What is an Angel Investor?

An angel investor is an individual who invests their own money in privately-held companies, often providing seed funding to early-stage startups in the technology world. Due to the high-risk nature of these startups, banks are often hesitant to provide funding, making angel investors a vital source of risk capital. Typically, angel investors are high-net worth individuals with relevant institutional knowledge and background to the companies they invest in. In addition to capital, angel investors often provide guidance and connections to clients, employees, and other investors to the companies they invest in.

Who Can Become an Angel Investor?

Angel investors are individuals who invest in early-stage startups, providing them with the necessary capital to grow and expand. However, not everyone can become an angel investor. Due to the high-risk nature of early-stage startups, regulators have put in place certain requirements that investors must meet to be able to invest in these types of companies.

To become an angel investor, one must meet the accredited investor designation. An accredited investor is an individual who meets certain financial and knowledge-based requirements. These requirements include:

- Individual or joint net worth in excess of $1M (not including the value of a primary residence);

- Individual income in excess of $200k or joint income in excess of $300k for the two most recent years, with a reasonable expectation of reaching this level in the current year;

- Holding a Series 7, 62, or 65 license (Hustle Fund’s Angel Squad pays members’ Series 65 exam fee and offers a community support group to help people study). Note to be accredited via licensure also requires the individual to register with either the state or SEC as an Investment Advisor Representative for a Registered Investment Advisor (RIA). The RIA can be the individual’s own firm.

It is the responsibility of the startup to ensure that an investor meets accreditation standards. Only raising from accredited investors can exempt a startup from certain required legal disclosures whenever there’s a sale of stock (e.g., during a fundraising round).

What If a Non-accredited Investor Wants To Invest?

A revision to the JOBS Act in 2012 has made it possible for startups to raise up to $1M from non-accredited investors. This has led to the rise of companies like Republic, which allow retail investors to participate in startup fundraises.

In conclusion, to become an angel investor, one must meet the accredited investor designation, which requires meeting certain financial and knowledge-based requirements. While non-accredited investors can also invest in startups, they are subject to certain limitations and regulations.

How To Get Angel Investors for Your Business

There are several ways to attract angel investors for your business. Here are some tips:

- Build a strong business plan: Create a clear and comprehensive business plan that outlines your goals, strategies, and financial projections. This will help investors understand your vision and the potential for growth.

- Network: Attend industry events, conferences, and meetings to meet potential investors and build relationships. Joining business networks and associations can also help you connect with investors.

- Utilize online platforms: There are several online platforms that connect entrepreneurs with angel investors, such as AngelList, Gust, and SeedInvest. These platforms allow you to showcase your business and connect with potential investors.

- Seek referrals: Reach out to your professional network and ask for referrals to potential investors. This can help you find investors who are interested in your industry and have a track record of successful investments.

- Be prepared: Once you have identified potential investors, be prepared to pitch your business and answer any questions they may have. Have a clear understanding of your financials and be able to articulate your value proposition.

Remember, securing angel investment is a competitive process, so be persistent and don’t get discouraged if you face rejection. Keep refining your pitch and building relationships, and eventually, you will find the right investor for your business.

How to Break into VC as an Angel Investor

If you’re interested in becoming an angel investor, there are a few steps you can take to increase your chances of success. Here are some important considerations:

Learn the Risks of Angel Investing

As an angel investor, it’s important to understand the high-risk nature of early-stage startups. While it’s true that one or two successful investments can make up for losses, most angel investors are aware that they may lose all their money on a deal. Therefore, it’s important to adopt a strategy of broadly indexing, hoping to capture as many big winners in your portfolio as possible.

Develop an Investment Thesis

An investment thesis is a reasoned argument for a particular investment approach. As an angel investor, your investment thesis should be derived from your own research and understanding of the market, areas of interest, and financial situation. This should help you create a profile of the types of companies you want to invest in, including their stage, industry, location, and valuation.

Market Yourself

To invest in a startup, you need to be offered allocation. And if you want allocation in the best deals, you have to be an investor founders want on their cap table. A lot of this comes with building up a track record over time as a value-add investor in successful startups. But when you’re just starting out as an angel investor, an effective way to overcome adverse selection and win allocation in good deals is by building and promoting a personal brand. Investors often do this through content creation, such as writing and tweeting about investing, strategy, and other topics related to their areas of investing interest.

Learn to Evaluate Deals

Once you start seeing deals, the next step is picking the right deals to invest in. To determine if you’re investing in the “right” deal, consider filtering all deals through a series of questions. Ask yourself if the company aligns with your investment thesis, if the company has 100x potential, if the company has traction, if the company will be able to raise another round of financing, if the company has good signal, and why the founders are letting you invest.

Win Allocation

Winning allocation as a newbie angel investor requires some degree of cooperation. Founders generally set aside a certain portion of the fundraise for small checks from angel investors, but all must invest on similar terms, and don’t get much say by way of valuation or control. As such, you should aim to set expectations with founders around your investment process, including the number of meetings you require, and the amount of access you need to make a decision.

Size Your Check

Because angels invest their own money, many can only afford to cut relatively small checks. Check sizing is a function of how much allocation you’re offered, the startup’s valuation, and your level of belief in the business. Keep in mind that the larger the valuation, the more it’ll cost you to purchase a meaningful equity stake. At the same time, investing as little as $1k in deals can be a great way to earn more allocations, test your investment thesis, and fund more companies.

Build a Diversified Portfolio

To mitigate risk in angel investing, many investors attempt to build a large and diversified portfolio of investments. This means having a variety of companies, at least 10-20, across different industries, stages, and geographies.

Support Your Portfolio Companies

As an angel investor, it’s important to support your portfolio companies beyond just writing a check. This can include making introductions, providing advice and mentorship, and helping with recruiting.

Be Patient

Angel investing is a long-term game. It takes time to build a diversified portfolio and see returns. As such, it’s important to be patient and not expect immediate results.

Overall, becoming an angel investor requires a lot of research, networking, and due diligence. By following these steps, you can increase your chances of success in this exciting and high-risk field.

Angel Investing Resources

Aspiring angel investors have access to a variety of tools and services that can help them get started in the world of startup investing. Here are some recommended resources:

AngelList

AngelList is a platform that offers a wide range of investment options for angel investors. With over 1,000 fund managers on the platform, investors can easily invest small amounts in venture funds and SPVs. AngelList also offers tools that make it easy to track performance, discover new deals, and connect with other investors.

Republic

Republic is a platform that allows non-accredited investors to discover and invest in startup deals, as well as deals in real estate, crypto, and other sectors. The platform offers a variety of investment options and provides investors with access to high-quality deal flow.

SeedInvest

SeedInvest is an equity crowdfunding platform that vets every startup that applies to be listed on their platform, ensuring quality deal flow. Unlike AngelList and Republic, SeedInvest has lower investment requirements, and non-accredited investors can also participate.

Hustle Fund’s Angel Squad

For those who are looking for access to deal flow and the institutional knowledge to improve their investing skills, Hustle Fund’s Angel Squad is a program that teaches members how to angel invest and provides investment access to top-performing startups in Hustle Fund’s portfolio. Members will be invited to hear live pitches from Hustle Fund portfolio companies, attend virtual and IRL networking events with Hustle Fund’s 1.1k+ members, and receive guidance and training from Hustle Fund managing partners, including Elizabeth Yin and Eric Bahn.

In summary, AngelList, Republic, SeedInvest, and Hustle Fund’s Angel Squad are all excellent resources for aspiring angel investors. Each platform offers unique features and investment options that can help investors get started in the world of startup investing.

FAQs

How much money is needed to become an angel investor?

To become an angel investor, one needs to have enough money to meet the accredited investor requirements. These requirements include an individual or joint net worth in excess of $1 million (excluding the value of a primary residence) or individual income in excess of $200,000 or joint income in excess of $300,000 for the two most recent years with a reasonable expectation of reaching this level in the current year. However, it is possible to angel invest without meeting these net worth requirements if one holds a Series 7, 62, or 65 license.

Do angel investors receive payments?

Angel investors receive payments when the companies they invest in experience a liquidity event, which is a rare occurrence. The most common types of liquidity events are an IPO or acquisition by another company. Angel investors may also be able to sell their equity stake to another investor without the startup itself going under a change of control. However, it is important to note that angel investors should be prepared to never be paid back on a majority of their investments.

Is angel investing tax-free?

Angel investing is not tax-free. Realized returns from angel investing are typically taxed at the long-term capital gains tax rate (assuming the asset has been held for at least three years), which tops out at 20%. Capital gains can be offset by writing off capital losses from angel investing. Many angel investors also save on capital gains by utilizing the qualified small business stock (QSBS) exemption, which allows U.S. investors to exclude or defer federal capital gains taxes upon the sale of the stock.

In summary, becoming an angel investor requires meeting the accredited investor requirements, and angel investors receive payments only when the companies they invest in experience a liquidity event, which is rare. Angel investing is not tax-free, and realized returns are typically taxed at the long-term capital gains tax rate. However, many angel investors save on capital gains by utilizing the QSBS exemption.

Become an Angel Investor via Angel Squad

Angel Squad offers a program that teaches individuals how to become angel investors. The community is made up of executives, operators, creatives, and visionaries. Visit their website to learn more.

Frequently Asked Questions

Requirements to Become an Accredited Investor

To become an accredited investor, one must meet certain financial requirements set by the Securities and Exchange Commission (SEC). As of 2021, an individual must have a net worth of at least $1 million, excluding their primary residence, or have an annual income of at least $200,000 for the past two years with the expectation of earning the same or higher income in the current year. A married couple can also qualify as accredited investors if their joint income exceeds $300,000 for the past two years and is expected to remain the same or increase in the current year.

Difference between Angel Investors and Venture Capitalists

Angel investors and venture capitalists are both sources of funding for startups, but there are some key differences between the two. Angel investors are typically high net worth individuals who invest their own money in early-stage startups in exchange for equity. They often provide mentorship and guidance to the startups they invest in. In contrast, venture capitalists manage funds that are raised from institutional investors and invest that money in startups. They typically invest larger sums of money in later-stage companies and often take a more hands-on approach to managing their investments.

Best Angel Investing Platforms

There are several angel investing platforms that individuals can use to find and invest in startups. Some of the most popular platforms include AngelList, SeedInvest, and Wefunder. These platforms allow investors to browse and invest in a variety of startups, often with low minimum investment amounts.

Amount of Money Needed to Become an Angel Investor

The amount of money needed to become an angel investor can vary depending on the individual’s financial situation and investment goals. While there is no minimum amount required to become an angel investor, it is important to have a significant amount of disposable income to invest in startups. It is also important to have a diversified investment portfolio to manage risk.

Finding a List of Angel Investors

There are several ways to find a list of angel investors, including attending networking events and joining angel investor groups or networks. Online resources such as AngelList and Crunchbase can also provide information on individual angel investors and their investment history.

Examples of Successful Angel Investors

Some of the most successful angel investors include Peter Thiel, Ron Conway, and Chris Sacca. These investors have made successful investments in startups such as PayPal, Google, and Twitter. While their success is notable, it is important to remember that investing in startups carries significant risk and success is not guaranteed.

How to Avoid Overspending and Stick to Your Budget

Identifying and Understanding Your Income and Expenses.

The first step in sticking to a budget is to identify your income. This includes all the money you earn, including your salary, bonuses, and any other sources of income. It’s important to be as accurate as possible when calculating your income to ensure that you have a clear picture of your financial situation.

One way to identify your income is to look at your pay stubs or bank statements. You can also use online tools or apps to track your income automatically. Once you have a clear understanding of your income, you can start to plan your budget accordingly.

Listing Your Expenses

The next step is to list your expenses. This includes all the money you spend, including bills, groceries, entertainment, and any other expenses. It’s important to be as detailed as possible when listing your expenses to ensure that you don’t miss anything.

One way to list your expenses is to keep track of your spending for a few weeks. You can use a notebook or an app to record your expenses. Once you have a clear understanding of your expenses, you can start to categorize them and prioritize them based on their importance.

Here’s an example of how you could categorize your expenses:

| Category | Examples |

|---|---|

| Housing | Rent/mortgage, utilities, maintenance |

| Transportation | Car payments, gas, insurance |

| Food | Groceries, dining out |

| Entertainment | Movies, concerts, hobbies |

| Personal Care | Clothing, haircuts, gym membership |

| Debt | Credit card payments, student loans |

| Savings | Emergency fund, retirement savings |

By categorizing your expenses, you can see where your money is going and identify areas where you can cut back. This will help you create a budget that is realistic and achievable.

Creating a Realistic Budget

Setting Financial Goals

To create a realistic budget, I start by setting financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, if I want to pay off my credit card debt, I would set a specific goal of paying off $5,000 within the next 12 months.

Once I have set my financial goals, I can then work backward to determine how much money I need to allocate to each category in my budget. This helps me prioritize my spending and avoid overspending in areas that are not aligned with my goals.

Allocating Money for Each Category

The next step in creating a realistic budget is to allocate money for each category. I start by listing all of my monthly expenses, including fixed expenses such as rent, utilities, and car payments, as well as variable expenses such as groceries, entertainment, and clothing.

To ensure that I am not overspending in any category, I use a percentage-based budgeting approach. For example, I might allocate 50% of my income to fixed expenses, 30% to variable expenses, and 20% to savings and debt repayment. However, these percentages can vary depending on my financial goals and individual circumstances.

To keep track of my spending, I use a budgeting app or spreadsheet to monitor my expenses and make adjustments as needed. By creating a realistic budget and sticking to it, I can avoid overspending and achieve my financial goals.

Implementing Your Budget

Now that you have created a budget, it’s time to put it into action. Here are two important steps to help you implement your budget successfully.

Tracking Your Spending

The first step in implementing your budget is to track your spending. This will help you see where your money is going and where you need to make adjustments. There are several ways to track your spending, including:

- Using a budgeting app: Many budgeting apps allow you to link your bank accounts and credit cards, so your transactions are automatically tracked. This can save you time and make it easier to stay on top of your spending.

- Keeping a spending journal: Write down every expense you make in a notebook or spreadsheet. This can be helpful if you prefer a more hands-on approach to budgeting.

- Saving receipts: Keep all your receipts and add up your expenses at the end of each day or week.

No matter which method you choose, make sure to review your spending regularly. This will help you stay on track and make adjustments as needed.

Adjusting Your Budget

Once you have tracked your spending for a month or two, it’s time to adjust your budget. This may involve cutting back on certain expenses or finding ways to earn more money. Here are some tips to help you adjust your budget:

- Identify areas to cut back: Look at your spending and identify areas where you can cut back. This may involve eating out less, finding cheaper alternatives for entertainment, or reducing your grocery bill.

- Find ways to earn more money: Consider taking on a part-time job, selling items you no longer need, or finding freelance work. Even small amounts of extra income can help you reach your financial goals.

- Be flexible: Remember that your budget is not set in stone. It’s okay to make adjustments as your circumstances change. Just make sure to stay focused on your goals and make choices that align with your priorities.

By tracking your spending and adjusting your budget regularly, you can stay on track and avoid overspending. With a little patience and discipline, you can achieve your financial goals and live a more secure and fulfilling life.

Avoiding Overspending

Recognizing Triggers

One of the first steps in avoiding overspending is to recognize the triggers that lead us to spend more than we intended. These triggers can be different for everyone, but some common ones include:

- Emotional states: feeling stressed, anxious, or bored can lead us to seek comfort in shopping or spending money on things we don’t need.

- Social pressure: feeling the need to keep up with friends or family members who have a higher income or different spending habits can lead us to overspend.

- Sales and promotions: seeing a sale or promotion can make us feel like we’re getting a good deal, even if we don’t really need the item.

- Impulse buying: buying something on a whim without really thinking it through can lead to overspending.

Once you’ve identified your personal triggers, you can start to develop strategies to avoid or manage them. For example, if you know that stress often leads you to overspend, you may want to find other ways to manage your stress, such as exercise or meditation.

Practicing Mindful Spending

Another key strategy for avoiding overspending is to practice mindful spending. This means being intentional about how and where you spend your money, and making sure that your spending aligns with your values and priorities.

Some tips for practicing mindful spending include:

- Creating a budget: having a clear understanding of your income and expenses can help you make more informed spending decisions.

- Setting goals: having specific goals for your money, such as saving for a vacation or paying off debt, can help you stay focused and motivated.

- Planning ahead: thinking ahead about upcoming expenses, such as birthdays or holidays, can help you avoid last-minute impulse buys.

- Asking yourself questions: before making a purchase, ask yourself if you really need the item, if it aligns with your values and priorities, and if you can afford it.

By recognizing your personal triggers and practicing mindful spending, you can develop habits that will help you stick to your budget and avoid overspending.

Reviewing and Adjusting Your Budget

Monthly Review

To ensure that I stick to my budget and avoid overspending, I make it a habit to review my budget on a monthly basis. During this review, I check my spending against my budgeted amounts to see if I am on track. I also take note of any unexpected expenses that came up during the month and adjust my budget accordingly.

One tool that I find helpful during my monthly review is a budgeting app. The app allows me to easily track my spending and see how much I have left in each budget category. It also sends me alerts when I am getting close to reaching my budget limit.

Making Necessary Adjustments

If I find that I am consistently overspending in a certain category, I know it is time to make some adjustments to my budget. One option is to cut back on spending in that category. For example, if I am consistently overspending on dining out, I may decide to cook more meals at home.

Another option is to increase the budgeted amount for that category. However, I am careful not to increase my budget too much, as this can lead to overspending in other categories.

In some cases, unexpected expenses may come up that require me to adjust my budget. For example, if my car needs repairs, I may need to take money from another budget category to cover the expense. In these situations, I make sure to adjust my budget accordingly and continue to track my spending to stay on track.

Overall, reviewing and adjusting my budget on a regular basis helps me stay on track and avoid overspending. By being proactive and making necessary adjustments, I am able to stick to my budget and achieve my financial goals.

Conclusion

In conclusion, sticking to a budget and avoiding overspending is not an easy task, but it is definitely achievable with dedication and discipline. It requires a lot of planning, tracking, and self-control. However, the benefits of budgeting are immense and can help you achieve your financial goals and live a stress-free life.

Throughout this article, I have shared some of my personal tips and tricks that have helped me stick to my budget and avoid overspending. By following these simple steps, you can take control of your finances and achieve financial freedom.

Remember, budgeting is not a one-time event, but a continuous process. It requires regular review and adjustment to make sure it is aligned with your changing needs and goals. So, don’t be afraid to make changes to your budget as needed.

Finally, always be mindful of your spending habits and keep track of your expenses. By doing so, you can avoid impulse purchases and unnecessary expenses, and stay on track with your budget.

I hope this article has provided you with valuable insights and information on how to stick to a budget and avoid overspending. Good luck on your budgeting journey!

Frequently Asked Questions

What are some effective ways to control overspending?

To control overspending, I recommend setting a budget and tracking your expenses. You can also try avoiding impulse purchases, using cash instead of credit cards, and finding cheaper alternatives for the things you need.

How can I stick to my budget when shopping?

When shopping, it’s important to have a list of the items you need and stick to it. You should also avoid shopping when you’re hungry or tired, as this can lead to impulse purchases. Additionally, you can try using coupons and shopping during sales to save money.

What are some common mistakes people make when trying to stick to a budget?

Some common mistakes people make when trying to stick to a budget include not setting realistic goals, not tracking their expenses, and not accounting for unexpected expenses. It’s important to be flexible and adjust your budget as needed.

How can I motivate myself to stick to my budget?

To motivate yourself to stick to your budget, you can try setting rewards for reaching your financial goals. You can also find a budgeting buddy to hold you accountable and provide support. Additionally, you can remind yourself of the benefits of sticking to your budget, such as financial stability and reduced stress.

What are some tips for creating a realistic budget?

When creating a budget, it’s important to be realistic about your income and expenses. You should also account for unexpected expenses and prioritize your spending based on your needs and goals. It can be helpful to use budgeting tools and resources to guide you.

How can I track my expenses to avoid overspending?

To track your expenses, you can use a budgeting app or spreadsheet to record your purchases and categorize them. You should also review your expenses regularly and adjust your budget as needed. It can also be helpful to set alerts for when you’re nearing your budget limits.

The Benefits of Tracking Your Expenses for Budgeting

Understanding the Concept of Expense Tracking:

What is the definition of expense tracking? Expense tracking refers to the process of recording and monitoring all the money spent over a certain period. It involves keeping track of all expenses, including cash, credit card, and bank transactions.

By tracking expenses, you can gain a better understanding of their spending habits and identify areas where they can reduce expenses and prosper.

Importance of Expense Tracking

Tracking expenses is an essential aspect of budgeting. It helps to keep your finances in check and ensure that you’re spending within your means. By tracking expenses, you can identify areas of overspending and make necessary adjustments.

Expense tracking also helps to set financial goals and prioritize spending. For instance, if you want to save for a vacation or a down payment on a house, they can identify areas where they can cut back on expenses and redirect those funds towards their financial goals.

In addition, expense tracking enables tracking progress towards financial goals. By monitoring spending habits, you can determine if you’re on track to achieving your goals or if you need to make adjustments.

Overall, expense tracking is a crucial tool for anyone looking to take control of their finances and achieve financial stability.

The Benefits of Tracking Your Expenses

Improved Financial Awareness

Tracking your expenses can help you gain a better understanding of your financial situation. By keeping track of your spending, you can identify areas where you may be overspending and make adjustments to your budget. This can help you avoid unnecessary expenses and better manage your money.

Effective Budgeting

Tracking your expenses is an essential part of budgeting. By knowing exactly where your money is going, you can create a realistic budget that takes into account your income and expenses. This can help you avoid overspending and ensure that you have enough money to cover your bills and other expenses.

Debt Reduction

One of the biggest benefits of tracking your expenses is that it can help you reduce your debt. By identifying areas where you may be overspending, you can redirect that money towards paying off your debts. This can help you pay off your debts faster and save money on interest charges.

Savings Growth

Tracking your expenses can also help you grow your savings. By identifying areas where you may be overspending, you can redirect that money towards your savings goals. This can help you build up your emergency fund, save for a down payment on a house, or invest in your future.

Overall, tracking your expenses is an essential part of financial management. By keeping track of your spending, you can gain a better understanding of your financial situation, create an effective budget, reduce your debt, and grow your savings.

Methods of Expense Tracking

Keeping track of expenses is crucial for budgeting. There are several ways to track expenses, including manual tracking, digital tools, and professional services.

Manual Tracking

Manual tracking involves writing down expenses in a notebook or spreadsheet. This method is straightforward and can be done using a pen and paper or a computer. It is ideal for those who prefer a hands-on approach to budgeting. However, manual tracking can be time-consuming and prone to errors.

Digital Tools

Digital tools make expense tracking more manageable. There are several apps and software available that can help with budgeting. These tools automatically categorize expenses, generate reports, and provide insights into spending habits. Some popular digital tools include Mint, YNAB, and Personal Capital. These tools are convenient and save time, but they may require a subscription fee.

Professional Services

For those who want expert help with budgeting, professional services are available. Financial advisors and accountants can help create a budget, track expenses, and provide advice on saving and investing. This method is ideal for those who have complex financial situations or need help with long-term financial planning. However, professional services can be expensive and may not be necessary for everyone.

In conclusion, there are several methods of expense tracking, each with its own advantages and disadvantages. It is essential to choose the method that works best for you and your financial situation.

Implementing Expense Tracking

Starting Small

To start tracking your expenses, I recommend beginning with a small, manageable goal. This could be as simple as tracking all of your expenses for one week. Once you’ve accomplished that, you can gradually increase the length of time you track your expenses until it becomes a habit.

One effective way to track your expenses is to use a spreadsheet or budgeting app. This will allow you to easily categorize your expenses and see where your money is going. You can also use a notebook or a simple app like a notes app to record your expenses manually.

Consistency is Key

Consistency is crucial when it comes to tracking your expenses. It’s important to make it a habit and to track every expense, no matter how small. This will give you an accurate picture of your spending habits and help you identify areas where you can cut back.

To make tracking your expenses easier, try to get into a routine. Set aside a specific time each day or week to record your expenses, and make it a part of your regular routine. You can also set reminders on your phone or computer to help you remember.

Periodic Review

Once you’ve been tracking your expenses for a while, it’s important to periodically review your spending habits. This will help you identify any areas where you’re overspending and make adjustments to your budget.

Review your expenses on a monthly or quarterly basis and look for trends. Are you spending more than you budgeted for in certain categories? Are there areas where you can cut back? Use this information to make adjustments to your budget and spending habits.

By starting small, being consistent, and periodically reviewing your expenses, you can successfully implement expense tracking into your budgeting routine and reap the benefits of a more financially stable future.

Potential Challenges and Solutions

Time-Consuming Process

Tracking expenses can be a time-consuming process. It requires discipline and patience to record every single expense. It can be challenging to stick to the habit of tracking expenses, especially when life gets busy.

One solution to this challenge is to use technology. There are many apps and software available that can help automate the process of tracking expenses. These tools can link to your bank account and credit cards to automatically categorize expenses. This can save a lot of time and effort.

Another solution is to set a specific time each day or week to track expenses. By making it a habit and incorporating it into your routine, it becomes easier to stick to.

Data Privacy Concerns

Some people may have concerns about the privacy of their financial information. They may worry about the security of their data and who has access to it.

To address these concerns, it’s important to choose a reputable app or software that has strong security measures in place. Look for tools that use encryption and two-factor authentication to protect your data.

It’s also important to read the privacy policy of any app or software you use to understand how your data is being used and who has access to it.

Sustainability of the Habit

Tracking expenses is a habit that requires consistency and sustainability. It can be challenging to maintain the habit over the long term.

One solution is to set specific goals and incentives for tracking expenses. For example, you could set a goal to save a certain amount of money each month and reward yourself when you achieve that goal.

Another solution is to find an accountability partner. This could be a friend or family member who is also interested in tracking their expenses. By holding each other accountable, you can help each other stay motivated and on track.

Conclusion

In conclusion, tracking your expenses is a simple yet powerful way to take control of your finances. By keeping a record of your spending, you can identify areas where you are overspending and make adjustments to your budget accordingly. This can help you save money and work towards your financial goals.

Additionally, tracking your expenses can help you identify patterns in your spending behavior. For example, you may notice that you tend to overspend on eating out or impulse purchases. Once you are aware of these patterns, you can take steps to change your behavior and make more mindful spending choices.

Overall, tracking your expenses is a valuable tool for budgeting that can lead to greater financial stability and peace of mind. Whether you choose to use a spreadsheet, a budgeting app, or a pen and paper, the important thing is to start tracking your expenses today.

Frequently Asked Questions

How can tracking your expenses help you save money?

By tracking your expenses, you can see where your money is going and identify areas where you can cut back. This can help you save money in the long run and achieve your financial goals.

What are the best tools for tracking expenses?

There are many tools available for tracking expenses, including budgeting apps, spreadsheets, and even pen and paper. The best tool is one that you feel comfortable using and that allows you to easily track your expenses.

What are the most common expenses people forget to track?

People often forget to track small, everyday expenses such as coffee, snacks, and impulse purchases. These expenses can add up quickly and have a big impact on your budget.

How often should you review your expenses?

It’s a good idea to review your expenses on a regular basis, such as once a week or once a month. This can help you stay on track with your budget and make adjustments as needed.

What are some tips for sticking to a budget?

Some tips for sticking to a budget include setting realistic goals, tracking your expenses, avoiding impulse purchases, and finding ways to save money on everyday expenses.

How can tracking expenses help you identify areas to cut back on?

By tracking your expenses, you can see where your money is going and identify areas where you may be overspending. This can help you make adjustments to your budget and cut back on unnecessary expenses.

Flow for Entrepreneurs in Achieving Optimal Productivity and Creativity

I believe that achieving a state of flow is one of the most important skills anyone could learn. When we are in flow state, we can accelerate learning, enjoy tasks much more, and actually lose track of time because we’ve entered a semi state of bliss and harmony.

Unfortunately, too many people seek these feelings from artificial methods by using medications and alcohol. But there is a way to activate hormones and neurotransmitters naturally.

Mihaly Csikszentmihalyi’s theory of flow describes a state of complete absorption and focus in an activity, where one loses track of time and experiences a sense of enjoyment and fulfillment. According to Csikszentmihalyi, when we learn to do a task mindfully, it’s usually going to give us an experience of flow.

In this article, I will discuss the six neurotransmitters that are believed to be involved in achieving a flow state: dopamine, norepinephrine, serotonin, anandamide, endorphins, and GABA.

Key Takeaways

- Achieving a state of flow is important for accelerating learning and enjoying tasks.

- There is a way to activate hormones and neurotransmitters naturally to achieve flow state.

- Mindfulness is key to experiencing flow and the six neurotransmitters involved are dopamine, norepinephrine, serotonin, anandamide, endorphins, and GABA.

Mindfulness Creates the Experience of Flow

As I have learned, mindfulness is a powerful tool that can significantly increase one’s level of attention with practice. This increased level of attention is essential for creating flow experiences. Flow experiences require attention, and mindfulness is all about attention. By practicing mindfulness regularly, our brain becomes better at paying attention to what we need and want to focus on. This increased level of attention makes flow experiences far more likely.

Another benefit of practicing mindfulness is that it provides immediate feedback. Flow needs direct feedback as to how we’re doing. Through practicing mindfulness, we get immediate feedback because we know second by second if we’re paying attention or if our mind is wandering again. This means that when we notice our mind has drifted away from the present moment, we can gently bring our attention back to the immediate moment. By performing a challenging task and using mindfulness, we are participating in an active process of repeatedly rebalancing our mind to come back to the present moment. Our mind naturally wants to pull us away into other thoughts.

A good exercise to create a flow experience is to drive in a mindful way from work to home. This is a simple challenge for anyone to create a flow experience. Once we’ve done this successfully and entered into flow, we can do it again but with different tasks. Eventually, we will be able to learn faster and complete complex tasks more proficiently.

Using mindfulness with our thoughts and feelings gives us a deep sense of personal control. We become more aware of the choices we have and generate a sense of control. This translates into a better quality of life because we can choose how to react to situations. For example, when driving, if a vehicle cuts in front of us, we have a powerful choice. We can either react and feel annoyed or practice letting it go and focusing on safety and getting to our destination.

Finally, when we use mindfulness, we become overwhelmed that what we are doing and where we’re at is intrinsically rewarding. We begin performing and completing tasks for the experience of just doing them. For example, if we’re driving our car to get home as quickly as we can so we can begin dinner, we’re not going to be able to obtain a flow experience. If we drive to simply enjoy each moment of the journey, noticing things along the way, we can appreciate the flowers along the way and feel the warmth of the sunshine on our arm. We will feel gratitude and in control of our moods.

In conclusion, mindfulness creates the experience of flow by increasing our level of attention, providing immediate feedback, giving us a deep sense of personal control, and making us feel intrinsically rewarded. By practicing mindfulness regularly, we can create more flow experiences in our lives, leading to a better quality of life and increased proficiency in completing complex tasks.

Three other important hormones and body chemicals:

There are many hormones and body chemicals that play important roles in our daily lives. In addition to the well-known hormones like testosterone and estrogen, there are three other important hormones and body chemicals that are worth discussing.

Oxytocin

Oxytocin is often referred to as the “love hormone” because it is released during social bonding activities such as hugging, kissing, and sex. It is also involved in childbirth and breastfeeding. Oxytocin is produced in the hypothalamus and released by the pituitary gland. It has many important functions in the body, including regulating social behavior, reducing stress levels, and promoting feelings of trust and bonding.

Phenylethylamine

Phenylethylamine is a naturally occurring chemical that is found in chocolate and is believed to have mood-enhancing effects. It is also involved in the release of dopamine in the brain. Phenylethylamine is produced by the body and is a precursor to dopamine, a neurotransmitter that is associated with pleasure and reward. It is also thought to play a role in regulating mood and anxiety.

Nitric oxide

Nitric oxide is a compound in the body that causes blood vessels to widen, which increases circulation and stimulates the release of certain hormones like insulin and human growth hormone. Nitric oxide is produced in the endothelial cells, the single thick wall of cells that comprise the inner lining of blood vessels. Nitric oxide works as a retrograde neurotransmitter in synapses, allows the brain blood flow and also has important roles in intracellular signaling in neurons. Nitric oxide is a gas we make within our own bodies from nitrates and nitrites found naturally in our foods. Good sources include dark green leafy vegetables like kale, arugula, Swiss Chard and spinach. Other great sources include beets, cabbage, cauliflower, carrots and broccoli.

In conclusion, these three hormones and body chemicals play important roles in our daily lives. Oxytocin is involved in social bonding, Phenylethylamine is associated with mood regulation, and Nitric oxide is involved in blood vessel dilation and hormone release.

How Reading a Story Can Affect Our Brain

As Lisa Cron, a renowned author on the elements of story, explains, reading a story is like a chemical cocktail to our brain and nervous system. It triggers the release of inner body hormones such as dopamine, cortisol, and oxytocin.

Dopamine, for instance, is associated with our curiosity and keeps us engaged in the story, making us want to read more to find out what happens next. Cortisol, on the other hand, is the stress hormone that keeps us reading because we feel that something is at stake and something is at risk in the story. However, for a story to have a five-star rating, it must also involve oxytocin.

Oxytocin is involved with the emotion of empathy, which is crucial to caring about the protagonist and the story. It is this empathy that helps us connect with the story on a deeper level. To have a significant impact, the empathy must be more involved than just feeling fear or danger. For instance, it could be a situation where the protagonist is facing a challenging decision that we can relate to or an emotional struggle that resonates with us.

In conclusion, reading a story can have a significant effect on our brain, and the inner body hormones that are triggered when we read can help us connect with the story on a deeper level. By keeping the reader engaged and emotionally invested in the story, authors can create a memorable reading experience that leaves a lasting impression on the reader.

Frequently Asked Questions

How can I find my flow state as an entrepreneur?

As an entrepreneur, finding your flow state can be challenging, but it is essential for achieving optimal productivity. To find your flow state, you need to engage in activities that you enjoy and are passionate about. This could be anything from brainstorming new ideas to developing a new product or service. It is also essential to eliminate distractions and focus on the task at hand.

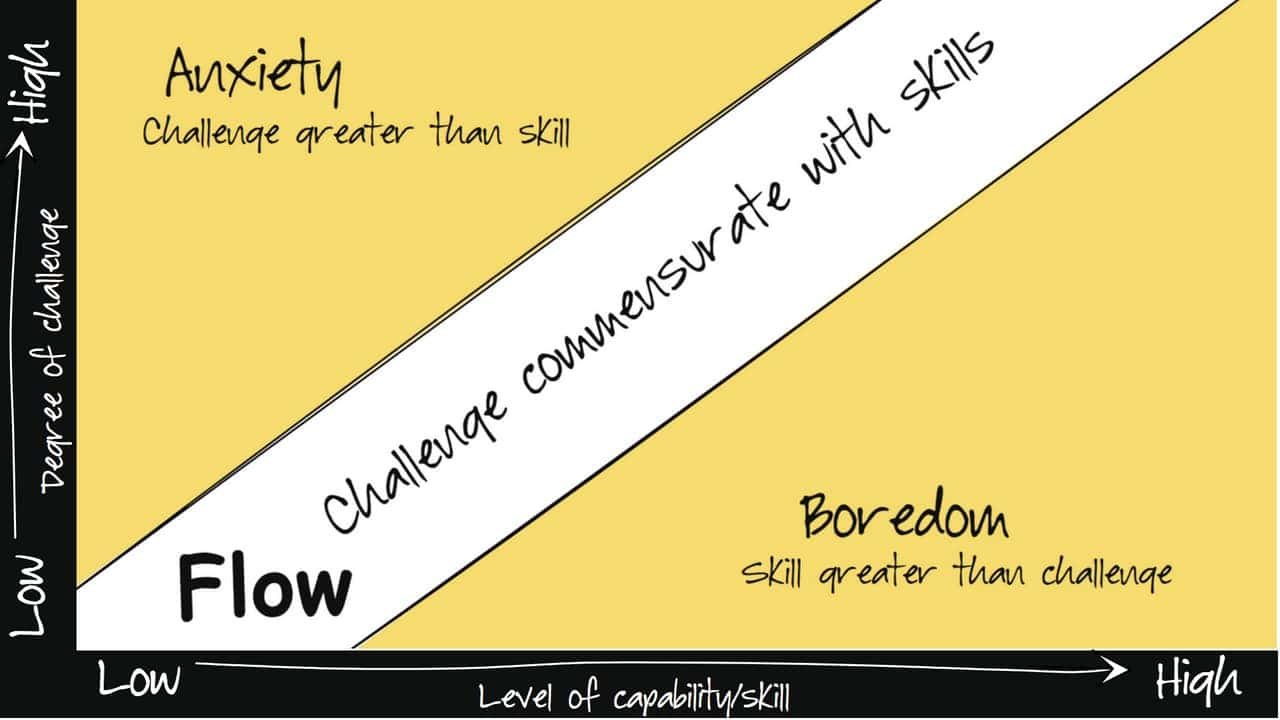

Using the Flow Chart below, you can follow the degree of challenge with the level of skill to see where the two meet within the state of flow. It is within this Flow State that the perception of time changes. You want to be between the anxiety of having too much challenge, and boredom of being unchallenged.

If you find yourself in boredom with too many mundane tasks then hire out that work and work on higher level tasks. If you think you’ve maxed out in your niche business then start something else that will bring back new challenges. That’s where the satisfaction lies.

What are the benefits of finding your flow state as an entrepreneur?

Finding your flow state as an entrepreneur can have several benefits, including increased productivity, improved focus and concentration, and a sense of fulfillment. When you are in your flow state, you are more likely to be creative, innovative, and come up with new ideas. It can also help you to achieve your goals and improve your overall well-being.

What are some examples of flow for entrepreneurs?

Some examples of flow for entrepreneurs include developing a new product or service, brainstorming new ideas, and creating a marketing strategy. It could also be anything that challenges you and requires your full attention and focus.

What are the key stages of the entrepreneurial process?

The key stages of the entrepreneurial process include ideation, market research, product development, marketing, and sales. Each stage requires different skills and expertise, and it is essential to have a clear understanding of each stage to succeed as an entrepreneur.

How can entrepreneurs recognize opportunities and find their flow?

Entrepreneurs can recognize opportunities by staying up to date with industry trends and identifying gaps in the market. To find their flow, entrepreneurs should engage in activities that they are passionate about and that challenge them. It is also essential to eliminate distractions and focus on the task at hand.

What are some movies that can boost an entrepreneur’s flow?

Some movies that can boost an entrepreneur’s flow include “The Social Network,” “The Pursuit of Happiness,” and “The Wolf of Wall Street.” These movies can provide inspiration, motivation, and insights into the entrepreneurial mindset.

Becoming an Entrepreneur: 16 Ways to Find Ideas for Your Product

Becoming an entrepreneur is an exciting and challenging journey. It requires patience, persistence, and a willingness to take risks. Here are some tips to help you get started on your entrepreneurial journey:

- Identify your passions and interests: Start by identifying the things that you are passionate about and interested in. This will help you come up with ideas for products or services that you can offer.

- Research the market: Once you have identified your passions and interests, research the market to see if there is a demand for your product or service. Look for gaps in the market that you can fill.

- Find a mentor: Finding a mentor who has experience in entrepreneurship can be invaluable. They can provide guidance and support as you navigate the ups and downs of starting a business.

- Network: Attend networking events and connect with other entrepreneurs. This can help you build relationships and find potential partners or investors.

- Develop a business plan: A business plan is essential for any entrepreneur. It outlines your goals, strategies, and financial projections.

- Secure funding: Starting a business requires money. Look for funding options such as loans, grants, or investors.

- Build a team: As your business grows, you will need to build a team of employees who can help you achieve your goals.

- Stay focused: Starting a business can be overwhelming, but it’s important to stay focused on your goals. Prioritize your tasks and stay organized.

- Embrace failure: Failure is a natural part of the entrepreneurial journey. Learn from your mistakes and use them as opportunities to grow and improve.

- Stay motivated: Entrepreneurship can be challenging, but it’s important to stay motivated. Surround yourself with positive people and celebrate your successes along the way.

Remember, becoming an entrepreneur takes time and effort. But with the right mindset and strategies, you can turn your ideas into a successful business.

16 Ways To Find Ideas For Your Product

If you’re thinking about becoming an entrepreneur, finding the right product idea can be a daunting task. Here are 16 ways to help you come up with great ideas for your product:

Identify A Problem You Personally Face And Try To Come Up With A Solution For It

One of the best ways to find a product idea is to identify a problem that you personally face and try to come up with a solution for it. Chances are, if you’re facing a problem, there are others who are facing the same problem and would be willing to pay for a solution.

Look For Gaps In The Market And Try To Fill Them With A Unique Product Or Service

Another way to find a product idea is to look for gaps in the market and try to fill them with a unique product or service. Look for areas where there is a need but no one is currently offering a solution.

Conduct Market Research To Understand The Needs And Preferences Of Your Target Audience

Market research can help you understand the needs and preferences of your target audience. Use surveys, focus groups, and other research methods to gather information about what your potential customers are looking for.

Keep Up With Industry Trends And Try To Innovate Within Them

Staying up to date with industry trends can help you identify opportunities for innovation. Look for ways to improve upon existing products or services or create new products that are in line with current trends.

Look For Inspiration From Successful Businesses In Other Industries

Successful businesses in other industries can provide inspiration for your own product ideas. Look for businesses that have a similar target audience or business model and see what you can learn from them.

Attend Trade Shows And Conferences To Learn About New Products And Technologies

Trade shows and conferences can be a great way to learn about new products and technologies. Attend events that are relevant to your industry or target audience to stay up to date with the latest developments.

Ask Friends, Family, And Colleagues For Their Opinions And Feedback On Potential Product Ideas

Getting feedback from people you trust can be a valuable way to refine your product ideas. Ask friends, family, and colleagues for their opinions and feedback on potential product ideas.

Conduct Surveys And Focus Groups To Get More In-Depth Feedback From Potential Customers

Surveys and focus groups can provide more in-depth feedback from potential customers. Use these methods to gather insights about what your target audience is looking for in a product.

Use Social Media To Gather Insights And Feedback From Your Target Audience

Social media can be a powerful tool for gathering insights and feedback from your target audience. Use platforms like Twitter, Facebook, and Instagram to engage with potential customers and gather feedback about your product ideas.

Look For Opportunities To Improve Existing Products Or Services

Improving upon existing products or services can be a great way to find a product idea. Look for areas where existing products or services are lacking and see how you can improve upon them.

Consider Creating A Product That Complements An Existing Product Or Service

Creating a product that complements an existing product or service can be a smart strategy. Look for areas where an existing product or service could be enhanced by a complementary product.

Look For Emerging Markets Or Niches That Are Underserved

Emerging markets or niches that are underserved can be a great opportunity for a new product. Look for areas where there is a need but no one is currently offering a solution.

Follow The News And Current Events To Identify Potential Opportunities

Following the news and current events can help you identify potential opportunities for a new product. Look for areas where there is a need or a problem that needs to be solved.

Look For Inspiration From Your Hobbies Or Interests

Your hobbies or interests can provide inspiration for a new product idea. Look for ways to turn your passion into a business opportunity.

Consider Partnering With Other Businesses Or Individuals To Develop New Products

Partnering with other businesses or individuals can be a great way to develop new products. Look for businesses or individuals who have complementary skills or resources.

Look For Ways To Improve Upon Existing Products Or Services That Are Lacking In Some Way

Finally, look for ways to improve upon existing products or services that are lacking in some way. Use customer feedback and market research to identify areas where improvements can be made.

Frequently Asked Questions

What are some effective methods for generating business ideas?

There are many effective methods for generating business ideas. One method is to identify problems or pain points that people experience in their daily lives and develop a product or service that solves those problems. Another method is to identify trends or emerging technologies and develop a product or service that leverages those trends or technologies.

What are the most common sources of business ideas?

The most common sources of business ideas are personal experience, hobbies, interests, and observations of the world around you. You can also generate business ideas by talking to friends, family, and colleagues about their experiences and challenges.

What are some unique sources of inspiration for new business ideas?

Some unique sources of inspiration for new business ideas include traveling to new places, attending conferences and events, reading books and articles outside of your field, and brainstorming with a diverse group of people.

How can entrepreneurs identify gaps in the market to develop a product?

Entrepreneurs can identify gaps in the market by conducting market research, analyzing industry trends, and talking to potential customers. They can also observe the products and services that are currently available and identify areas where there is room for improvement.

What are some strategies for refining and developing a business idea?

Some strategies for refining and developing a business idea include conducting customer research, creating a prototype or minimum viable product, and testing the product or service with a small group of potential customers. Entrepreneurs can also seek feedback from mentors and advisors to help refine their ideas.

How can entrepreneurs validate their business ideas before investing time and resources?

Entrepreneurs can validate their business ideas by conducting market research, creating a landing page or pre-order page to gauge interest, and testing the product or service with a small group of potential customers. They can also seek feedback from mentors and advisors to help identify potential challenges and opportunities.

This Week’s Action Step

If you don’t have one, start your list of ideas that will be part of your selection strategy, and begin diving deeper into them every day.

Build a simple spreadsheet or document you can take notes on and fall back on each week ensuring you are validating your entrepreneurial idea, while taking action on these ideas.

That’s it for today.

If you have randomly found or been forwarded this Newsletter and would like to be on the Saturday Cents subscriber list, where you will get content like this once a week on Saturday morning, then you can subscribe here>>

See you next week.

Budgeting Apps For Beginners to Help Manage Finances

As someone who has struggled with managing finances in the past, I know firsthand how overwhelming it can be to get started with budgeting.

Fortunately, there are now a plethora of budgeting apps available that can make the process much easier and more manageable, even for beginners.

Understanding budgeting apps is the first step to choosing the right one for your needs.

These apps can help you track your expenses, set financial goals, and even automate some of your savings. With so many options available, it can be difficult to know where to start. But with a little research and some trial and error, you can find an app that works for you.

In this article, I’ll share some of the top budgeting apps for beginners, as well as tips for using them effectively. Whether you’re just starting out on your financial journey or looking to take your budgeting to the next level, there’s an app out there that can help.

Key Takeaways

- Budgeting apps can help beginners manage their finances more effectively.

- Understanding the features of budgeting apps is key to choosing the right one.

- With the right app and some effective strategies, budgeting can become a manageable and even enjoyable part of your financial routine.

Understanding Budgeting Apps

What are Budgeting Apps?

Budgeting apps are software applications designed to help individuals manage their finances. These apps typically provide users with tools to track income and expenses, create budgets, and set financial goals. Some budgeting apps also offer additional features, such as investment tracking and bill payment reminders.

There are many different types of budgeting apps available, ranging from simple tools that focus on basic budgeting to more complex applications that offer a range of financial management features. Some budgeting apps are free, while others charge a fee for access to premium features.

Why Use Budgeting Apps?

There are several reasons why someone might choose to use a budgeting app. For one, budgeting apps can help individuals gain a better understanding of their finances by providing a clear picture of their income and expenses. This can help users identify areas where they may be overspending and make adjustments to their budget accordingly.

Budgeting apps can also help users set financial goals and track their progress towards those goals. For example, someone might use a budgeting app to save for a down payment on a house or to pay off credit card debt.

Finally, budgeting apps can be a useful tool for individuals who want to simplify their financial management. By consolidating all of their financial information in one place, users can save time and avoid the hassle of manually tracking their finances.

Overall, budgeting apps can be a helpful tool for individuals who want to take control of their finances and improve their financial well-being.

Choosing the Right Budgeting App

When it comes to choosing the right budgeting app, there are a few key factors to consider. Here are some things to keep in mind:

Ease of Use

One of the most important factors to consider when choosing a budgeting app is how easy it is to use. You want an app that is intuitive and user-friendly, so you can quickly and easily enter your income and expenses. Look for an app that has a clean, simple interface and doesn’t require a lot of time to set up.

Features and Functionality

Another important factor to consider is the features and functionality of the app. Look for an app that offers the features you need to manage your finances effectively. For example, if you want to track your spending in different categories, look for an app that allows you to create custom categories. If you want to set savings goals, look for an app that has a savings goal feature.

Security and Privacy

Finally, it’s important to consider the security and privacy of the app. Look for an app that uses encryption to protect your data and has a privacy policy that clearly outlines how your data will be used. You should also look for an app that allows you to set a password or PIN to protect your data.

Overall, when choosing a budgeting app, it’s important to find one that meets your specific needs and preferences. By considering factors like ease of use, features and functionality, and security and privacy, you can find an app that will help you manage your finances effectively.

Top Budgeting Apps for Beginners

As someone who has struggled with managing my finances in the past, I have found that using budgeting apps can be a great way to stay on top of my spending. Here are my top picks for budgeting apps that are perfect for beginners.

Mint

Mint is a popular budgeting app that is great for beginners. It allows you to connect all of your accounts in one place, including bank accounts, credit cards, and investments. Mint also automatically categorizes your transactions and provides you with a breakdown of your spending habits. You can set up budgets for different categories and receive alerts when you are close to going over your budget. One downside to Mint is that it does have a lot of ads and promotions for financial products, so you’ll need to be mindful of that.

You Need a Budget (YNAB)

You Need a Budget (YNAB) is another popular budgeting app that is great for beginners. YNAB uses a unique budgeting method called “zero-based budgeting,” which means that every dollar you earn is assigned a job. YNAB also offers free online workshops and resources to help you learn how to manage your money better. One downside to YNAB is that it does have a monthly subscription fee.

PocketGuard

PocketGuard is a budgeting app that is perfect for beginners who want a simple and easy-to-use app. It allows you to connect all of your accounts in one place and provides you with a snapshot of your finances. PocketGuard also offers suggestions for ways to save money and tracks your bills so you never miss a payment. One downside to PocketGuard is that it doesn’t have as many features as some of the other budgeting apps on this list.

Overall, these budgeting apps can be a great way for beginners to start managing their finances. Each app has its pros and cons, so it’s important to find the one that works best for you.

How to Use Budgeting Apps Effectively

As a beginner looking to manage your finances, budgeting apps can be a great tool to help you achieve your financial goals. Here are some tips on how to use budgeting apps effectively:

Setting Up Your Budget

When you first start using a budgeting app, the first thing you should do is set up your budget. This involves inputting your income and expenses, and categorizing them accordingly. Most budgeting apps will have pre-set categories, but you can also create your own custom categories if needed.

It’s important to be realistic when setting up your budget. Don’t underestimate your expenses or overestimate your income. The more accurate your budget is, the more effective it will be in helping you manage your finances.

Tracking Your Spending

Once your budget is set up, the next step is to track your spending. Most budgeting apps will allow you to link your bank accounts and credit cards, which will automatically track your transactions. You can also manually input any cash transactions.

It’s important to regularly check your budgeting app to make sure your spending is in line with your budget. If you notice that you’re overspending in a certain category, you may need to adjust your budget or find ways to cut back on expenses.

Adjusting Your Budget Over Time

Your budget is not set in stone. As your income and expenses change, you may need to adjust your budget accordingly. For example, if you get a raise at work, you may want to allocate more money towards savings or debt repayment.

It’s important to regularly review your budget and make adjustments as needed. This will help you stay on track towards your financial goals.

In conclusion, budgeting apps can be a great tool for beginners looking to manage their finances. By setting up your budget, tracking your spending, and adjusting your budget over time, you can effectively use budgeting apps to achieve your financial goals.

Conclusion

In conclusion, budgeting apps are an excellent tool for beginners looking to manage their finances. With a wide range of features, these apps can help you track your spending, create a budget, and save money.

When choosing a budgeting app, it’s important to consider your individual needs and preferences. Some apps may be better suited for those who want a more hands-on approach, while others may be better for those who prefer a more automated experience.

Regardless of which app you choose, it’s important to stay committed to using it regularly. By consistently tracking your spending and sticking to your budget, you can take control of your finances and achieve your financial goals.

Overall, budgeting apps can be a valuable tool for anyone looking to improve their financial literacy and take control of their finances. With the right app and a commitment to using it regularly, you can achieve financial success and live a more financially secure life.

You can learn more about how to create a budget that works for your lifestyle here.

Related posts:

- Is It Better to Buy a New or Used Car?

- 10 Ways To Get Out Of Debt This Year: Expert Tips

- 50/30/20 Budget Rule: How to Manage Your Finances Effectively

- Smart Grocery Shopping Strategies for Saving Money

- Frugal Grocery Shopping Tips and Tricks: How to Save Money on Your Next Trip to the Store

Frequently Asked Questions

What are some free budgeting apps for iPhone?

There are several free budgeting apps for iPhone that can help you manage your finances. Some popular options include Mint, PocketGuard, and Wally.

Which budgeting app is best for couples?

If you are looking for a budgeting app that is specifically designed for couples, then Honeydue may be a good option as can Goodbudget. Both allow you to share and track expenses with your partner, set budget goals, and receive alerts when bills are due.

What are the best budgeting apps for 2023?

As of 2023, some of the best budgeting apps include Mint, YNAB (You Need a Budget), PocketGuard, and Wally. These apps offer a range of features, including expense tracking, budgeting tools, and bill reminders.

How do I start budgeting and saving money as a beginner?

To start budgeting and saving money as a beginner, it’s important to first track your expenses and identify areas where you can cut back. Once you have a clear picture of your spending habits, you can create a budget and set financial goals. Use budgeting apps that can help you with this process, including Mint and YNAB. A quick overview of ones to check out and for what purposes are: Best free budgeting app: Mint. Best for tracking spending: PocketGuard. Best for user-friendliness: You Need a Budget (YNAB). Best for organizing funds: EveryDollar. Best for couples: Goodbudget. Best for worldwide access: Wally. These aren’t the only ones, yet what I selected at the time of writing this article.

What is the easiest budgeting app to use?

If you are new to budgeting and looking for an app that is very easy to use, then PocketGuard may be a good option. It offers a simple interface and allows you to link all of your financial accounts in one place.

What app can help me keep track of my finances?

There are several apps that can help you keep track of your finances, including Mint, Personal Capital, and Clarity Money. These apps allow you to track your expenses, monitor your investments, and receive alerts when bills are due. Also look at the ones I listed above.