During a falling economy, like during the 2020 pandemic, the stock market actually grew many months.

This caused millions of people to scratch their heads in amazement.

Lots of people began to develop a distrust in the stock market.

If we inspect what really drives the stock market, we will make sense of these phenomena.

The US economy and world economy can decrease and US stock market can rise because the S&P 500’s top ten stocks make up 28% of the market.

Let Us Take a Look At Who These Top Ten Stocks Are

The S&P 500 reflects nearly all the largest stocks in the U.S., we often refer it to be synonymous with “the market” as a whole.

To simplify how to explain it, we need to realize the S&P index is really the U.S. stock index.

The Standard & Poor’s 500 Index, or S&P 500, is a market-capitalization-weighted index of exactly 505 large-cap U.S. stocks.

The index makes up 80% of the market value of the U.S. equities market.

Since it’s weighted by market cap, the largest stocks have a big impact on both the long-term performance and daily movement of the index.

This may shock you to know the 10 biggest stocks make up 28% of the index’s market value.

This means every investor should become familiar with these 10 giant companies so they can understand what drives the broader market.

This explains the original question of how the economy can be nose diving while the stock market is making gains.

Below is a list of the 10 largest companies in the S&P 500. Weighting and market capitalization are as of November 2020, and are courtesy of S&P Dow Jones Indices.

1. Apple Inc. (AAPL)

Index Weighting: 6.5%

Market Cap ($B): 1,750.1

Revenue ($B) (4-Quarter Trailing): 274.5

Net Income ($B) (4-Quarter Trailing): 57.4

Place Change from last month: None

Apple is a major producer of hardware and software products, primarily for the consumer market. Its most prominent product is the Apple iPhone brand, but Apple also produces other brands, including Mac computers and iPad tablets. It also operates the Apple Music and Apple TV media distribution platforms.

2. Microsoft Corp. (MSFT)

Index Weighting: 5.7%

Market Cap ($B): 1,532.2

Revenue ($B) (4-Quarter Trailing): 147.1

Net Income ($B) (4-Quarter Trailing): 47.5

Place Change from last month: None

Microsoft is a computer hardware and software company that makes products for both personal and enterprise use. A major player in the tech industry for decades, Microsoft is best known for its Windows operating system, the Microsoft Office suite of programs, and the Xbox game system. The company also is a major player in cloud computing services with its cloud platform, Azure.

3. Amazon.com Inc. (AMZN)

Index Weighting: 4.8%

Market Cap ($B): 1,292.7

Revenue ($B) (4-Quarter Trailing): 347.9

Net Income ($B) (4-Quarter Trailing): 17.4

Place Change from last month: None

Amazon is an online retailer of all kinds of goods, but has increasingly diversified its business. It also has a major cloud-computing business known as Amazon Web Services (AWS), and runs the Whole Foods chain of brick-and-mortar grocery stores.

4. Facebook Inc. (FB)

Index Weighting: 2.3%

Market Cap ($B): 705.0

Revenue ($B) (4-Quarter Trailing): 79.0

Net Income ($B) (4-Quarter Trailing): 25.3

Place Change from last month: None

Facebook runs the dominant social networking platform, by far the largest in the world. It also owns photo-sharing app Instagram, messenger app WhatsApp, and virtual reality equipment maker Oculus. Facebook rose in the rankings as people spent more time on social media to keep in touch during quarantine.

5. Alphabet Inc. Class A Shares (GOOGL)

Index Weighting: 1.8%

Market Cap ($B): 485.6

Revenue ($B) (4-Quarter Trailing): 171.7

Net Income ($B) (4-Quarter Trailing): 35.7

Place Change from last month: None

Alphabet is the parent company of search-engine giant Google. Among its other products besides the Google search engine, Alphabet runs video sharing site YouTube. It’s notable that the company splits its stock into two main share classes. Google’s C shares are nonvoting shares, meaning they do not entitle the holder to take part in proxy votes. The A shares usually trade for slightly more than the C shares and carry voting rights. Each of these shares trades on the S&P 500, and each is large enough, by itself, to make the top 10 list. If we counted together the two share classes, it would place Alphabet 4th on this list and would make up 3.6% of the index. There are also B shares, which have disproportionate voting rights and are only held by Google insiders. The B shares do not trade on the open market.

6. Alphabet Inc. Class C Shares (GOOG)

Index Weighting: 1.8%

Market Cap ($B): 475.9

Revenue ($B) (4-Quarter Trailing): 171.7

Net Income ($B) (4-Quarter Trailing): 35.7

Place Change from last month: None

(See above for company description.)

7. Berkshire Hathaway Inc. (BRK.B)

Index Weighting: 1.5%

Market Cap ($B): 400.2

Revenue ($B) (4-Quarter Trailing): 260.5

Net Income ($B) (4-Quarter Trailing): 22.2

Place Change from last month: None

Berkshire Hathaway is a holding company for the various investments Warren Buffett has made over the years. Among its many holdings are insurance businesses such as GEICO, large energy and utilities businesses, a major railroad, consumer brands such as ice cream store Dairy Queen, and manufacturers such as aerospace parts manufacturer Precision Castparts Corp. It also owns an enormous portfolio of equities, which is why Berkshire Hathaway notably fell several places in the rankings. Those equities took an enormous hit when stocks dropped during the first quarter, absolutely crushing Berkshire’s first-quarter profits, and dragging down the company’s stock.

8. Johnson & Johnson (JNJ)

Index Weighting: 1.3%

Market Cap ($B): 361.0

Revenue ($B) (4-Quarter Trailing): 80.9

Net Income ($B) (4-Quarter Trailing): 17.0

Place Change from last month: Up One Place

Johnson and Johnson is a medical and consumer products conglomerate. Its main three businesses are pharmaceuticals (both over the counter and prescription), medical devices, and consumer hygiene and wellness products. The last category includes notable brands such as Band-Aid bandages, Listerine mouthwash, and Neutrogena skin care products.

9. Procter & Gamble

Index Weighting: 1.3%

Market Cap ($B): 341.3

Revenue ($B) (4-Quarter Trailing): 72.5

Net Income ($B) (4-Quarter Trailing): 13.7

Place Change from last month: Up One Place

Procter & Gamble is a consumer products company that sells mainly personal care and home care products. They own over 65 brands, including Tide detergent, Pampers disposable diapers, Tampax tampons, Gillette razors, Crest toothpaste, and Ivory soap.

10. Nvidia Corp.

Index Weighting: 1.1%

Market Cap ($B): 309.3

Revenue ($B) (4-Quarter Trailing): 13.1

Net Income ($B) (4-Quarter Trailing): 3.4

Place Change from last month: New Entrant

Nvidia is a company that develops and manufacturers Graphics Processing Units (GPUs). GPUs are a type of computer chip used for creating computer graphics, usually for visual design or computer gaming. However, GPUs are increasingly in demand for other tasks such as cryptocurrency mining and artificial intelligence (AI) and machine learning development. We know Nvidia for its GeForce brand of consumer GPU’s.

As you see these companies are comprised of producing products and/or services in industries that are related to computers, internet services, and medical and pharmaceuticals.

Now you know how the stock market can go up during a pandemic while the economy takes a dive.

If you liked this article, you may be interested in learning about Exchange Traded Funds. The first ETF was developed in 1993. They are traded publicly on the stock exchanges and are easy to invest in. Most investors are happy with returns, and ETFs are a positive vehicle that can take your investing to a new level. Go here to learn more.

What Is An Annuity And How Does It Work?

An annuity is a life insurance product. It is a form of insurance or investment entitling the investor to a series of annual sums. It’s a savings account with a life insurance company.

An annuity is actually a contract between you and an insurance company. You, the annuitant, will pay for the annuity through a lump sum or payments made over time.

The insurance company makes money by investing your money. The most common way an insurance company invests is through mutual funds.

If someone works for a company that doesn’t have a pension annuities are the best and cleanest way to create one.

From these earnings, the insurance company will make regular payments to you. Again these are in the form of a lump sum or payments over time. There are several types of annuities and the exact payment structure of each will vary based on the terms and requirements that the annuitant agrees to with the insurance company.

There are four categories of annuities with life insurance companies.

Fixed Annuity, Immediate Payment Annuity, Indexed Annuity, and an Individual Retirement Annuity.

To simplify it, there are 2 types of annuities, fixed and variable.

Fixed annuities pay you a cd (certificate of deposit) rate or slightly higher, around 2 or 3% in 2020. You take a fixed amount of dollars today and receive a fixed income stream for that money.

A second kind of fixed annuity is a deferred fixed annuity. This is where you take that sum of money and put it to work in the annuity to earn a guaranteed stated rate of return over a defined period.

It’s not creating income in the annuitant’s hands yet, but is a growth mechanism of a fixed rate over a fixed period. The money grows inside the annuity tax deferred like a 401k or IRA does.

There is a surrender charge and usually has a 7 year seasoning before that surrender charge ends.

A variable annuity is an investment vehicle that has mutual funds inside, and they have extra benefits after you’ve maxed out your retirement accounts. The payments you receive will depend on how well your investments perform.

An indexed annuity is technically a version of a fixed annuity, it mostly combines the benefits of both fixed and variable products. The returns you earn from an indexed annuity aren’t based on investment decisions of the annuitant. Instead, the money will follow the performance of a stock market index like the S&P 500.

Annuitization is what’s known as converting an annuity investment into periodic payments paid out to the annuitant. Annuities may be annuitized for a specific period of time, or for the life of the annuitant.

At What Age Can You Annuitize?

You can avoid the 10% penalty by withdrawing substantially equal annual amounts over your life expectancy until age 59 ½ or for five years, whichever comes later. So, if you are age 58, you must take withdrawals through age 63. But, if you are age 45, you need to continue making withdrawals through age 59 ½.

Can You Lose Your Money In An Annuity?

The value of your annuity changes based on the performance of those investments. … This means that it is possible to lose money, including your principal with a variable annuity if the investments in your account don’t perform well. Variable annuities also tend to have higher fees, increasing the chances of losing money.

What Is The Safest Type Of Annuity?

One of the most frequently asked questions from investors is “are annuities safe?” The answer is yes, they are very safe. Fixed annuities are one of the safest investment vehicles available today.

Is An Annuity Better Than a 401k?

Another big difference is that an annuity offers a guaranteed payment for as long as you live. That means, at least with most annuities, you can’t run out of money. A 401(k), on the other hand, can only give you as much money as you have deposited into it, plus the investment earnings on that money.

A quick tip: There is usually no need to house your annuity inside a 401k because the annuity already has tax benefits. Housing an annuity inside a 401k would double down on tax advantages. The annuitant can only use the tax deference once.

What Are the Pros of Annuities?

- Your Contributions Can Grow Tax-Deferred

- You Will Receive Regular Payments

- Death Benefits Are Typically Available Making It Essentially Willable

- Fixed Annuities Offer Guaranteed Rates of Return

What Are the Cons of Annuities?

- Annuities Can Be Pricey

- Getting Out of an Annuity May Be Difficult or Impossible

- Returns of an Annuity Might Not Match Investment Returns For Annuity Fees And Gains Can Be Capped Through Something Called a “participation rate.”

- Inflation Can Be Greater Than The Rate Of Return In Some Years In Rare Cases

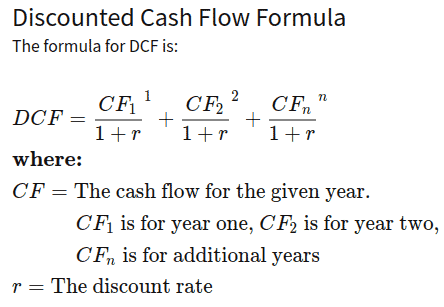

Discounted Cash Flow To Determine Intrinsic Value Of a Stock

What Is Discounted Cash Flow (DCF)?

Discounted cash flow (DCF) is a method used to estimate the value of an investment based on its expected future cash flows.

DCF analysis shows us how to figure out the value of an investment today by basing future projections of how much money it will generate later down the road.

Since most of the benefits of a stock or other other investment will not be seen until later down the road.

It answers the question: is one dollar in 4 years time worth as much as one dollar is today?

Some weighting should be allocated to future costs and benefits to reflect what management accountants call ‘The Time Value Of Money’.

This is why we use the discounted cash flow process to see the value of our investment in its related concept Net Present Value (NPV).

When we add each of the discounted cash flows up we produce the NPV of the investment.

This applies to both investors sinking money into financial investments, and for business owners looking to make changes to their businesses, like purchasing new equipment or space.

A discount rate is applied to future costs and benefits to reflect that present value.

Using a discounted cash flow (DCF) model to calculate the intrisic value of a stock is a mixture of art and science.

The mathematical part is of course pure science, yet finding the numbers to go into the formula is art.

The science behind the math says we measure the current value of a company.

Next apply a growth rate to calculate how much that value may increase over time as the company hopefully grows.

Lastly, apply a discount rate to account for any risk involved.

This can indicate how much the companies future growth is worth now.

So that’s how you estimate the intrisic value of a stock.

As stock prices constantly move as people buy and sell shares at different price levels it’s clear that every market participant has a different expectation of a stocks future performance and risk.

This holds true even with the DCF model we’re discussing. This is where we apply the art side of our formula.

Different expectations lead to different stock evaluation numbers.

If we have a stock with annual earnings of $5 per share, lets say one investor expects earnings to be conservative at 5% per year.

Lets say our second investor expects annual earnings to grow at 10% per year because they are in the mindset the companies new product will sell better than expected.

To think about it the difference between the two may not seem like much at first yet it is nearly a 60% difference.

As we just demonstrated a small change like the growth rate can make a huge difference over time.

The same is true of other variables. The discount rate for example would be one.

Just because valuation analysis is a mixture of science and art, does not mean you can’t make educated decisions.

Lets Recap How Discounted Cash Flow Works

The purpose of DCF analysis is to estimate the money an investor would receive from an investment, adjusted for the time value of money.

The time value of money assumes that a dollar today is worth more than a dollar tomorrow because it can be invested.

A DCF analysis is appropriate in any situation where a person is paying money in the present with expectations of receiving more money in the future.

All you need is some experience and support to go along with it. With these two in your corner you can learn to make reasonable assumptions.

When you decide to estimate a stocks value you can conduct an educated analysis along with it with confidence your estimate is built on a solid foundation.

What is the DCF Formula Used For?

The DCF formula is used to determine the value of a business or a security.

The DCF formula represents the value an investor would be willing to pay for an investment, given a required rate of return on their investment (the discount rate).

Here Are Some Other Examples Of Uses For The DCF Formula:

- To value an entire business

- To value a project or investment within a company

- To value a bond

- To value shares in a company

- To value an income-producing property

- To value the benefit of a cost-saving initiative at a company

- To value anything that produces (or has an impact on) cash flow

Discounted Cash Flow (DCF) Formula – Tutorial

Should You Invest $1,000 In Gold To Make Money?

Think about this for a second. 2020 is the first year since 1979 to have both Gold and the S&P 500 mark new highs during the calendar year.

What does this mean and what can these new highs of both the major indexes mean?

First it’s saying asset prices are going up because the Fed is buying assets with printed money while rates are very low.

An example would be if you have stock in a company that makes commodities, with rates so low the market is willing to pay for that yield. So that’s the reason the stock market is up.

The reason gold is up, the market isn’t sure how all this is going to play out since the buying of assets with printed money is dangerous from an inflation perspective, so the question is what’s going to happen to other goods.

People are buying gold now as a hedge against broader consumer inflation.

This pans out to having equities being relatively cheap because it is all about interest rates and the potential return you get for buying those stocks.

Again with interest rates being rock bottom, if you buy Proctor Gamble you get around 2-2.5% yield.

This is cheap for a steady stream of income. Another plus is they pay dividends and owning bonds at this same time would give you a negative.

Even if you’re in Apple or Netflix or some other big companies, they will do well because they have access to capital and they will be able to do better than many small companies that don’t have access to as much capital.

Another thing is the smaller company’s capital might be more expensive.

So large companies that are growing and pay dividends are an excellent place to be if you’re going to play the equity market.

What About The Mining Stocks?

For gold mining companies, we want to look for companies that have the best assets in the world along with the best management. Look for companies that also are trading at reasonable valuations.

Putting all that together means you find a company that’s generating a cash flow and paying dividends to shareholders.

In the past several years, we’ve seen the trend of more and more mining companies paying dividends. Shareholders started expecting it and as the mining companies complied, it’s become an ongoing norm in the mining stocks.

After 2013, when mining stocks got slammed, these companies curved back expenses, optimized their operations and slimmed down drastically. This lesson learned is paying off for shareholders today.

One thing that got the mining companies into trouble years ago was during the strong bull market they started building mines all over the place. This isn’t happening this time.

What Gold Stock Is The Best?

It’s safer to hold a bigger position in a diversified company that generates free cash flow from mines all over the world, than to have a junior that produces from only two mines in a single country.

The risk management would be more in the latter, so if you have the tolerance and time to stay abreast of the companies go for both because currently there’s value across the board here in late 2020.

How About Gold vs. Silver?

It looks like gold is the way to go in the longer term. If for some reason a recession comes about in 2021 gold will be the beneficiary and not silver.

There are significant cash flows into the gold market consistently in late 2020 and seems like a big trend lately.

Is Bitcoin A Good Investment In The Last Quarter Of 2020?

The crypto space seems to to be dying down a little. It seemed to be a creation of something out of nothing, with speculation for lots of people to become multi-millionaires.

This is on the slow down now. Governments are reluctant to tie their currencies to bitcoin instead of gold, which is an important point to know about the mining business down the road.

What Is The 2021 Forecast For Gold?

There was a run-up close to 2,100 and then a bit of a consolidation taking a little down.

The gold price forecast for end 2020 is USD 1,900 per ounce (was USD 1,700 per ounce). Our new gold price forecast for end 2021 is USD 2,000 per ounce (was USD 1,800 per ounce).

The bank’s analysts continue to expect gold to reach $2,000 per ounce in the first half of 2021.

To see the current price of gold go here: Gold Price org.

Term Or Whole Life Insurance: Which To Choose

It may be a tough thought to imagine, yet you may not always be around. This emotionally trying time could be hard for your family, especially if they rely on you for financial support.

Six in 15 households would struggle to pay the bills if the primary breadwinner died, according to recent reports.

Term vs. Whole Life Insurance Overview

Term life insurance is financial protection for a set number of years, and it may be the affordable option that would fit your needs.

Whole life insurance offers permanent protection for the rest of your life.

This differs from term insurance that covers you for a defined period.

One of the other big differences between term life insurance and whole life insurance is that whole life can accumulate cash.

Get The Latest Issue Of The Guiding Cents Newsletter Sent Straight To Your Inbox

Join 97,000+ getting mind knowledge every Saturday morning while reading, you’ll learn a bit about life & business too. Just click the button to go to the signup page which opens in a new tab.

You may also receive dividends from your provider. Consider a whole life insurance policy if you prefer lifelong coverage with savings benefits.

Whole life insurance is a choice because your family may need cash to pay for your estate taxes at death.

You would want coverage for your final expenses, or you’d like to fund a trust to pass on to the next generation.

Term life is “pure” insurance, where whole life insurance adds a cash value component which can be tapped into during your lifetime.

Term coverage only protects you for a limited number of years, while whole life provides lifelong protection if you can keep up with the premium payments.

Whole life premiums can cost five to 15 times more than term policies with the same death benefit, so they may not be an option for people on a strict budget.

What Is Term Life Insurance?

Term life insurance is the easiest to understand. It’s straightforward insurance without the bells and whistles.

The only reason to buy a term policy is because of the promise of a death benefit.

It pays for the beneficiary should they pass away while it’s in force.

This stripped-down form of insurance is only good for a certain period.

This could be five years, 25 years, or 35 years. After that, the policy just expires.

Because of its simplicity and finite duration, these term policies also are the cheaper.

If all you seek from a life insurance policy is the ability to protect your family when you die, term is likely the best fit.

One example is many new parents purchase term insurance that lasts just long enough for their kids to finish college or join the workforce full time.

A variety of factors will change policy prices. For example, a larger death benefit or longer length of coverage will increase the premiums.

Keep in mind that most term policies require a medical exam. This makes health complications raise your rates above the norm.

Because term insurance eventually expires, you can end up spending all that money for no purpose other than peace of mind. Also, you can’t use your investment in term insurance to build wealth or save on taxes.

However, term insurance has a much lower cost than other types of life insurance. It is simpler to understand than “permanent” policies.

A few negatives is the protection is only available for the term of the policy and it can’t be used as a wealth-building or tax-planning strategy.

What Is Whole Life Insurance?

Whole life insurance is a permanent life insurance.

This means the insurance covers the policyholder for the duration of their life as long as premiums are paid on time.

Permanent life insurance differs from term life insurance, which covers the insured person for a set amount of time (usually between 10 and 30 years).

Whole life insurance is the most common type of permanent life insurance policy that people purchase. This is according to the Insurance Information Institute (III).

Like most permanent life insurance policies, whole life also offers a savings component, which is referred to as “cash value.”

What Are The Benefits Of Whole Life Insurance?

There are several parts of whole life insurance that can make it an attractive choice.

Your premiums are fixed and will never go up. This is regardless of market conditions.

Most plans are written so the insured can withdraw funds or take out a loan.

Death benefits are guaranteed as long as the required premium payments are paid.

In most cases, the premium and death benefit stay constant for the duration of a whole life insurance policy.

A universal life insurance policy, on the other hand, may offer the option to adjust your premiums or death benefit over time but lets not get off track.

Because whole life insurance gives you fixed premiums and a fixed death benefit, you won’t have to worry about increased premiums as you get older.

Your loved ones will know how much to expect when your life insurance benefit is paid out after you pass away.

Whole Life Builds Cash Value

A whole life policy can serve as a source of emergency funds for you if something happens like a costly emergency.

The policy holder may also take out a loan against the policy, in most cases. That’s because it funnels a portion of each premium payment into a savings component of the policy called the “cash value.”

Over time, the cash value of the whole life policy increases. The policy holder may be able to withdraw funds or borrow against it.

The rules on how and when this can be done vary by company and policy. The insurer may also offer guidelines to follow so that the policyholder won’t inadvertently reduce the policy’s death benefit or create a tax burden.

How Much Does Whole Life Insurance Cost?

The cost of a whole life insurance policy depends on several factors. This includes how much coverage is bought and other things.

With paying premiums, the policyholder makes a fixed annual payment for a whole life insurance policy. Some life insurance companies may also offer the option to pay monthly, quarterly, or twice a year.

Most of the time paying premiums more frequently than once per year, like making monthly payments, may incur additional fees.

Are Whole Life Insurance Premiums Tax Deductible?

According to the Internal Revenue Service, you cannot deduct premiums you paid for a whole life insurance policy on your tax return.

The principal reason is if your beneficiaries receive the death benefit from your policy, they likely would not have to pay federal income taxes on that benefit.

Be advised that they will probably consider any interest earned on top of the death benefit taxable income.

Who Should Take Out A Whole Life Insurance Policy?

A whole life insurance policy might be a fit for someone who likes predictability. Since whole life insurance offers death benefit guarantees and fixed premiums, it’s stable and solid.

If you’re considering a whole life insurance policy, it may be a good idea to talk it over with an agent.

Experienced life insurance agents can help you review the different options before you make any decisions.

Using that approach ensures confidence and certainty that you’ve chosen the life insurance policy that works best for you and your family.

What Is An Exchange Traded Fund ETF

For many people, their investing desire is to have a stable portfolio of stocks and investments.

An investment that will not get hit too badly in a bad economy, and one that will not get caught in a hyper growth cycle and lose all its earnings in only a few months.

An Exchange Traded Fund is an investment that trades like a stock. ETF’s like many other funds pull together money from investors into a group of different investments.

These include stocks, bonds, and other securities. By spreading the funds money into different securities ETF’s can equip investors with the important diversification they’re looking for that helps balance risk.

ETFs Trade On The Stock Exchange Therefore They’re Bought And Sold Like Stocks

From one fund in 1993, the ETF market grew to 102 funds by 2002, and nearly 1,000 by the end of 2009 and there are around 7,000 ETFs traded worldwide in 2021.

Mutual fund inflows have typically exceeded ETF inflows during years where market returns are positive, but ETF net inflows are superior in years where the major markets are weak.

Each ETF has a different aim. Some invest in a variety of stocks and bonds. While others replicate the performance of a stock index like the Dow Jones or S&P 500.

Other ETFs track performance of a particular market sector like technology or pharmaceuticals.

It’s important to know that different ETF’s offer different amounts of diversification.

Those that represent market sectors offer less diversification than those that replicate an index.

Some ETFs pay dividends, but not all. A good deal of re-invest earnings into the funds holdings.

Looking at the dividend yield allows investors to see if the ETF pays dividends. This yield is the amount the fund pays out compared to the current market of a share.

ETF Funds Have Other Qualities That They Draw Investors To

Just like there are a variety of mutual funds, there are a variety of ETF’s.

Compared to many mutual funds which can require a minimum and enormous investment, ETF investors can just buy a single share and pay commissions and fees.

They almost never incur yearly capital gains taxes like mutual funds can. Investors only pay taxes when the ETF shares sell through a profit.

ETF’s aren’t actively managed. This passive management creates lower management fees. Lower than popular mutual funds.

Another way to look at an ETF is if we combined an index fund and stock. It would have traits from both the index fund and the stock.

The significant thing about ETF’s is the investor need not be wealthy. They are simple to buy, sell, and own.

Multi-trillions of dollars in ETF’s are traded every year. It’s clear they are going to be part of the world of investing and trading for many years down the road.

Get The Latest Issue Of The Guiding Cents Newsletter Sent Straight To Your Inbox

Join 97,000+ getting mind knowledge every Saturday morning while reading, you’ll learn a bit about life & business too. Just click the button to go to the signup page which opens in a new tab.

What Are Alpha Seeking ETFs

Alpha-seeking ETFs are equity funds attempting to outperform the market with various investment strategies.

They show a vast range of investment aims, from hedged funds mimicking strategies as the Alphaclone Alternative Alpha ETF (ALFA) to funds following proprietary stock picking strategies as the VanEck Vectors Morningstar Wide Moat ETF (MOAT).

With 240 ETFs traded in the U.S. markets, Alpha-Seeking ETFs gather total assets under management of $34.37B.

The largest Alpha-Seeking ETF is the ARK Innovation ETF ARKK with $9.85B in assets.

In the last trailing year, the best performing Alpha-Seeking ETF was the ARKG at 164.57%.

How Defined Outcome ETFs Work

Defined outcome ETFs aren’t exactly new with the first funds of this type launched by Innovator in 3rd quarter 2018.

In fact, the concept behind them is rooted in annuities and structured products.

We can use defined Outcome ETFs in portfolios for several purposes related to taking some risk off the table.

These strategies ultimately allow investors to stay in the market when volatility is up because of a built-in “buffer” from market losses.

That’s important, because it can base many large market gains on single-day movements, and if you’re out of the market for even just a few days, you could miss out. Market timing is a loser’s game as most seasoned investors know.

Defined outcome ETFs also have implications for retirement investing when a fixed income isn’t performing as it has done historically.

Traditionally, investors reduce their equity exposure as they get closer to retirement and shift more of their portfolio into fixed income, seeking stability and income.

There are certain similarities that these funds seem to have in common.

All invest in Flexible Exchange (FLEX) options based on an index or ETF.

The vast majority invest in FLEX options tied to the S&P 500 Index or ETFs that track it, though Innovator offers some that track other key indexes like the MSCI EAFE Index or the Russell 2000 Index.

There are also versions of these funds that offer exposure to fixed income.

All the issuers of these funds have tools available on their websites to let you know what limits you’ll be getting on the day you purchase one of their funds.

Related content: Exchange Traded Funds: What Are They?

Tax Efficiency With ETFs

One of the big selling points for ETFs as investment vehicles is that they are much more tax efficient than their competing mutual funds.

If a mutual fund or ETF holds securities that have appreciated in value, and sells them, they will create a capital gain.

These sales can result either from the fund selling securities for a tactical move, because of a rebalancing effort, or to meet redemptions from shareholders.

We know that by law, if funds accrue capital gains, they must pay them out to shareholders at the end of each year.

As a general rule, ETFs do much better than mutual funds for paying out capital gains.

Most ETFs don’t pay out any capital gains. Data shows just 6.2% of U.S.-listed ETFs paid out a capital gain in 2018, but over 60% of mutual funds did as well.

Because they’re index funds, most ETFs have very little turnover. Far fewer capital gains than an actively managed mutual fund would. 70% of mutual funds are actively managed.

However, ETFs are also more tax efficient than index mutual funds, thanks to the magic of how new ETF shares are created and redeemed.

When a mutual fund investor asks for their money back, the mutual fund must sell securities to raise cash to meet that redemption.

But when an individual investor wants to sell an ETF, they sell it to another investor like a stock.

No hassles and no capital gains transaction for the ETF.

When an authorized participant (AP) redeems shares of an ETF with an issuer it gets better.

When an AP redeems shares, the ETF issuer doesn’t rush out to sell stocks to pay the AP in cash.

Instead, the issuer pays the AP thus delivering the underlying holdings of the ETF itself. This no sale means no capital gains accrued.

The ETF issuer can even pick which shares to give to the AP. This means the issuer can hand over the shares with the lowest possible tax basis.

This leaves the ETF issuer with only shares purchased at or even above the current market price while reducing the fund’s tax burden and ultimately resulting in higher after-tax returns for investors.

The system doesn’t work so smoothly for all ETFs, however. Fixed income ETFs, which have more turnover and often have cash-based creations and redemptions, are less tax efficient than their equity akin.

But all else equal, ETFs win hands-down, with over two decades of history showing they have the best tax efficiency of any fund structure in the business.

This explains most of the Pros of ETF funds.

Related content:

- Strategies for Savings and Investing in a Volatile Market

- Investing in Dividend Stocks

- Investing in Real Estate Crowdfunding

- What Is the Rule of 72 in Personal Finance?

- Epic Games with Disney’s Magic Partner for Fortnite Metaverse

What About The Cons Of ETF Funds?

There are commissions and trading fees. Experts have argued that ETFs trade as short-term speculations.

This makes frequent commissions and other trading costs take away from investor returns.

There can be limited diversification sometimes. Most ETFs, say some experts, do not provide sufficient diversification.

Other authorities, with opposing views, say that there are widely diversified ETFs, and holding them for the long term can produce profits.

ETFs tied to unknown or untested indexes are a major negative aspect of investing in these instruments many investment advisors will tell you.

Conclusion:

ETFs generally offer a low cost, widely diverse, tax efficient method of investing across a single business sector, or in bonds or real estate, or in a stock or bond index, providing even wider diversity.

Commissions and management fees are relatively low, and ETFs may be included in most tax-deferred retirement accounts.

On the negative side ETFs which trade frequently, incurring commissions and fees have limited diversification in some ETFs and some ETFs may be tied to unknown and or untested indexes.