The topic in this article is one of the most important concepts to learn and master you will ever encounter.

It’s really the key to success and failure in anything you do. It’s the root of everything.

It may sound silly to you and something of a cliche, but just keep reading for a couple minutes.

Hey, I hope you find the video below helpful! It is a quick clip featuring Dr. Jones and Dr. Joe Vitale teaching how to catch your negative thoughts’ and turn them into positive thoughts/beliefs. Enjoy!

You may have already read my eBook How To Change Anything In Your Life, but if not, I’ll link to it at the end of this article, but until then, this content will get you going in the right direction quickly.

Let’s Make Some Changes Right Now

First, write four actions that you need to take that you’ve been putting off.

Maybe you need to make more money. Maybe you need to stop smoking. Maybe you need to communicate with someone you’ve had a falling out with, or reconnect with.

Second, under each of these actions, write the answer to the following questions:

Why haven’t I taken action? What pain have I linked to taking this action before? Answering these questions will help you understand that what has held you back is that you’ve associated greater pain with taking the action than to not taking it.

Be honest with yourself. If you’re thinking, “I have no pain that is associated to it,” think a little harder.

Maybe the pain is simple: maybe it’s the pain of taking time out of your busy schedule.

Third, write all the pleasure you’ve had in the past by indulging in this negative pattern.

It’s crazy us humans take pleasure in negative and destructive patterns, yet it’s super important to believe and accept we all do it.

For example, if you think you should lose some weight, why have you continued to eat whole slices of

cake and bulk-size bags of donuts, and to guzzle twelve-packs of sugary soda pop?

You’re avoiding the pain of depriving yourself from these foods.

You’re eating these foods because it makes you feel good right now. It gives you pleasure! Instant pleasure! No one wants to give up these feelings!

Creating a change that will last means finding a fresh way to get the same pleasure without the negative consequences.

Identifying the pleasure you’ve been getting will help you know what your target is.

Fourth, write what it will cost if you don’t change now.

What will happen if the eating of so much sugar and fat continues? If you don’t stop smoking? If you don’t make that phone call that you know you need to make? If you don’t start consistently working out each day?

Be honest with yourself. What’s it going to cost you over the next two and even five years?

What’s it going to cost emotionally? What’s it going to cost in terms of your self-image? How much physical energy will it cost?

What will it cost you in your feelings of self-esteem? What will it cost financially? What will it cost in relationships with the people you care about most?

How does that make you feel? Don’t just say, “It will cost me money” or “I will be fat.” That’s not enough.

It’s important to remember that what drives our emotions.

Get associated with and use pain as a friend. One that can drive a new level of success.

The last step is to write all the pleasure you’ll receive by taking each of these actions in this moment.

Make a huge list that will drive you emotionally, that will really get you excited: “I’ll gain the feeling of really being in control of my life, of knowing that I’m in charge.

I’ll gain a new level of self-confidence. I’ll gain physical and health and have more energy. I’ll be able to strengthen all my relationships.

I’ll develop more self-directiveness which will help in every other area in life. My life will be better in every area over the next two to five years.

By taking this action, my dream will be a reality. See all the positive affects both in the present and in the long term.

We Link Negative Associations To Change

The idea of instant change is scary to most. Instant change means if we can change that easily, why didn’t we change a week ago, a month ago, a year ago, and it would have been over.

How quickly could a person recover from the loss of a loved one and felt differently? Physically, they can do it the next morning, yet they don’t.

The reason is that we have a set of beliefs in our culture that fuels the need to grieve for a certain time period.

We choose the pain of grieving rather than changing our emotions until we’re satisfied that our rules and cultural standards about what’s appropriate have been met.

There are cultures that celebrate when someone dies. They believe God always knows the right time for us to leave the earth, and that death is graduation.

They also believe if you were to grieve about someone’s death, that action would show nothing but your own lack of understanding of life. That you would show your own selfishness.

Since this person has gone on to a better place, you’re feeling sorry for no one but yourself. They link pleasure to death, and pain to grieving, so grief is not a part of their culture.

Not that grief is bad or wrong by any means. I’m just saying that we need to realize it’s based upon our beliefs that pain takes a long time to recover from.

To change how we feel about death is a painful and even ridiculous thought to many.

This can relate to how we feel about changing a dangerous habit. We want the results, but the actual change is not comfortable.

Link this to feeling good about when someone dies. Doing this linking allows you to understand the pain involved, and the ridiculous feeling of making the change.

You probably will never feel good about the death of a loved one, but you can learn to feel good about making a necessary change of thought pattern that will create a new constructive pattern guiding toward change.

It goes around the short circuit of paralysis created by not wanting to change because it seems too hard and uncomfortable. The results of the change seem good, yet the implementation is a different story. Can you see the point?

Using this technique is a way to get rid of the enjoyment of destructive behavior embedded in our habits.

In case you haven’t seen this yet, my friend and coach Dr. Steve G. Jones recorded a video where he shows the first of many secrets to Total Money Magnetism.

At the end of the video, I give details of my recommended program. You can watch the video now here.

Here is the link to my my eBook How To Change Anything In Your Life. I promised to provide a reference to it at the beginning of this article. You can find it by going here.

How To Program Your Mind For Wealth

Did you know that there are very specific parts of your brain responsible for creating wealth? And that these parts MUST become activated, in order for you to manifest financial success?

It’s true.

This is the reason success and wealth seem to come so EASY to some people, yet is such a struggle for others.

Download This eBook Report By Dr. Jones Worth $597 Here For FREE.

Have You Ever Wondered How Some People Just Have a Natural Know-how To Attract Good Luck And Wealth?

I’ve got news for you. Most of it isn’t luck. It is a mindset and learned process. Would you like the shortcut using how to reprogram your mind that’s in this eBook report?

Click HERE to download.

Think of it like this…

Rich people (especially self-made millionaires) have incredible neural strength and connectivity in the areas of their brain that make them wealthy and successful…

They literally have a ‘rich brain’…

They have all the mental programming necessary to draw in vast wealth and success, to where their brain will see that they end up successful no matter what.

Just look at Steve Jobs…

If he’d had a ‘poor brain’ he would have sunk without a trace…

He grew up with a challenging life; he flunked out of university; he got fired from multiple jobs…

But because he had a RICH brain with RICH programming, his brain saw that he became wealthy and successful no matter what he did.

If you keep trying to change your life, but you just keep getting the same lackluster results…

Know that it’s not your fault at all…

It’s your brain following its survival instinct to keep you ALIVE – in a way that no longer serves you.

Let me explain…

Your brain is the machine that drives your life.

Every time you do anything, it comes directly from a THOUGHT your brain had… and without the thought of driving the action, there IS no action, right?

So that means…

If you don’t have the thoughts of a rich person, then you’ll never have the life, the money, or the results of a rich person…

Because no wealth is possible without the right THOUGHTS driving it – and the right thoughts aren’t possible without the corrected brain driving them.

In fact, 80% of the population has a brain which is NOT optimized for wealth and success, and there is a scientifically backed reason for this.

Your brain is ultimately a survival machine, and its number one priority is to keep you alive and breathing, no matter what…

So, to your brain, anything ‘new’ returns the perception as a THREAT…

New ideas…

New opportunities…

New chances for wealth and success…

Even if they’re good, your brain sees all new things as DANGER…

Now, it’s not that your brain wants you to FAIL, it’s just that it developed through the ages to deal with a very different world…

A world where threats were EVERYWHERE, and every time you left the house (or the cave), you might never come back…

So as a result, your subconscious mind strives to keep you safe, with security (and struggling), because what it KNOWS is ‘safe’…

You might be broke, but at least you’re ALIVE (and to your brain, that is success)…

So it keeps you STUCK in the same old life, facing the same problems, worrying the same worries… and never really seeing results.

Does that make sense?

Obviously, our world has grown well beyond the caveman days, but parts of your brain haven’t, which means…

Your brain being stuck in the ‘survival wiring’ that keeps you from seeing opportunities as risks, and BLINDED from all the skills, talents, and mental abilities necessary for making money…

Skills like:

Curiosity…

Creativity…

Power…

Drive…

Opportunity awareness…

If you can’t seem to achieve the financial success you want, it’s because we have turned all the skills necessary to make money ‘off’ from inside our brain… all because of this simple ‘glitch’ in your brain’s survival programming.

Can you see how a brain that’s operating in this ‘survival state’ of scarcity, is a brain that can NEVER bridge the gap and become rich?

Without even realizing it, successful people can mentally bypass these self-doubts and survival programming.

They have no mental barriers in place which prevent them from genuinely believing that they can create wealth.

And as a result, they subconsciously guide themselves toward wealth-creating opportunities, situations and people.

That’s the power of the ‘Rich Brain’.

Yet, here is the glorious news for you:

Most people, scientists included, used to think after a certain age, your brain ‘sets’ like concrete… and that all your mental programming and neural pathways are set in stone.

But now, over 40 years of neuroscience research has now proven that you CAN change your brain at ANY age… including the parts of your brain related to wealth and success.

Which means, even if you’ve had a ‘poor person’s brain’ all your life…

You can reshape it into a RICH brain…

A brain that’s better, faster, stronger, more powerful than ever before…

A brain that flushes out all of negative thought programs that were keeping you stuck, and develops powerful mental connections and neural strength in the areas related to money, success, and wealth…

A brain that sees to it you just get rich and more successful in life, no matter what happens.

Take the free personalized quiz below to discover what kind of brain YOU have…

And what you can do to reshape it effortlessly into a wealth-attracting ‘rich brain’ that will finally get you the results you want!

Learn how to quickly reprogram your mind for wealth with the eBook click HERE.

Do you have a ‘Rich Brain’? Is wealth in your future..?

Find out in this 60-second quiz!

*Note: I’ve created a quick quiz which will determine whether you have the mind of a millionaire. You can go to the quiz here.

9 Ways To Build Business Credit Fast

The core difference between business credit and personal credit is that business credit is tied to your EIN (employer identification number). As you proceed through various financial activities within the boundaries of your business, like the processes of opening a business bank account, getting a business credit card, and paying suppliers is crucial.

As your business operates, these accounts and activities provide information that becomes part of your credit history. Most credit related activities of a business are reported to credit bureaus that deal specifically with businesses.

Here’s the list of 9 ways to build business credit fast, along with explanations further explaining each in this very helpful article.

1) Register your business as a corporation or LLC.

2) Get an employer identification number (EIN).

3) Open a business banking account.

4) Establish a business address and get a phone number.

5) Apply for and get a business DUNS number.

6) Open trade lines with your suppliers and/or service providers.

7) Get a business credit card and/or business line of credit.

8) Borrow from lenders who report to business credit bureaus.

9) Keep business information current with the bureaus and pay all of your business’s bills and loans back on time.

Some of these principles of how to build business credit are simple and common sense, but lets elaborate on a few of them that are somewhat unclear. This way you can be sure and get started building your business credit in the right direction and as soon as possible.

![]() Would You Like To Have 6-Figure Business Credit? Click HERE

Would You Like To Have 6-Figure Business Credit? Click HERE

Register and Establish a Business Identity Separate From Your Personal Identity

Credit bureaus must know your company exists so they can track it. If a business purchases supplies or software for the company under a personal name, those purchases didn’t build a business credit history.

There are things you can do to alert credit bureaus of your existence so they can start tracking your financial history and begin building your ever important business credit.

Set Up a Corporation or LLC

If you run your business as a sole proprietorship, then your business credit is tied to your personal credit. On the other hand, creating a separate business entity clarifies that your personal and business credit and finances are separate. Specifically, the credit bureau Dun & Bradstreet recommends incorporating or setting up an LLC.

Get an Employer Identification Number / EIN

An EIN (employer identification number) is basically a Social Security Number for your business. It’s free to get one from the IRS, and you’re required to have one if you have employees or if you’re taxed as a C corporation or LLC.

Apply For a Business DUNS Number

Register the business with Dun and Bradstreet, which is the biggest business credit bureau in the United states. They offer both free and paid options. By registering with Dunn and Bradstreet, you will be able to obtain a DUNS number.

A DUNS number is another identifier used to track businesses. It’s monitored by Dun & Bradstreet, and it’s free to apply for one online.

Get a Business Phone Number and Address

A dedicated phone number listed in your company’s name offers extra credibility. You’ll also use it to sign up for a DUNS number and other accounts in your company name, which go towards securing your business credit.

It doesn’t necessarily need to be an 800 number. You can get a local free phone number through Google Voice. You will need to verify the number with an active phone so if you only have one cell phone then you can only get one Google Voice number. That should be fine if you are starting your first business.

A business address can be as simple as using a UPS Store box. A better way is of course to have an actual office or center where you have an actual office.

Some people use temporary office space like that available from Regis. If you want to send out emails using a service like Aweber or Active Campaign, they will need to mail you a confirmation of address to use their services. Every email sent must comply with CANSPAM laws, and your business address must be at the bottom of every email sent.

Open a Business Checking Account

Many first time business owners feel they can get by using bank alternatives like PayPal and Stripe. Or worse, some business owners commingle all their business funds in their personal bank accounts. The problem is that these transactions don’t go toward establishing your business credit with reporting agencies that build your credit.

To fix this problem, simply sign up for an official bank account using the name of your business. You can still use services like PayPal and Stripe, but connect them to your business bank account. This way you’ll have an official record that credit bureaus will be able to track easily.

Get a Business Credit Card

A credit card is the easiest form of business credit to get. It will also help you establish a record of repayment, which will build your business credit score. So basically, you can sign up for a credit card in your company’s name and start making purchases and payments right away. This enables proving to creditors that your business has the ability to repay debts.

Make sure you sign up with a credit card company that reports to the main business credit agencies. Citi and Chase are two that do, but you can research your card of choice to make sure. Once you begin using your business credit card, you must pay your bills on time or early to avoid late fees and hits to your credit score.

Use Vendors that Report to Agencies

Working with vendors that supply equipment or inventory to your business can also help you establish a strong history of paying your bills and honoring agreements with partners. This is yet another way you can build your business credit. However, make sure you choose vendors that actually report to credit bureaus.

Some of these include Crown Office Supplies, Quill, Creative Analytics, Grainger, Uline and Summa Office Supplies.

How To Build Business Credit Without Using Personal Credit

By building business credit without using personal credit, you are not using a personal guarantee or consumer credit check. These are parts of personal credit.

We’ve already covered what’s involved in building a healthy business credit profile, but lets take another angle at looking into how to do this without using personal credit or a personal guarantee.

First, form a legal business entity like a corp or an LLC. This is the very first step in building business credit, because it separates you from your business. Then apply for a tax ID or an EIN and then open a business bank account.

Next, register the business with Dun and Bradstreet, which is the biggest business credit bureau in the United states. They offer both free and paid options. You can decide what’s best by visiting DNB.com. And once registered, they will issue the business a PayDex score, which is their new “business” credit score.

Unlike your personal credit score, it’s on a scale from 1 to 100. Paydex scores are much like consumers’ FICO scores, but there are some key differences.

Instead of displaying your personal credit history, your paydex score determines your business’s creditworthiness. It more specifically reflects how promptly your business pays its creditors and suppliers, which is a big part of the performance of your payment history.

Lenders will look at a business’s Paydex scores to determine the risks of lending to that business. That Paydex score will show how reliably a business meets their debt agreements.

One tip if you are starting from scratch and want to build a solid Paydex score is to get vendors first thing, and make sure they are vendors that report to Dun and Bradstreet. There are a bunch that will offer you credit without a personal credit check, as you’ve seen in this article.

Again, here are a few. Try applying with Quill Office Supplies for all your office needs. Paper, ink, pens and thousands of other items are available at Quill, and they will approve without a personal credit check and they report to Dunn and Bradstreet. Staples and Office Depot also generally offer net 30 accounts and they also report to Dun and Bradstreet.

If you need shipping supplies, try Uline. They also report to Dun and Bradstreet and will often give new businesses a line of credit, even if you’re a brand new business with no existing business credit.

For tools, try Grainger Outdoors.

Also, Wells Fargo offers a secured business credit card that reports to Dun and Bradstreet.

Even Amazon has a net 30 account available for new businesses to start building their Paydex score.

Remember that when opening business accounts, make sure you don’t attach them to your personal credit.

How To Build Business Credit With Bad Personal Credit

There is more than one type of business credit report.

The types of business credit reports include Dun & Bradstreet®, Experian® Business and Equifax® Business. These all create their own business credit reports. Some lenders and vendors may also turn to specialty business credit reports provided by other companies when evaluating your business.

Let’s discuss more about the following factors that will allow you to build business credit if you have bad personal credit. These are similar to the previous discussion of how to build business credit without using personal credit.

Establish Trade Lines.

While a lot of information can wind up on your business credit reports, trade lines can be very important.

Trade lines are lines of credit established between a business and a vendor. They can be things such as an account with an office supply company where the company allows the business to pay the account balance several days or weeks after receiving the inventory or services.

Vendors may report this account to any reporting agency, although they’re not required to do so. Depending on the type of credit report, a trade line that’s reported can include information like your available credit limit, the amount owed, the terms of the account, recent activity and when you pay based on your due date.

There is a scenario where you could have a business credit report with no trade lines. By doing this, it may be hard to build business credit with no business trade lines. This is because your number of trade lines and your payment history may be factors in your business credit file.

Here’s something to keep in mind. As we outlined earlier in this article, not every vendor will report your payment activity. This means that even if you always pay your vendors early or on time, you may not be building your business credit.

Always remember if you’re trying to boost your business credit, you may want to start opening business trade lines or accounts immediately. These are accounts such as a business credit card and trade lines with companies who report to the business credit reporting bureaus. We mentioned several earlier for your reference.

Just be careful about opening an account with an annual fee, as you don’t want to have an extra expense just to keep an account open. You may also be able to find more cost-effective options than a fee based credit card.

You may also consider opening term accounts with suppliers who will report your activity to at least one bureau. We discussed companies that will report for your business earlier. You can ask the vendor if and who they’ll report your payments to before opening an account. This way you will be certain to ensure it’ll help your credit.

How To Check Your Business Credit Score

While it’s easy to get a free look at your personal credit score using a variety of platforms, the same cannot be said about business credit scores. Sometimes, you’ll have to pay to see a business credit score for your own business other businesses.

Here are some details on how to check your business credit score with each of the credit reporting agencies that determine business credit scores.

Dun & Bradstreet

Consider signing up for Dun & Bradstreet Credit Signal. This service allows you to monitor your Dun & Bradstreet business credit score for changes over time. This free program lets you track when your business profile is being accessed, and you get the chance to view four Dun & Bradstreet business credit scores and ratings for a 14-day period.

Equifax

Equifax lets you order a single business credit report for $99.95. However, you can also order a package of reports for five businesses for $399.95. If you know other businesses who would like to see their reports, this package of reports could be used and the cost split between your business and the others. You can explore these options on the Equifax website.

Experian Intelliscore Plus

Experian also lets you check your business credit score and business credit report. How much you’ll pay depends on the plan you select. You can see your business credit report for as little as $39.95, but you can pay for an annual plan that lets you monitor your business credit reports and score for $189 per year. The Experian website offers more details on how to get started.

![]() Would You Like To Have 6-Figure Business Credit? Click HERE

Would You Like To Have 6-Figure Business Credit? Click HERE

Learning how to build your business credit is a precious skill set to know. Many people understand parts and pieces of the total formula but never carefully put all the parts together to work as one synergistic system. This can become an enormous opportunity cost over time for a business enterprise.

How To Start a Freelancing Business and Make Money

A freelancer is considered a self-employed person who: Pays their own self-employment taxes. Doesn’t have any employees. Sets their own rates…

For those of you who are interested in making a Steady Income or Retiring Early…Get this FREE eBook: Starting Your Own Freelance Business. Includes income scale.

Answer the question: Is freelancing a great career choice for me?

Highly researched data and real income numbers for those of you who are interested in becoming a freelancer to make a steady income or retiring early.

These Private Notes are available in eBook form for the first time. Download by clicking HERE.

**Book: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Moran

Hey congrats on seriously looking into starting a home based freelance business! If you haven’t yet downloaded my short yet informative report on this subject do so above.

It has lots of income statistics that will motivate you and help establish the belief you need to get started on the fast track.

Nearly 60 million Americans freelanced in 2019, both full-time or part-time. They represented more than a third of the American workforce, according to a separate study by Freelancers Union.

There are more than 15 million full-time freelancers, with with 20 percent earning more than $100,000 per year, according to a study by MBO Partners.

A list of the highest-paying freelance jobs, recently created by a global freelancing platform, shows dozens of jobs in which freelancers can earn $80,000 per year and even more. A strong list is in the highly researched report.

Experts say that 2024 and beyond holds plenty of opportunity for those freelance workers with professional skills. Now with the COVID effect, it’s looking like freelancers will be even in more demand.

We preferred to use pre-COVID numbers in our report and not over inflate using hypothetical numbers.

Learn how to market your freelance skills and receive your first paycheck this week!

I’d like to take a quick moment to share a few tips with you, today!

The benefits of running your own freelance business, as well as the challenges, should be an exciting journey to prosperity for you. Taken seriously you will succeed. The journey to learning the freelance lifestyle is fun too. I’ve done it.

There’s a few things to be considered before you decide to jump on the

work at home bandwagon and begin your freelance business.

I’m not going to “kid you” working at home is still work, but it can also be the most profitable and satisfying experience of a lifetime!

Time management is your first key to unlocking your freelance pathway to wealth. Once you get time management nailed down you’ve pretty paved your path to the door to success for anyone who works at home, from their laptop, or remotely if you choose.

That’s why I made it the topic of the report that I have given to you above in this post. This is life-changing information we’ve researched and made available for those interested in owning their freelance business.

As the master of your home based business you’ll find that being your own boss, It took me a while to get used to working at home after commuting all those years and can take some getting used to.

You’ll find, out (as I did), that you are able to get much more done in three hours (that are well spent) than in three days once you realize the great income you can make as a freelance business owner.

For instance, much of the information that you will find to help you succeed can be found online, but this can truly become a double-edged sword.

You need to set some clear Internet boundaries from the start!

Surfing the Internet, Facebook, and email are menacing time vampires to the home based entrepreneur, who is trying to succeed and serious about making it their career.

A great tip for you is to learn time buffering. If you don’t then a few three-minute videos could easily eat up a whole hour or worse, a whole day!

A second tip is to learn to dedicate, solid blocks of time to work “offline”.

If you come up against a block, and feel you need to go online to do research to resolve the problem, then consider making a place holder at that point in your offline work and moving on.

Using this method makes it so when you do go online for information it’s done so with the attitude of getting in, getting what you need, and getting out quickly!

Tip number three is the use of a timer. Even if it’s for 5 minutes while you go online to lookup one tidbit of information.

You should definitely use a timer to set work increments of no more than one hour before stopping for a few minutes.

One of the greatest ad and copywriters of all time Eugene Schwartz, would set his timer for 33:33. Yes you read that right, thirty-three minutes and thirty-three seconds. It got him super results and he always talked about it in his seminars.

Make an account of the time you spend online so that you don’t waste a moment in casual browsing, that should be dedicated to progress.

Separate your personal internet time so you won’t let it interfere with your freelance business work.

Trust me, you’ll feel a whole lot better at the end of a day when you get a lot done and make a lot of money…than if you look up at the clock and find that you have blown the day unintentionally distracted, or worse, goofing around! I’ve done plenty of that and it’s a bad feeling at the end of the day.

Checkout the latest review of the top Freelance Training Program available.

In our free report you’ll find the top categories and researched incomes for each genre of freelancing. I wanted to include a few more so here they are:

7 Top Freelance Job Categories

Computer & IT tops the list. These jobs can range from computer repair to website maintenance to Internet security positions…

Accounting & Finance…

HR & Recruiting…

Editing and Proofreading…

Writing…

Administrative…

Project Management.

Jobs That Earn The Most In The Freelancing Industry.

For those of you who are interested in making a steady income or retiring early, here are the jobs that earn the most in the freelancing industry.

Programming And Software Development…

Social Video Marketing…

Web Design And Development…

Content Marketing/Writing…

Graphic Design…

Copywriters…

Video Editors.

Get on the fast track to freelancing and receive your first paycheck this week by going HERE!

Where The Vanguard & Index Fund Founder Would be Investing In 2023?

As many people already know, John Bogle, or Jack as he preferred to be called, is one of the legendary all time investors and he actually created the Index Fund. He is the founder of Vanguard in 1975, which was the first discounted service for personal investors.

Warren Buffet is stated as saying, “Bogle has done more for the individual investor than just about anybody in history.”

Although Jack Bogle passed in 2025, his philosophy and amazingly strong portfolio strategy lives on. One significant thing about Jack is he dedicated his life to ensure it was the individual investor, not the corporation, that took home the grand share of profit.

You’re about to see his 2021 portfolio. How can I show it to you if he’s not with us anymore? Because his portfolio strategy didn’t really change over time and was solid as a rock.

The big debate has always been how much in bonds and how much in stocks.

Jack’s portfolio would be 100% in stocks for maximum returns, and he would be in the Index Fund VTSMX. The ETF version is VTI. Over the long term it will outperform the split against bonds.

Now lets take a look at how VTI has performed over the past ten years. Wow, as you can see it’s pretty much 200% as the arrow points to the 199.59%. That’s an average of 20%.

Bear in mind the historical average of the S&P 500 performance is closer to 10%. So US Stocks are outperforming that average.

As you age Jack mentioned having about 50% in stocks and 50% in bonds. Investopedia mentions Jack advocating a mixture of bonds being a split between intermediate bonds and inflation bonds.

Also, as a bonus, lets see below how to get to the one million dollar mark using his founded Low-fee Index Fund investing strategy.

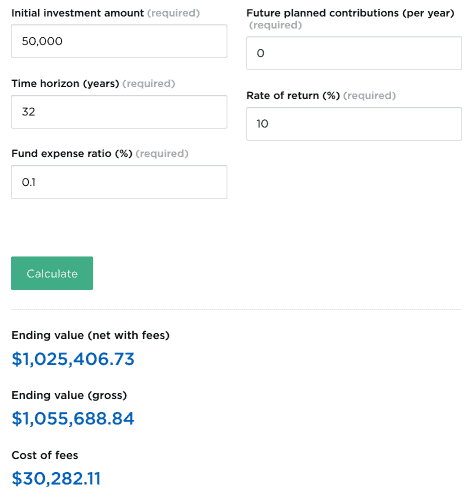

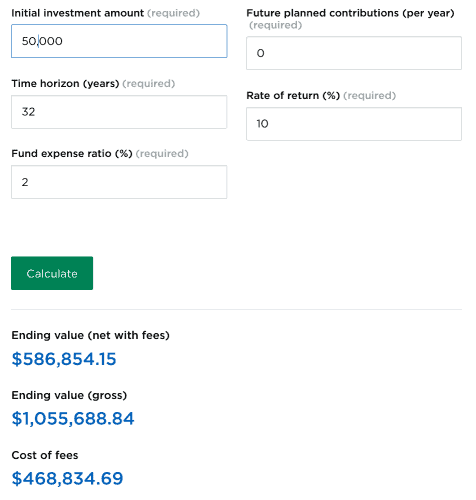

Fees can kill your gains. That was one of the big quarrels Jack Bogle had with Mutual Funds and other strategies before he invented low fee and Index Fund investing.

Take this example of the huge importance of expenses in your fund. Here is an eye-watering example of how just small fees steal your wealth by killing your gains.

Lets use $50,000 as the initial investment. Over the 32 year period with the 0.1% fees you would become a millionaire. On the other hand with the 2% fee you would only have $586.854.15.

As you clearly see in the above example, fees are a major deterrent. We see the amount lost due to fees is 44%. Even though this small little 2% seems insignificant, it has taken 44% of your total fund.

Everyone reading this needs to dig into their funds and find out exactly where your pension money is being invested.

Also, do you know the exact breakdown of all the fees you are paying in your current pension?

There are tens of thousands of people worldwide who are putting away pension money and they have no idea what they are being charged or where the money is going.

If I can do one thing it would be to carry on Jack Bogle’s work of helping people understand they don’t need to pay fees these toxic funds are taking.

“Don’t Do Something, Just Stand There”

Jack Bogle

I love this above quote and basically what Jack is saying is, when things seem uncertain, when things are going bad in the economy and market, 99 out of 100 times the best thing you can do is nothing, and just keep adding to your index fund.

What Is Market Cap?

Market cap, or market capitalization, is the total value of all a company’s shares of stock. It is calculated by multiplying the price of a stock by its total number of shares. For example, a company with 10 thousand shares selling at $50 a share would have a market cap of $500 thousand.

What Is Market Cap In Stocks And Why Is Market Capitalization Such An Important Concept?

It allows investors to understand the relative size of one company compared to another. Market cap measures what a company is worth on the open market, and the market’s perception of its future prospects.

Market cap, along with its volume, reflects what investors will pay for a company’s stock.

Another reason market cap is important is because it refers to the total value of all a company’s shares of stock, which puts the company in a category of either large, mid, or small cap.

What Is The Difference Between Large, Medium and Small Cap Companies?

- Large-cap companies usually have a market value of $10 billion or more. Large-cap firms often have a reputation for producing quality products and services.

Their reputation is of a history of consistent dividend payments and steady growth. They are many times dominant players within well-established industries, and their brand names may be familiar to consumers everywhere.

Because of these traits, investments in large-cap stocks may be considered more conservative than investments in small-cap or mid-cap stocks. This aspect potentially presents less risk in exchange for less aggressive growth potential.

- Mid-cap companies are mostly businesses with a market value between $2 billion and $10 billion. These businesses are established companies in industries experiencing or are on the horizon to experience faster growth.

These medium-sized companies may be increasing market share and improving their competitiveness in the marketplace. This stage of growth can determine if a company eventually lives up to its full potential.

Mid-cap stocks generally fall between large caps and small caps on their risk/return perspective. Mid-cap companies may offer more growth potential than large caps. Many times they can also offer investors less risk than small caps.

- Small-cap companies are those with a market value of $300 million to $2 billion. Most of the time these are young companies that serve niche markets or emerging industries.

Small caps are considered the most aggressive and risky of these 3 categories. Since small companies have low resources, this might make them more susceptible to a business or economic downturn.

They may also be vulnerable to the intense competition and uncertainties characteristic of untried markets. Small-cap stocks may offer investors high growth potential.

These long-term investors are usually the ones who can tolerate volatile stock price swings in the short term.

What’s The Difference Between Market Cap and Free-Float Market Cap?

Market cap is based on the total value of all a company’s shares of stock. Float is the number of outstanding shares for trading by the general public.

The free-float method of calculating market cap excludes locked-in shares. These are those shares held by company executives and governments.

Free-float market cap has been adopted by most of the world’s major market indexes, including the S&P 500 and the Dow Jones Industrial Average.

What Are Factors That Could Impact a Company’s Market Cap?

There are several factors that could affect a company’s market cap. One being large changes in the value of the shares. These changes could either be up or down.

Another factor affecting a company’s market cap could be changes in the number of shares issued. Any exercise of warrants on a company’s stock will increase the number of outstanding shares.

This in turn dilutes its existing value. As the exercise of the warrants is typically done below the market price of the shares, it could potentially affect the company’s market cap.