is a computer and a reliable internet connection to get started.

- Personal Shopping: Many people struggle with finding the time or the fashion sense to shop for themselves. As a personal shopper, you can offer your services to help them find the perfect outfit for any occasion. You can charge a commission on the total cost of the items purchased.

- Event Planning: If you have a knack for organizing and planning events, you can start an event planning business. You can offer your services for weddings, corporate events, or private parties. All you need is a phone, computer, and internet connection to get started.

These are just a few examples of low investment, high profit business ideas. With the right skills and determination, you can turn any business idea into a profitable venture.

Small Business Ideas for Men

As a business enthusiast, I have researched and come up with some small business ideas that men can venture into. These ideas require low investment and have the potential for high profits. Here are some of them:

1. Lawn Care Services

Men who love the outdoors and have a knack for landscaping can start a lawn care service. This business requires minimal investment in equipment such as lawnmowers, trimmers, and leaf blowers. With a little marketing and networking, this business can quickly grow to become profitable.

2. Home Improvement Services

Men with experience in carpentry, plumbing, or electrical work can start a home improvement service. This business can be started with a few basic tools and can be marketed to homeowners in the local area. With a good reputation and quality work, this business can quickly grow through word of mouth.

3. Mobile Car Wash

Men who love cars can start a mobile car wash service. This business requires minimal investment in equipment such as pressure washers, soap, and towels. This business can be marketed to car dealerships, businesses, and individuals looking for a convenient car wash service.

4. Personal Training

Men and women who are passionate about fitness and health can start a personal training business. This business requires certification in personal training and minimal investment in equipment such as weights and exercise mats. With a good reputation and quality work, this business can quickly grow through word of mouth.

5. Food Truck

Men and women who love cooking can start a food truck business. This business requires investment in a food truck, equipment, and permits. This business can be marketed to local events, businesses, and individuals looking for a unique and convenient food experience.

These are just a few small business ideas that men can venture into with low investment and high potential for profits. With hard work, dedication, and a little bit of luck, these businesses can quickly grow and become successful.

Small Business Ideas for Small Towns

As someone who has lived in a small town for most of my life, I understand the unique challenges and opportunities that come with starting a small business in a rural area. Here are a few business ideas that could work well in a small town setting:

- Bakery or Cafe: Everyone loves a good coffee shop or bakery, especially in a small town where people often gather to socialize. Consider offering local and organic ingredients to attract health-conscious customers.

- Pet Care Services: Many small towns have a high concentration of pet owners who need help with pet sitting, grooming, and training. Consider offering mobile services to reach a wider customer base.

- Handmade Crafts and Gifts: Small towns often have a strong sense of community and pride in local traditions. Consider selling handmade crafts, such as quilts, pottery, or jewelry, that celebrate the unique character of your town.

- Farm-to-Table Restaurant: If you live in an agricultural area, consider opening a farm-to-table restaurant that sources ingredients from local farmers. This can be a great way to support your local economy and offer customers fresh, healthy food.

- Tourism Services: Small towns often have unique attractions and historical sites that can draw tourists. Consider starting a tour company that showcases the best of your town, or offering vacation rental properties to visitors.

Remember, starting a business in a small town can be challenging, but it can also be incredibly rewarding. With a little creativity and hard work, you can build a successful business that supports your community and provides a valuable service to your customers.

Small Business Ideas for Rural Areas

As someone who has lived in a rural area, I understand the unique challenges and opportunities that come with starting a small business in these areas. Here are a few small business ideas that can work well in rural areas:

- Farm-to-Table Food Business: If you have access to fresh, locally grown produce, meats, and other foods, consider starting a farm-to-table food business. This can include a restaurant, food truck, or catering service that focuses on using locally sourced ingredients.

- Outdoor Recreation Business: Rural areas often have access to beautiful natural landscapes and outdoor activities, making an outdoor recreation business a great option. This can include guided tours, camping or glamping sites, or equipment rentals for activities like hiking, fishing, or kayaking.

- Craft Business: If you have a talent for crafting, consider starting a business selling your handmade goods. This can include anything from woodworking to jewelry making to pottery.

- Pet Care Business: Many rural areas have a high demand for pet care services, including dog walking, pet sitting, and grooming. Consider starting a business that caters to these needs.

- Home Services Business: Rural areas often lack access to certain home services, such as cleaning, landscaping, or handyman services. If you have the skills and equipment needed for these services, consider starting a business that caters to these needs.

These are just a few ideas for small businesses that can work well in rural areas. With a little creativity and hard work, there are many opportunities to start a successful small business in a rural community.

Small Manufacturing Business Ideas

As a small business owner, I know that manufacturing is a great industry to get into. Here are a few small manufacturing business ideas that can be started with low investment and have the potential for high profit:

- Candle Making: Candle making is a great small manufacturing business that can be started from home. With a small investment in materials and equipment, you can create beautiful candles that can be sold online or in local markets.

- Soap Making: Soap making is another small manufacturing business that can be started from home. With a few ingredients and some basic equipment, you can create high-quality soaps that can be sold online or in local markets.

- Jewelry Making: Jewelry making is a popular small manufacturing business that can be started with a small investment in materials and tools. With a little creativity and skill, you can create unique and beautiful pieces of jewelry that can be sold online or in local markets.

- Food Processing: Food processing is a growing industry that offers many opportunities for small manufacturing businesses. With a small investment in equipment and supplies, you can create a variety of food products that can be sold online or in local markets.

- Clothing Manufacturing: Clothing manufacturing is a more complex small manufacturing business that requires more investment in equipment and supplies. However, with the right skills and knowledge, you can create high-quality clothing that can be sold online or in local markets.

These are just a few small manufacturing business ideas that can be started with low investment and have the potential for high profit. With hard work and dedication, any of these businesses can be successful.

Small Business Ideas for 17 Year Olds

As a 17-year-old, starting a small business can be a great way to gain valuable experience and earn some extra money. Here are a few small business ideas that may be suitable for you:

- Social Media Management: If you are good at managing social media accounts, you can offer your services to small businesses who need help in this area. You can manage their accounts, create content, and help them grow their audience.

- Tutoring: If you excel in a particular subject, you can offer tutoring services to other students who need help. You can advertise your services through social media, word of mouth, or by putting up flyers in your local community.

- Pet Sitting: If you are an animal lover, you can offer pet sitting services to people who need someone to look after their pets while they are away. You can advertise your services through social media, local pet stores, or by putting up flyers in your local community.

- Lawn Care: If you enjoy working outside, you can offer lawn care services to people in your local community. You can mow lawns, trim hedges, and do other yard work for a fee.

- Car Washing: If you have access to a hose and some cleaning supplies, you can offer car washing services to people in your local community. You can charge a fee for washing cars and detailing them.

Remember, starting a small business requires hard work and dedication. But with the right idea and a little bit of effort, you can turn your passion into a profitable venture.

Frequently Asked Questions

What are some profitable small business ideas for women?

There are many small business ideas that women can pursue to earn a good income. Some profitable small business ideas for women include starting a daycare center, opening a bakery, starting a home-based catering business, and offering personal styling and fashion consulting services.

What are the best low investment high profit business ideas?

For those looking to start a business with low investment and high profit, some ideas include starting a dropshipping business, selling digital products online, starting a blog, offering social media management services, and starting a home-based cleaning business.

What are some small business ideas for men?

Men can pursue many small business ideas depending on their interests and skills. Some small business ideas for men include starting a landscaping business, offering handyman services, starting a home-based woodworking business, and starting a mobile car detailing service.

What are the most successful small business ideas for small towns?

Small towns offer unique opportunities for small business owners. Some successful small business ideas for small towns include starting a boutique, opening a coffee shop, starting a bed and breakfast, and offering pet grooming services.

What are some small business ideas for rural areas?

Rural areas also offer opportunities for small business owners. Some small business ideas for rural areas include starting a farm, offering hunting and fishing tours, starting a home-based craft business, and offering lawn care services.

What are some small manufacturing business ideas?

Small manufacturing businesses can be profitable and rewarding. Some small manufacturing business ideas include starting a candle-making business, starting a soap-making business, starting a home-based jewelry-making business, and starting a custom t-shirt printing business.

Atomic Habits and Wealth

Psychology of Money and Atomic Habits.

I find it fascinating how our psychology affects our financial habits and decisions. Atomic Habits by James Clear provides insight into how our habits shape our lives, including our financial situation. In this section, I will explore the connection between the psychology of money and atomic habits.

Clear emphasizes the importance of building systems instead of relying on motivation. He states, “You do not rise to the level of your goals. You fall to the level of your systems.” This quote is especially relevant when it comes to managing money. It’s easy to set financial goals, but without a system in place, it’s challenging to achieve them.

One of the habits of wealthy individuals is that they have a clear financial plan and stick to it. They have systems in place to manage their money, such as budgeting, investing, and saving. They don’t rely on motivation or willpower to make financial decisions.

The psychology of money plays a crucial role in our financial habits. Our beliefs, attitudes, and emotions about money can influence our financial decisions.

For example, if we have a scarcity mindset, we may be more likely to overspend or hoard money.

On the other hand, if we have an abundance mindset, we may be more likely to invest and take calculated risks.

Clear suggests we should focus on our identity instead of our goals. If we identify as someone who is financially responsible, we are more likely to make financial decisions that align with that identity. This is where atomic habits come into play. By building small habits that align with our financial identity, we can create long-term change.

In conclusion, the psychology of money and atomic habits are closely intertwined. If we create systems that match our financial identity, we can accomplish our goals and make long-term changes.

Habits of Wealthy Individuals

As I researched the topic of atomic habits and wealth, I found wealthy individuals have certain habits in common. Here are some habits that stood out to me:

- Goal Setting: Wealthy individuals tend to be goal-oriented and have a clear vision of what they want to achieve. They set specific, measurable, and achievable goals and work towards them consistently.

- Discipline: Wealthy individuals have a strong sense of discipline and self-control. They have developed the emotional strength to delay gratification and make sacrifices in the short-term to achieve their long-term goals that are in specific alignment inclusive of the context of tasks intended to increase their wealth.

- Continuous Learning: Wealthy individuals are constantly learning and seeking new knowledge. They invest in their education and personal development to improve their skills and stay ahead of the curve.

- Networking: Wealthy individuals understand the value of building relationships and networking. They surround themselves with like-minded individuals and seek opportunities to connect with others who can help them achieve their goals.

- Healthy Habits: Wealthy individuals prioritize their health and well-being. They make time for exercise, healthy eating, and self-care to ensure they have the energy and focus to achieve their goals.

These habits may seem simple, but they require consistent effort and dedication to develop and maintain. By adopting these habits, anyone can improve their chances of achieving financial success and building wealth over time. As James Clear, author of “Atomic Habits,” says, “You do not rise to the level of your goals. You fall to the level of your systems.” By building strong habits and systems, we can create the foundation for long-term success and financial prosperity.

Atomic Habits in Finance

As I have been exploring the concept of atomic habits, I have found that it has a lot of relevance to personal finance. The four laws of atomic habits can be applied to financial habits just as easily as they can apply to any other habits.

The first law of atomic habits is to make habits obvious. In terms of finance, this means being intentional about tracking your spending and income. By keeping a budget and regularly reviewing your expenses, you can become more aware of where your money is going and make adjustments as needed.

The second law is to make habits attractive. In finance, this means finding ways to make saving and investing more appealing. This could be by setting up automatic contributions to a retirement account or making saving a game or challenge.

The third law is to make habits easy. This could mean setting up automatic bill payments or finding ways to simplify your finances. By making it easy to save and invest, you can remove barriers to building wealth.

The fourth law is to make habits satisfying. In finance, this means finding ways to celebrate your successes and stay motivated. This could be by setting financial goals and rewarding yourself when you reach them, or by finding a community of like-minded individuals to share your progress with.

As James Clear, the author of Atomic Habits, says, “You do not rise to the level of your goals. You fall to the level of your systems.” By focusing on building strong financial habits and systems, you can achieve long-term financial success.

Get The Latest Issue Of The Guiding Cents Newsletter Sent Straight To Your Inbox

Join 97,000+ getting mind knowledge every Saturday morning while reading, you’ll learn a bit about life & business too. Just click the button to go to the signup page which opens in a new tab.

Quote About Systems in Atomic Habits

As James Clear says in his book Atomic Habits, “You do not rise to the level of your goals. You fall to the level of your systems.” This quote highlights the importance of systems in achieving success in any area of life, including wealth building.

The four laws of atomic habits – make it obvious, make it attractive, make it easy, and make it satisfying – emphasize the need for creating a system that supports your desired habits. When it comes to building wealth, this could mean creating a system for saving and investing a portion of your income each month.

Wealthy individuals often have habits that support their financial success, such as tracking their expenses, living below their means, and consistently investing in assets that appreciate over time. These habits become part of their system for building and maintaining wealth.

The psychology of money also plays a role in the importance of systems. Our habits and behaviors around money are often deeply ingrained, and changing them can be challenging. By creating a system that supports our desired financial habits, we can make it easier to stick to them over time.

Overall, the quote about systems in Atomic Habits highlights the importance of creating a system that supports our desired habits. When it comes to building wealth, this means creating a system that supports consistent saving, investing, and other financial habits that lead to long-term success.

Understanding Atomic Habits

As I delved deeper into the concept of atomic habits, I realized that it is not just about making small changes in our behavior. It is about understanding the psychology of habits and how they shape our lives. James Clear, the author of Atomic Habits, explains that there are four laws of behavior change that can help us create lasting habits.

The first law is to make the habit obvious. This means that we need to be intentional about our habits and make them a part of our daily routine. One way to do this is by creating a habit tracker or setting reminders on our phone.

The second law is to make the habit attractive. This means that we need to find ways to make our habits enjoyable. For example, if we want to exercise more, we can find a workout partner or listen to music while we work out.

The third law is to make the habit easy. This means that we need to remove any barriers that may prevent us from forming a habit. For example, if we want to read more, we can keep a book by our bedside table.

The fourth law is to make the habit satisfying. This means that we need to find ways to reward ourselves for our good habits. For example, if we want to save money, we can reward ourselves with a small treat every time we reach a savings goal.

Clear also emphasizes the importance of systems over goals. He says, “You do not rise to the level of your goals. You fall to the level of your systems.” This means that we need to focus on creating good habits rather than just setting goals.

When it comes to wealth, there are certain habits that wealthy individuals tend to have. These habits include setting goals, creating a budget, investing wisely, and living below their means. By understanding the psychology of habits and implementing the four laws of behavior change, we can create lasting habits that lead to financial success.

Atomic Habits 4 Laws

As I researched and studied James Clear’s book, “Atomic Habits,” I discovered the four laws that govern the process of building good habits and breaking bad ones. These four laws are fundamental and can be applied to any area of life, including wealth building.

1. Make it obvious

The first law is to make it obvious. This means that you need to make your desired habit visible and apparent. For example, if you want to save money, you can make it obvious by setting up automatic savings plans, creating a budget, or tracking your expenses. The more visible and apparent your desired habit is, the more likely you are to stick to it.

2. Make it attractive

The second law is to make it attractive. This means that you need to make your desired habit appealing and enjoyable. For example, if you want to exercise regularly, you can make it attractive by finding a workout partner, listening to music, or rewarding yourself after each workout. The more attractive and enjoyable your desired habit is, the more likely you are to stick to it.

3. Make it easy

The third law is to make it easy. This means that you need to make your desired habit simple and effortless. For example, if you want to read more books, you can make it easy by keeping a book on your nightstand, reading during your commute, or setting a daily reading goal. The easier and simpler your desired habit is, the more likely you are to stick to it.

4. Make it satisfying

The fourth law is to make it satisfying. This means that you need to make your desired habit rewarding and fulfilling. For example, if you want to save money, you can make it satisfying by setting a savings goal, celebrating your milestones, or using your savings to buy something you’ve always wanted. The more rewarding and fulfilling your desired habit is, the more likely you are to stick to it.

In summary, the four laws of atomic habits are crucial for building good habits and breaking bad ones. By making your desired habit obvious, attractive, easy, and satisfying, you can increase your chances of success and achieve your goals.

Atomic Habits Questions and Answers

As I continue to explore the topic of atomic habits and wealth, I’ve encountered several questions that readers may have. Here are some answers to the most common questions:

How long does it take to form a habit?

According to atomic habits, it takes about 66 days to form a new habit. However, this number may vary depending on the person and the habit they are trying to form. It’s important to remember that forming a habit is a process that takes time and effort.

How can I make sure I stick to my habits?

One way to make sure you stick to your habits is to create a system that supports your habits. This means identifying the cues, cravings, responses, and rewards associated with your habit and creating an environment that makes it easy to follow through. Additionally, tracking your progress and celebrating your successes can help you stay motivated.

What are some habits of wealthy individuals?

Some habits of wealthy individuals include setting goals, creating a budget, investing in themselves, and seeking advice from experts. Wealthy individuals also tend to have a growth mindset and are willing to take calculated risks to achieve their goals.

How can atomic habits help with finances?

Atomic habits can help with finances by creating systems that support good financial habits. For example, setting up automatic savings transfers, creating a budget, and tracking expenses can all be part of a system that supports good financial habits.

What is the psychology behind atomic habits?

The psychology behind atomic habits is based on the idea that small changes can lead to big results. By breaking down habits into small, manageable steps, individuals can create a sense of accomplishment and build momentum towards their goals. Additionally, focusing on the process rather than the outcome can help individuals stay motivated and engaged in their habits.

Overall, atomic habits can be a powerful tool for achieving success in all areas of life, including wealth and finances. By creating systems that support good habits and focusing on small, manageable changes, individuals can achieve their goals and build a life of abundance and prosperity.

Frequently Asked Questions

What are the 4 principles of Atomic Habits and how can they be applied to building wealth?

The 4 principles of Atomic Habits are:

- Make it obvious

- Make it attractive

- Make it easy

- Make it satisfying

These principles can be applied to building wealth by creating habits that make it obvious to save money, attractive to invest, easy to manage finances, and satisfying to see progress towards financial goals.

What is the psychology behind the connection between Atomic Habits and wealth?

The psychology behind the connection between Atomic Habits and wealth is that our habits determine our actions, and our actions determine our success. By developing habits that align with financial goals, we can create a positive feedback loop of success and build wealth over time.

How can Atomic Habits help individuals develop better financial habits and achieve financial success?

Atomic Habits can help individuals develop better financial habits by breaking down financial goals into small, manageable habits that can be consistently practiced over time. By focusing on small wins and creating a system of positive reinforcement, individuals can achieve financial success and build wealth.

What is the famous quote from Atomic Habits about systems and how does it relate to wealth-building?

The famous quote from Atomic Habits is “You do not rise to the level of your goals. You fall to the level of your systems.” This quote relates to wealth-building because it emphasizes the importance of developing systems and habits that align with financial goals, rather than relying solely on willpower or motivation.

What are the key habits of wealthy individuals and how can they be developed through Atomic Habits?

The key habits of wealthy individuals include saving consistently, investing wisely, and living below their means. These habits can be developed through Atomic Habits by breaking down financial goals into small, manageable habits that can be consistently practiced over time.

Can you explain the concept of Atomic Habits as it relates to personal finance and wealth-building?

The concept of Atomic Habits as it relates to personal finance and wealth-building is that small, consistent habits can lead to significant progress over time. By breaking down financial goals into small habits that can be practiced daily, individuals can build wealth and achieve financial success.

This Week’s Action Step

If you don’t have one, start your list of habits you need to implement that will be part of your system strategy, and begin practicing those habits every day.

If you already have a list of habits you know need implementing into your life, consider building a simple template that you can fall back on each week to ensure you are holding yourself accountable to taking action on these habits.

That’s it for today.

If you have randomly found or been forwarded this Newsletter and would like to be on the Saturday Cents subscriber list, where you will get content like this once a week on Saturday morning, then you can subscribe here>>

See you next week.

How to Make Extra Money Woodworking

Woodworking for Extra Money: Easy Ways and Side Business Ideas.

Woodworking is a great way to earn some extra money full time or as a side hustle. Whether you’re new to woodworking or have some basic skills, I can show you how to turn it into a profitable side business. Here are some ideas to get you started:

1. Build and Sell Small Items

One of the easiest ways to make money woodworking is by building and selling small items. These could include things like cutting boards, coasters, picture frames, and small furniture pieces. You can sell these items online through platforms like Etsy, or at local craft fairs and markets.

2. Offer Custom Woodworking Services

Another way to make money woodworking is by offering custom woodworking services. This covers making personalized furniture, building cabinets, or creating custom woodwork for home remodeling. You can advertise your services online or through local home improvement stores.

3. Teach Woodworking Classes

If you have advanced woodworking skills, you can also make money by teaching woodworking classes. You can offer classes in your own workshop or through local community centers. You can also offer online classes through platforms like Udemy or Skillshare.

4. Sell Woodworking Plans and Kits

If you have a talent for designing woodworking plans, you can make money by selling your plans online. You can also sell woodworking kits that include all the materials and instructions needed to build a specific project.

Overall, woodworking can be a great way to earn some extra money. With some creativity and hard work, you can turn your woodworking hobby into a profitable side business.

How to Make Extra Money Woodworking

Woodworking is an enjoyable and rewarding hobby, but it can also be a lucrative way to earn extra money. Here are some easy ways to make money woodworking, along with some woodworking side hustle ideas and woodworking home business opportunities.

Easy Ways to Make Money Woodworking

One of the easiest ways to make money woodworking is to sell your creations online. Websites like Etsy, eBay, and Amazon Handmade make it easy to set up an online store and start selling your handmade items. You can also sell your items locally at craft fairs and farmers markets.

Another way to make money woodworking is by offering your services as a custom furniture maker. Many people are willing to pay a premium for handmade, one-of-a-kind furniture pieces. You can advertise your services on social media, local classifieds, and through word of mouth.

Woodworking Side Business Ideas

If you’re looking to turn woodworking into a side business, there are many different avenues you can explore. Here are a few woodworking side business ideas to consider:

- Woodworking classes: If you have a knack for teaching, consider offering woodworking classes to beginners. You can rent out a space or teach from your own workshop.

- Woodworking kits: Create and sell woodworking kits that include all the materials and instructions needed to complete a project. This is a great way to introduce people to woodworking and make a profit at the same time.

- Woodworking repairs: Many people have furniture or other items that need repairs. Offer your services as a woodworking repair specialist and charge by the hour or by the project.

Woodworking Home Business Opportunities

Starting a woodworking home business can be a great way to turn your passion into a full-time career. Here are a few woodworking home business opportunities to consider:

- Custom furniture making: As mentioned earlier, offering your services as a custom furniture maker can be a lucrative business. You can work from your own workshop and take on as many or as few projects as you like.

- Woodworking supplies: If you have a knack for sourcing high-quality woodworking supplies, consider starting your own online store. You can sell everything from lumber to tools to finishes.

- Woodworking instruction: If you have a lot of experience in woodworking, consider offering instruction to others. You can create online courses, write books, or even start your own woodworking school.

In conclusion, woodworking can be a great way to make extra money. Whether you’re looking to sell your creations online, start a side business, or turn your passion into a full-time career, there are many different opportunities to explore. With a little creativity and hard work, you can turn your woodworking skills into a profitable venture.

![]() STOP: Before You Do Anything Else. Click HERE to Get Instant Access To 16,000 Plans >>

STOP: Before You Do Anything Else. Click HERE to Get Instant Access To 16,000 Plans >>

Woodworking Questions

How Much Can a Woodworker Make

As a woodworker, the amount of money you can make depends on several factors, including your level of expertise, the type of products you make, and the demand for your products.

According to the Bureau of Labor Statistics, the median annual wage for woodworkers was $32,690 as of May 2022. However, this figure varies widely depending on the industry you work in. For example, woodworkers in the furniture and related product manufacturing industry earned a median annual wage of $34,710, while those in the architectural and structural metals manufacturing industry earned a median annual wage of $43,360.

If you are just starting out in woodworking, you may not make much money at first. However, as you gain experience and develop your skills, you can expect to earn more. You can also increase your earning potential by specializing in a particular type of woodworking, such as furniture making or cabinetry.

In addition to selling your products, you can also make money as a woodworker by teaching others how to work with wood, writing woodworking books or articles, or offering woodworking services such as repair and restoration. With the right skills and business acumen, woodworking can be a lucrative career or side business.

Woodworking Qualifications

As someone who has been woodworking for several years now, I can confidently say that there are no formal qualifications required to become a woodworker. However, having some basic knowledge and skills can help you get started on the right foot. It doesn’t matter if you don’t even know what a woodworking 45 degree joint is, you can start from scratch and be making money quickly. There is the long path and the short path, which I will show you near the end of this article.

Woodworking University

If you are interested in learning more about woodworking, there are several universities and colleges that offer woodworking courses. These courses can range from basic woodworking techniques to more advanced skills such as furniture making and cabinetry.

One such university is the North Bennet Street School in Boston, Massachusetts. This school offers a two-year program in traditional woodworking techniques that covers everything from hand tool use to furniture design.

Another option is the College of the Redwoods in Fort Bragg, California. This college offers a two-year program in fine woodworking that focuses on furniture making, cabinetmaking, and woodturning.

Attending a woodworking university can be a great way to gain the knowledge and skills needed to start a woodworking business or to simply pursue woodworking as a hobby. However, keep in mind that these programs can be expensive and time-consuming, so it’s important to weigh the benefits against the costs before making a decision.

Overall, while there are no formal qualifications required to become a woodworker, attending a woodworking university or taking courses can be a great way to gain the knowledge and skills needed to succeed in this field.

10 Woodworking Tools

As a woodworker, it’s important to have the right tools to create quality projects efficiently. Here are ten essential woodworking tools that I recommend:

- Table Saw – A table saw is the centerpiece of any woodworking shop. It’s used to rip, crosscut, and shape wood.

- Miter Saw – A miter saw is used to make precise crosscuts and angled cuts. It’s perfect for cutting trim, molding, and framing.

- Router – A router is a versatile tool that can be used for shaping, cutting, and carving wood. It’s great for creating decorative edges and joints.

- Cordless Drill – A cordless drill is a must-have tool for any woodworking project. It’s used to drill holes and drive screws.

- Jigsaw – A jigsaw is a handheld saw that’s perfect for cutting curves and intricate shapes. It’s great for making decorative pieces and cutting out patterns.

- Circular Saw – A circular saw is a handheld saw that’s perfect for cutting large sheets of wood. It’s great for making long, straight cuts.

- Random Orbital Sander – A random orbital sander is used to smooth out rough surfaces and remove old finishes. It’s great for prepping wood for staining or painting.

- Chisels – Chisels are used for carving and shaping wood. They come in different sizes and shapes for different tasks.

- Hand Planes – Hand planes are used to smooth out rough surfaces and plane wood to a specific thickness. They come in different sizes and shapes for different tasks.

- Clamps – Clamps are used to hold wood together while glue dries or while making cuts. They come in different sizes and styles for different tasks.

These ten tools are a great starting point for any woodworking project. With these tools, you’ll be able to create quality projects efficiently and with precision.

Woodworking Business Tips

As someone who has turned my woodworking hobby into a successful business, I have learned a few tips that have helped me along the way. Here are some woodworking business tips that I think will be helpful for anyone looking to start or grow their woodworking business.

Woodworking Business Idea

The first tip I want to share is to have a clear idea of what kind of woodworking business you want to start. There are many different niches within woodworking, so it’s important to figure out what you enjoy making and what you’re good at. Some popular woodworking business ideas include:

- Custom furniture

- Home decor items (e.g. picture frames, shelves, etc.)

- Outdoor furniture

- Wooden toys

- Cutting boards and other kitchen items

Once you have a clear idea of what you want to make, you can start to focus on building your brand and marketing your products.

One important thing to keep in mind is that woodworking is a competitive industry, so it’s important to find ways to stand out from the crowd. This could mean offering unique designs, using high-quality materials, or providing exceptional customer service.

Overall, starting a woodworking business can be a rewarding and profitable venture if you’re willing to put in the time and effort to make it successful. By following these woodworking business tips and staying focused on your goals, you can turn your woodworking hobby into a thriving business.

Woodworking Guild

As a woodworker, joining a woodworking guild can be a great way to network, learn new skills, and take your woodworking business to the next level. A woodworking guild is a group of like-minded individuals who come together to share their knowledge, ideas, and experiences in the woodworking industry.

By joining a woodworking guild, you will have access to a community of experienced woodworkers who can offer guidance and advice on everything from tool selection to pricing your products. You can also attend workshops, seminars, and other events organized by the guild to improve your skills and stay up-to-date with the latest trends and techniques in the industry.

One of the biggest benefits of joining a woodworking guild is the opportunity to showcase your work and gain exposure for your business. Many woodworking guilds organize exhibitions and shows where members can display their products and connect with potential customers.

To find a woodworking guild near you, you can search online or check with your local woodworking supply store. Some popular woodworking guilds include the American Association of Woodturners, the International Woodworkers of America, and the Woodworkers Guild of America.

Overall, joining a woodworking guild can be a great way to grow your skills, connect with other woodworkers, and take your woodworking business to the next level.

Woodworking Makerspace Near Me

If you’re interested in woodworking as a hobby or a potential side business, finding a woodworking makerspace near you can be a great way to get started. A makerspace is a collaborative workspace where members can access tools and equipment they might not have at home, as well as learn from and collaborate with other makers.

To find a woodworking makerspace near you, start by doing a quick online search. Many makerspaces have websites or social media pages where you can learn more about their offerings and membership options. You can also check out online directories like the Makerspace Directory or the Fab Lab Network.

When you visit a makerspace, be sure to ask about their woodworking equipment and facilities. Some makerspaces may have a full woodworking shop with everything from table saws to lathes, while others may have a more limited selection of tools. Make sure the makerspace has the equipment you need to work on your projects.

Another important consideration when choosing a makerspace is the community. Look for a makerspace with a friendly, welcoming atmosphere and a community of makers who are passionate about woodworking. This can be a great way to learn new skills, get feedback on your projects, and make connections with other makers.

Overall, a woodworking makerspace can be a great resource for anyone interested in woodworking. By finding a makerspace near you, you can access tools and equipment you might not have at home, learn from other makers, and become part of a supportive community of woodworking enthusiasts.

Woodworking School

If you’re interested in woodworking, attending a woodworking school can be a great way to learn new skills and techniques. Woodworking schools offer a variety of classes and workshops, ranging from beginner-level courses to advanced master classes.

At woodworking schools, you’ll have access to state-of-the-art tools and equipment, as well as experienced instructors who can help you develop your skills and techniques. You’ll also have the opportunity to work on a variety of projects, from small decorative items to large pieces of furniture.

Some woodworking schools offer certificate programs, which can be a great way to demonstrate your skills and knowledge to potential clients or employers. Additionally, many woodworking schools offer job placement assistance to help you find work in the industry.

When choosing a woodworking school, be sure to consider factors such as location, cost, and course offerings. Look for schools that have a strong reputation in the industry and that offer courses that align with your interests and goals.

Overall, attending a woodworking school can be a great way to take your woodworking skills to the next level and open up new opportunities in the industry.

Woodworking Wood Near Me

When it comes to woodworking, one of the most important things you need is good quality wood. Finding the right type of wood for your project can be a challenge, especially if you’re not sure where to look. Fortunately, there are many options available to you, and with a little bit of research, you can find the perfect wood for your project.

One of the first places to look for woodworking wood near you is at your local lumberyard. Lumberyards typically carry a variety of different types of wood, including hardwoods and softwoods. They may also have specialty woods that are perfect for specific projects, such as exotic woods or reclaimed wood.

Another option is to look for woodworking wood online. There are many online retailers that specialize in selling wood for woodworking projects. These retailers often have a wider selection of woods than your local lumberyard, and they may also offer lower prices.

If you’re looking for a more unique type of wood, you may want to consider visiting a sawmill or a woodworking specialty store. These types of stores often carry woods that are not available at your local lumberyard or online retailer. They may also be able to provide you with advice on which type of wood is best for your project.

When it comes to finding woodworking wood near you, it’s important to do your research and shop around. By taking the time to find the right type of wood for your project, you can ensure that your finished product is of the highest quality.

Want A Great Shortcut To Get Started Selling In Just a Few Weeks?

I’ve found a great self-starter program with the earth’s largest database of woodworking projects!

It is suitable for beginners & pros. You can make over 16,000 projects with step-by-step plans…even if you don’t have a large workshop or expensive tools!

It doesn’t even matter if you’re not ready for a full-scale shop. Along with step-by-step instructions there are cutting & materials lists, detailed schematics, and multiple views from all angles.

Plus, you can get free monthly plans for life… and YOU GET TO CHOOSE your own custom plans too!

It doesn’t matter what your current skill level is.

It doesn’t matter what your budget is.

You can also opt for the DVDs & USB thumb drive of all current plans, training, bonuses and we’ll ship it to your mailbox.

Plus bonus materials worth hundreds. Check it out here.

Frequently Asked Questions

What are some easy woodworking projects that can be sold for extra money?

There are many easy woodworking projects that can be sold for extra money, such as birdhouses, cutting boards, picture frames, and small furniture pieces. These projects are relatively simple to make and require only a few basic tools, making them a great option for beginners.

What are some tips for starting a woodworking side business?

Starting a woodworking side business requires careful planning and preparation. Some tips for getting started include creating a business plan, setting up a workspace, acquiring the necessary tools and materials, and marketing your products effectively.

What are some woodworking business ideas that can be profitable?

There are many woodworking business ideas that can be profitable, such as making custom furniture pieces, creating unique home decor items, or offering woodworking classes or workshops. It’s important to identify a niche and focus on creating high-quality products that appeal to your target market.

What are some common woodworking qualifications or certifications?

Some common woodworking qualifications or certifications include completing an apprenticeship program, earning a degree in woodworking or furniture design, or obtaining a certification from a woodworking organization such as the National Wood Flooring Association or the Architectural Woodwork Institute.

What is the average salary for a self-employed woodworker?

The average salary for a self-employed woodworker can vary widely depending on factors such as experience, location, and the type of work being done. However, according to data from the Bureau of Labor Statistics, the median annual wage for self-employed carpenters and woodworkers was $37,040 in 2020.

What are some resources for finding woodworking makerspaces or schools?

There are many resources available for finding woodworking makerspaces or schools, such as online directories, community bulletin boards, and social media groups. Some popular makerspace networks include TechShop, Maker Faire, and Fab Lab. Additionally, many community colleges and vocational schools offer woodworking classes and workshops.

Where can someone sell their woodworking projects online?

There are several online platforms where someone can sell their woodworking projects. Some popular options include:

Etsy – a marketplace for handmade and vintage items, including woodworking projects.

eBay – an online auction and shopping website where people can sell new or used items, including woodworking projects.

Amazon Handmade – a marketplace for handmade items, including woodworking projects.

Facebook Marketplace – a platform for buying and selling items within a local community, including woodworking projects.

Shopify – an e-commerce platform that allows users to create their own online store to sell their woodworking projects.

These are just a few examples, but there are many other options available depending on the type of woodworking projects someone is selling and their target audience.

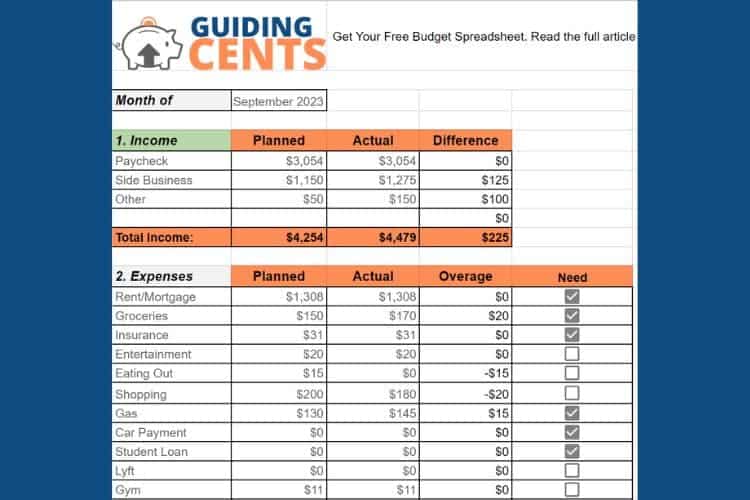

How To Set Up a Household Budget Spreadsheet

Creating and maintaining a budget is an essential part of managing your finances.

A budget spreadsheet is a useful tool that can help you keep track of your income and expenses, and plan for your financial goals. In this article, I will guide you through the process of setting up a household budget spreadsheet, creating a personal budget spreadsheet, and setting up a home budget sheet.

To start, it’s important to understand the basics of budgeting and how it can benefit you. A budget helps you to identify your spending habits and make adjustments to achieve your financial goals. With a budget spreadsheet, you can easily track your income and expenses, and monitor your progress towards your financial goals.

Once you have a clear understanding of the benefits of budgeting, it’s time to create your own budget spreadsheet. Whether you’re looking to create a personal budget or a household budget, there are a few key steps to follow. By following these steps and maintaining your budget spreadsheet regularly, you can take control of your finances and achieve your financial goals.

Key Takeaways

- A budget spreadsheet is an essential tool for managing your finances.

- Understanding the benefits of budgeting is the first step in creating a successful budget spreadsheet.

- By following a few key steps and maintaining your budget spreadsheet regularly, you can take control of your finances and achieve your financial goals.

Understanding Household Budget

Creating a household budget is an essential step towards financial stability. It allows you to track your expenses, monitor your income, and plan for future expenses. A household budget is a financial plan that outlines your income, expenses, and savings for a specific period, usually monthly or annually.

How to Create a Personal Budget Spreadsheet for Your Home

To create a household budget, you need to understand your income and expenses. Income includes your salary, bonuses, and any other sources of income. Expenses include your bills, groceries, transportation, and any other expenses you incur.

Once you have a clear understanding of your income and expenses, you can create a budget spreadsheet. A budget spreadsheet is a tool that helps you track your income and expenses. You can use a simple spreadsheet program like Microsoft Excel or Google Sheets to create your budget.

To create a budget spreadsheet, start by listing your income sources in one column and your expenses in another. Next, categorize your expenses into fixed and variable expenses. Fixed expenses are those that remain the same every month, such as rent or mortgage payments. Variable expenses are those that change from month to month, such as groceries or entertainment.

After categorizing your expenses, assign a budgeted amount for each category. This will help you stay within your budget and avoid overspending. Be sure to include a category for savings, even if it’s a small amount.

Finally, track your actual expenses against your budgeted amounts. This will help you identify areas where you are overspending and adjust your budget accordingly.

In summary, understanding your income and expenses is the first step towards creating a household budget. With a budget spreadsheet, you can track your expenses, monitor your income, and plan for future expenses. By staying within your budget, you can achieve financial stability and reach your financial goals.

Creating a Personal Budget Spreadsheet

Choosing the Right Software

To create a personal budget spreadsheet, I recommend using software like Microsoft Excel or Google Sheets. Both of these programs offer templates specifically designed for budgeting, making it easy to get started. If you prefer, you can also create a budget spreadsheet from scratch using these programs. I have created a Google Sheets spreadsheet for you and it can be downloaded in this article.

Setting Up the Spreadsheet

Once you have chosen your software, it’s time to set up your spreadsheet. Start by creating columns for your income, expenses, and any other categories you want to track. You can also add rows for each month or week of the year, depending on how often you want to track your budget.

Inputting Your Income

Next, input all of your sources of income into the appropriate column. This can include your salary, any side hustles, or any other money you receive on a regular basis. Be sure to include the exact amount you receive for each income source.

Listing Your Expenses

After inputting your income, list all of your expenses in the appropriate column. This can include bills, groceries, entertainment, and any other expenses you have on a regular basis. Be sure to include the exact amount you spend on each expense.

Creating Categories

To make it easier to track your budget, create categories for your expenses. This can include categories like “Housing,” “Transportation,” “Food,” and “Entertainment.” Assign each expense to its appropriate category, and then use formulas to calculate the total amount spent in each category.

By following these steps, you can create a personal budget spreadsheet that will help you track your finances and achieve your financial goals.

Setting Up a Home Budget Sheet

As someone who has experience managing finances, I can attest to the importance of having a home budget sheet. It’s an effective tool for keeping track of your expenses and ensuring that you’re not overspending. Here are the steps to setting up a home budget sheet:

Identifying Your Financial Goals

Before creating a budget sheet, it’s important to identify your financial goals. This will help you determine how much money you need to allocate to each category. For example, if your goal is to save for a down payment on a house, you may need to allocate more money to your savings category. On the other hand, if your goal is to pay off debt, you may need to allocate more money to your debt repayment category.

Tracking Your Spending

Once you’ve identified your financial goals, it’s time to track your spending. This will help you determine where your money is going and where you can cut back. There are several ways to track your spending, including using a budgeting app, keeping receipts, or manually entering your expenses into a spreadsheet.

When tracking your spending, be sure to categorize your expenses. This will make it easier to see where your money is going and identify areas where you can cut back. Common expense categories include housing, transportation, food, entertainment, and utilities.

Adjusting Your Budget

After tracking your spending for a few weeks or months, it’s time to adjust your budget. This may involve increasing or decreasing the amount of money allocated to certain categories. For example, if you notice that you’re spending more on entertainment than you initially budgeted for, you may need to reduce your entertainment category and allocate more money to your savings or debt repayment categories.

It’s important to remember that your budget is not set in stone. It’s okay to make adjustments as needed to ensure that you’re meeting your financial goals.

By following these steps, you can set up a home budget sheet that works for you and helps you achieve your financial goals.

Maintaining and Updating Your Budget Spreadsheet

Regular Review

Once you have set up your budget spreadsheet, it is important to review it regularly to ensure that you are on track with your financial goals. I recommend reviewing your budget at least once a month to ensure that you are staying within your budget and making progress towards your financial goals.

During your review, take note of any areas where you may have overspent or underspent. Look for patterns in your spending and identify areas where you can cut back or where you may need to increase your budget. It is also important to review your income to ensure that it is accurate and up-to-date.

Making Necessary Adjustments

After reviewing your budget, you may need to make some adjustments. This could include increasing or decreasing your budget in certain categories, or finding ways to reduce your expenses in other areas.

When making adjustments, it is important to consider your overall financial goals and priorities. If you are working towards paying off debt, for example, you may need to redirect funds from other categories to help you reach your goal faster.

Be sure to update your budget spreadsheet with any changes you make. This will help you stay organized and ensure that you are always working with the most up-to-date information.

By regularly reviewing and updating your budget spreadsheet, you can stay on track with your financial goals and make any necessary adjustments along the way.

Conclusion

In conclusion, creating a budget spreadsheet can be a helpful tool in managing personal finances. By tracking income and expenses, individuals can gain a better understanding of their financial situation and make informed decisions about spending and saving.

When creating a budget spreadsheet, it is important to start with a clear understanding of your income and expenses. This can be achieved through tracking expenses for a few months or reviewing past bank statements. Once you have a clear picture of your finances, you can use spreadsheet software to create a budget template that works for you.

Remember to include all sources of income and expenses, including fixed and variable expenses. Be sure to update your budget spreadsheet regularly to reflect changes in income or expenses.

In addition, consider using tools such as tables, bullet points, and bold text to make your budget spreadsheet easier to read and understand. This can help you stay organized and on track with your financial goals.

Overall, creating a personal or household budget spreadsheet can be a valuable tool in achieving financial stability and security. With a little effort and attention to detail, anyone can create a budget spreadsheet that works for their unique financial situation.

Frequently Asked Questions

How can I create a simple budget spreadsheet in Excel?

Creating a simple budget spreadsheet in Excel can be done by opening a new workbook and setting up the columns for income and expenses. You can then input your monthly income and expenses, and use formulas to calculate totals and balances. There are also many free templates available online that can be customized to fit your needs.

What are the essential items to include in a personal budget spreadsheet?

A personal budget spreadsheet should include all sources of income, such as salary, investments, and side hustles. It should also include all expenses, such as rent, utilities, groceries, and entertainment. Other important items to include are savings goals, debt payments, and emergency fund contributions.

How do I set up a household budget spreadsheet?

To set up a household budget spreadsheet, you should first gather all income and expense information for all members of the household. You can then create separate columns for each income source and expense category. It’s important to include all regular bills, as well as occasional expenses such as car repairs and home maintenance. You can also use formulas to calculate totals and balances.

What are some free Excel budget templates available online?