If you’re an avid Amazon shopper, you know how quickly those purchases can add up. But what if you could earn free Amazon gift cards to use towards your shopping sprees? Luckily, there are several easy ways to do just that.

One of the most popular ways to earn free Amazon gift cards is through online surveys. Many survey sites offer rewards in the form of gift cards, including Amazon. By sharing your opinions on various topics, you can earn points that can be redeemed for gift cards.

Another way to earn free Amazon gift cards is through cashback shopping apps. These apps allow you to earn cashback on your purchases from various retailers, including Amazon. Some apps even offer sign-up bonuses or referral bonuses, making it even easier to earn gift cards.

Understanding Amazon Gift Cards

If you’re not familiar with Amazon gift cards, they are essentially digital currency that can be used to purchase items on Amazon.com. Amazon gift cards come in various denominations, from $5 to $500, and can be used to buy anything from books to electronics.

One of the best things about Amazon gift cards is that they never expire. You can use them at any time, and they can be redeemed for any product that Amazon sells. Additionally, Amazon gift cards can be used to purchase items from third-party sellers on Amazon’s platform.

Another great feature of Amazon gift cards is that they can be used in conjunction with other payment methods. For example, if you have a $50 Amazon gift card and want to buy a $100 item, you can use your gift card to pay for half of the item and use another payment method, such as a credit card, to pay for the other half.

Amazon gift cards can be purchased directly from Amazon’s website, or they can be earned through various methods, such as taking surveys or using cashback apps. Some credit cards also offer rewards in the form of Amazon gift cards.

Overall, Amazon gift cards are a convenient and versatile way to shop on Amazon.com. Whether you’re using them to buy gifts for friends and family or treating yourself to something special, Amazon gift cards are a valuable tool for any shopper.

Participating in Online Surveys

If you’re looking for an easy way to earn free Amazon gift cards, participating in online surveys can be a great option. While you won’t get rich from taking surveys, you can earn gift cards in your spare time. Here are some popular survey sites to consider:

Survey Junkie

Survey Junkie is a well-known survey site that pays in gift cards. They have a low cash-out minimum of only $10, making this site much more attractive than similar sites. You can take surveys on a variety of topics and earn points that can be redeemed for Amazon gift cards.

Swagbucks

Swagbucks offers surveys, game playing, shopping, and more in exchange for “SB” points. It only takes 500 SBs for a $5 Amazon gift card. In addition to surveys, you can earn points by watching videos, searching the web, and shopping online.

Vindale Research

Vindale Research is another survey site that pays in cash or gift cards. You can earn up to $50 per survey, and they also offer a $1 sign-up bonus. While Vindale Research has a higher cash-out minimum than some other sites ($50), it can be a good option if you’re looking to earn more money per survey.

Keep in mind that you may not qualify for every survey, and some surveys may take longer to complete than others. However, if you’re willing to put in the time and effort, participating in online surveys can be a simple way to earn free Amazon gift cards.

Using Cashback Apps

If you’re looking for an easy way to earn free Amazon gift cards, using cashback apps is a great option. These apps allow you to earn cashback on your purchases, which you can then redeem for gift cards.

Rakuten

Rakuten is one of the most popular cashback apps out there. Formerly known as Ebates, Rakuten offers cashback at over 2,500 stores, including Amazon. To use Rakuten, simply sign up for an account and start shopping through the app. You’ll earn cashback on your purchases, which you can then redeem for gift cards.

Honey

Honey is another great cashback app to consider. In addition to offering cashback at over 30,000 stores, Honey also helps you find the best deals and discounts on your purchases. To use Honey, simply install the browser extension and start shopping. When you make a purchase, Honey will automatically apply any available coupons or discounts, and you’ll earn cashback on your purchase.

TopCashback

TopCashback is a lesser-known cashback app, but it’s still worth considering. With TopCashback, you can earn cashback at over 4,000 stores, including Amazon. To use TopCashback, simply sign up for an account and start shopping through the app. You’ll earn cashback on your purchases, which you can then redeem for gift cards.

Overall, using cashback apps is an easy way to earn free Amazon gift cards. By simply shopping through these apps, you can earn cashback on your purchases and redeem it for gift cards. Just be sure to compare cashback rates across different apps to ensure you’re getting the best deal.

Signing Up for Amazon Promotions

One way to earn free Amazon gift cards is by signing up for Amazon promotions. Amazon regularly offers promotions for their products and services, and these promotions often include gift card rewards.

To sign up for Amazon promotions, you can visit the Amazon website and navigate to the “Today’s Deals” section. From there, you can browse through the available promotions and select the ones that interest you. Some promotions require you to purchase a specific product or service, while others may only require you to complete a simple task or survey.

It’s important to note that not all Amazon promotions offer gift card rewards. However, by regularly checking the “Today’s Deals” section and signing up for relevant promotions, you can increase your chances of earning free Amazon gift cards.

Additionally, you can also sign up for Amazon’s email newsletter to receive notifications about upcoming promotions and deals. This can be a great way to stay informed about the latest opportunities to earn gift card rewards.

When signing up for Amazon promotions, it’s important to read the terms and conditions carefully to ensure that you meet all of the requirements for earning gift card rewards. By following the rules and guidelines set forth by Amazon, you can ensure that you receive your gift card rewards in a timely and efficient manner.

Overall, signing up for Amazon promotions can be a simple and effective way to earn free Amazon gift cards. By taking advantage of these opportunities, you can save money on your Amazon purchases and enjoy all of the benefits that come with being an Amazon customer.

Trading In Your Old Stuff

If you have old items lying around your house that you no longer need, you can trade them in for Amazon gift cards. Amazon has a trade-in program that allows you to exchange your old items for gift cards. Here’s how it works:

- Go to the Amazon Trade-In page and search for the item you want to trade in.

- If Amazon accepts the item, you’ll be given a trade-in value. This value is the amount that Amazon will give you in gift cards for your item.

- If you accept the trade-in value, you can ship your item to Amazon for free using a prepaid shipping label.

- Once Amazon receives your item and verifies its condition, they will credit your account with the gift card amount.

The Amazon Trade-In program accepts a wide variety of items, including electronics, books, video games, and more. However, keep in mind that not all items are eligible for trade-in and the trade-in value may vary depending on the condition of the item.

Before trading in your items, it’s a good idea to check the trade-in value of your item on other platforms such as eBay or Craigslist to ensure that you’re getting a fair deal. Additionally, make sure to read the trade-in program’s terms and conditions to avoid any surprises.

Overall, trading in your old items for Amazon gift cards is a great way to declutter your home and earn some extra cash.

Related content:

- Strategies for Savings and Investing in a Volatile Market

- Easy Ways To Earn Free Amazon Gift Cards

- How Much You Really Need to Be Financially Independent?

- 50/30/20 Budget Rule: How to Manage Your Finances Effectively

- Ways to Cut Down Your Grocery Bill

Using Credit Card Rewards

Another easy way to earn free Amazon gift cards is by taking advantage of credit card rewards programs. Many credit cards offer rewards points or cashback for purchases made with the card. These rewards can then be redeemed for various items, including Amazon gift cards.

To maximize your rewards, look for credit cards that offer bonus rewards for purchases in categories that you frequently spend in, such as groceries or gas. Some credit cards even offer sign-up bonuses for new cardholders, which can be a quick way to earn a large number of rewards points.

When redeeming your rewards for Amazon gift cards, be sure to check the redemption value. Some credit card rewards programs offer better value for gift cards than others, so it’s important to compare your options before redeeming.

Additionally, consider using your credit card rewards in combination with other methods of earning free Amazon gift cards, such as surveys or cashback apps. This can help you accumulate rewards points more quickly and reach your gift card redemption goal sooner.

Overall, using credit card rewards is a simple and effective way to earn free Amazon gift cards. Just be sure to use your credit card responsibly and pay off your balance in full each month to avoid interest charges.

Participating in Giveaways and Contests

Participating in giveaways and contests is another way to earn free Amazon gift cards. Many companies and websites run regular giveaways and contests, offering Amazon gift cards as prizes.

To find these giveaways and contests, you can simply search online using keywords such as “Amazon gift card giveaways” or “Amazon gift card contests.” You can also follow your favorite brands and websites on social media to stay updated on any giveaways or contests they may be running.

When participating in giveaways and contests, it’s important to read the rules and requirements carefully. Some giveaways and contests may require you to complete certain tasks or follow specific instructions in order to be eligible to win the prize.

It’s also important to be cautious of scams and fake giveaways. Make sure to only participate in giveaways and contests from reputable sources and avoid giving out personal information or paying any fees to enter.

Overall, participating in giveaways and contests can be a fun and easy way to earn free Amazon gift cards. Just make sure to do your research and follow the rules to increase your chances of winning.

Testing Amazon Products

One way to earn free Amazon gift cards is by becoming an Amazon product tester. As a product tester, you get to try out new products for free in exchange for providing feedback. Here are some websites where you can sign up to become an Amazon product tester:

| Website | Description |

|---|---|

| Rebaid | Rebaid offers deals for Amazon products in exchange for honest reviews. You can sign up for free and start browsing deals today. |

| Vipon | Vipon provides deep discounts (at least 50% and up to 90%) for Amazon products upon approval of the sellers. |

| Elite Deal Club | Elite Deal Club offers free and deeply discounted products in exchange for honest reviews. You can sign up for free and start browsing deals today. |

Before signing up to become an Amazon product tester, it’s important to understand the guidelines and rules for leaving reviews. Amazon has strict policies in place to prevent fake reviews, so make sure you’re following the rules to avoid getting banned.

Additionally, keep in mind that becoming an Amazon product tester is not a guaranteed way to earn free Amazon gift cards. You may not qualify for every product test, and you’ll need to put in the time and effort to write detailed and honest reviews.

Overall, if you enjoy trying out new products and are willing to provide honest feedback, becoming an Amazon product tester can be a fun and rewarding way to earn free Amazon gift cards.

Conclusion

In conclusion, there are many easy ways to earn free Amazon gift cards. By completing online surveys, taking polls, referring friends, and shopping, you can easily stack up points that you can redeem for free gift cards.

Some of the best ways to earn free Amazon gift cards include using services or apps that incentivize users with digital currency, such as Swagbucks or Survey Junkie. These sites offer surveys, game playing, shopping, and more in exchange for points that can be redeemed for Amazon gift cards.

Another easy way to earn free Amazon gift cards is by signing up for credit cards that offer rewards points that can be redeemed for gift cards. Some of the best credit cards for earning Amazon gift cards include the Amazon Prime Rewards Visa Signature Card and the Chase Freedom Unlimited.

Overall, there are many legitimate ways to earn free Amazon gift cards. By taking advantage of these opportunities, you can save money on your purchases and enjoy all that Amazon has to offer. So start earning those gift cards today and enjoy the benefits of free shopping!

How Much You Really Need to Be Financially Independent?

After going through a series of major changes in my life, including quitting my job, ending a long-term relationship, and selling my houses, I was reminded of a quote from Tyler Durden in Fight Club: “It’s only after we’ve lost everything that we’re free to do anything.” This inspired me to take the opportunity to transform myself and become financially independent.

Through research, I discovered the “4% rule,” which allows for safe withdrawal of 4% from investment accounts annually, adjusted for inflation, without running out of money. This rule applies to any time horizon and has been supported by various studies.

To achieve financial independence, it is important to work on the relationship between spending and savings. By multiplying yearly spending by 25, one can determine their necessary “number” for financial independence. It is not about how much money one has, but rather how much they spend. By spending less and saving more, one can reach their number faster and become financially independent.

Frequently Asked Questions

What are the different levels of financial independence?

Financial independence can be achieved at different levels, depending on one’s financial goals. Some people aim to have enough savings to cover their basic living expenses, while others strive for complete financial freedom where they can afford luxuries and take on risks without worrying about money.

Here are some common levels of financial independence:

- Coast FI – Having enough saved that your investments will grow enough through market returns alone to support your expenses by the time you retire, without needing to save any more.

- FIRE (Financial Independence, Retire Early) – Having enough saved to cover your living expenses indefinitely through investment returns, allowing you to retire before the standard retirement age. Common savings targets are 25 times annual expenses.

- Lean FIRE – Aiming for a more minimal FIRE through lower expenses and savings, often having 15-20 times annual expenses saved.

- Fat FIRE – Achieving a very high level of savings, often $5 million or more, to support a more lavish lifestyle in retirement.

- Barista FIRE – Being financially independent but continuing to work part-time in retirement for income, health insurance or personal fulfillment, often in more enjoyable jobs.

- Location Independence – Having passive income from online work or investments to be location independent and not tied to a traditional 9-5 job. However, not fully financially independent yet.

- Traditional Retirement – Reaching the standard retirement age (65 in many countries) and relying on government pensions and personal retirement savings to be financially

Can you achieve financial independence without real estate investments?

Yes, it is absolutely possible to achieve financial independence without real estate investments. Here are a few common alternative paths:

- Index fund investing – Putting money into low-cost stock and bond index funds over the long run can allow your investments to grow enough through market returns alone. This is a popular strategy for FIRE folks.

- Small business ownership – Growing a successful small business that provides income can be another path, as long as the business is profitable and can continue functioning without needing to actively work in it.

- Passive income streams – Things like building a blog, YouTube channel, or developing an online course/program that generates ongoing royalties or affiliate income can help.

- High savings rate – Aggressively saving 50-70% or more of your income every year and investing it allows reaching FI goals more quickly without real estate.

- Pension plans – Government or private sector plans that provide guaranteed lifetime income in retirement can replace the need for real estate income.

- Freelancing/consulting – Working as an independent contractor or consultant in your field allows saving more and having more control over expenses than traditional employment.

So in summary, with diligent saving and investing over time, real estate is not required to achieve financial independence through other means like business ownership or index fund investing. It’s just one of several viable paths.

What are some strategies for becoming financially independent?

Here are some common strategies for becoming financially independent:

- Increase your savings rate – Aim to save 50% or more of your take-home pay each month by living below your means.

- Pay off high-interest debt – Get rid of credit card balances and other loans to avoid paying interest.

- Build an emergency fund – Save 3-6 months’ worth of living expenses as a financial cushion.

- Invest for the long run – Put money into low-cost stock and bond index funds for decades to harness the power of compound growth.

- Max out tax-advantaged retirement accounts – Fully fund IRAs and 401(k)s up to the annual limit to grow your nest egg tax-free.

- Consider real estate investing – Rental properties, house hacking, or flipping can provide income and appreciation.

- Generate passive income streams – Pursue side hustles, blogs, apps, or royalty-generating products.

- Minimize expenses – Track your spending closely to reduce costs in areas like housing, food, transportation.

- Develop valuable skills – Continually learn new abilities that allow higher pay or freelancing opportunities.

- Pay off a mortgage early – Eliminating housing costs boosts your savings rate significantly.

- Reach Coast FI and keep working – Retire when your nest egg is large enough to last on returns alone.

- Consider working abroad – Relocating to a lower cost area can stretch your savings further.

How much money do I need to save to become financially independent?

There’s no single number that defines how much you need to save to become financially independent, as it depends on several factors:

- Your annual living expenses – The lower your costs, the less you need to save. Aim to estimate your expenses in retirement.

- Your age – The earlier you start saving and investing, the less total amount you need due to compound interest over decades.

- Expected investment returns – Historically, a balanced portfolio returns around 7% average annually. Higher returns mean you need less saved.

- Location in retirement – Living abroad can cut costs significantly.

- Other income sources – Pensions, rental income, side jobs, or Social Security can reduce what you need from your investments.

As general guidelines:

- Coast FI number: 2.5x-3x your annual expenses to rely solely on investment growth.

- Conservative FIRE number: 25x your annual expenses for a 3-4% withdrawal rate each year to make savings last 30+ years.

- Moderate FIRE number: 30-35x expenses for a 2.5-3% withdrawal rate.

- Aggressive FIRE number: Under 25x expenses by aiming for lower costs or higher returns.

So in summary, most experts recommend aiming to save $500,000-$1 million or more depending on the above factors. Use online calculators to estimate your specific number. The earlier you start, the less daunting the goal becomes.

The amount of money needed to achieve financial independence varies based on individual circumstances, such as lifestyle, expenses, and goals. A general rule of thumb is to save at least 25 times your annual expenses, but this can vary depending on your goals and risk tolerance.

What are the benefits of being financially independent?

Being financially independent provides a sense of security and freedom, as you are no longer dependent on a job or others for financial support. It also allows you to pursue your passions and interests without worrying about money, and to have a comfortable retirement.

Related content:

- The Importance of Retirement Planning and Saving

- How Much You Really Need to Be Financially Independent?

- Secure Financial Planning For Retirement

- Retirement Savings Tips and Planning for Your Future

- Retirement Planning And Saving And Investing Tips

What are some common misconceptions about financial independence?

One common misconception is that financial independence means you have to be a millionaire. While having a high net worth can certainly help, financial independence is about having enough savings and investments to cover your expenses and achieve your goals. Another misconception is that financial independence is only for the wealthy, but anyone can achieve it with the right strategies and mindset.

Here are some very common misconceptions about financial independence:

- That you need to be wealthy – While achieving FI does require significant savings, you don’t need to be rich. It’s more about living below your means and diligent long-term saving and investing.

- You can never spend any money – Financial independence means having enough assets/income to cover essential expenses, not that you can never purchase anything again. Some spending is still possible.

- You have to sacrifice enjoyment – With proper planning, you don’t need to give up all life’s pleasures to become financially independent later in life. It just requires more discipline early on.

- It’s impossible without a high-paying job – While higher earnings can help, average income earners can still achieve FI through aggressive savings over many years thanks to compound interest.

- You have to stop working completely – Many FIRE pursuers continue working part-time for enjoyment or extra income after reaching their number. Complete retirement isn’t required.

- It all depends on the stock market – While market returns help you reach your goal faster, as long as expenses are covered by safe withdrawal rates, you don’t need to depend entirely on stock performance.

- You need real estate to succeed – Real estate can help but isn’t required. Index fund investing alone over decades can provide sufficient returns if done consistently.

So in summary, with discipline it’s achievable for more people than commonly believed without requiring extreme sacrifices.

Secure Financial Planning For Retirement

Are you approaching retirement and feeling unsure about your financial future? A financial advisor can help you navigate the complexities of retirement planning and create a personalized plan to achieve your goals. Retirement planning services can include investment advice, retirement income planning, tax planning, and estate planning. By working with a financial advisor, you can have peace of mind knowing that your retirement is in good hands.

Retirement planning is not just about saving money; it’s about creating a plan that will provide you with the lifestyle you want in retirement. A financial advisor can help you determine how much you need to save, what kind of investments to make, and how to manage your income in retirement. They can also help you plan for unexpected expenses and ensure that your estate is in order. With a solid retirement plan in place, you can enjoy your retirement years without worrying about financial stress.

If you’re ready to take control of your financial future and plan for a better retirement, consider working with a financial advisor. They can help you create a personalized plan that takes into account your unique goals and circumstances. With their expertise and guidance, you can feel confident about your retirement and enjoy the lifestyle you’ve always dreamed of.

Key Takeaways

- Retirement planning services can help you create a personalized plan to achieve your retirement goals.

- A financial advisor can provide investment advice, retirement income planning, tax planning, and estate planning.

- With a solid retirement plan in place, you can enjoy your retirement years without worrying about financial stress.

A Retirement Plan

When it comes to retirement planning, having a solid retirement plan is essential. A retirement plan is a financial plan that outlines your retirement goals and helps you achieve them. It takes into account your current financial situation, your retirement goals, and your investment preferences.

A good retirement plan should include the following:

- Retirement goals: You should have clear and achievable retirement goals. This can include things like the age you want to retire, the lifestyle you want to have in retirement, and any travel or other goals you may have.

- Retirement income: You need to have a plan for generating income in retirement. This can include things like Social Security, pensions, and investments.

- Investment strategy: You should have a clear investment strategy that takes into account your risk tolerance and investment preferences. This can include things like stocks, bonds, and mutual funds.

- Retirement expenses: You need to have a plan for managing your retirement expenses. This can include things like healthcare costs, housing expenses, and any other expenses you may have.

By creating a comprehensive retirement plan, you can ensure that you are on track to achieve your retirement goals and enjoy a comfortable retirement. A financial advisor can help you create a retirement plan that is tailored to your specific needs and goals.

About Retirement Planning

Retirement planning is the process of determining your retirement income goals and the actions and decisions necessary to achieve those goals. It involves identifying sources of income, estimating expenses, implementing a savings program, and managing assets and risk.

Retirement planning is important because it allows you to maintain your lifestyle and financial independence during your retirement years. It also provides a sense of security and peace of mind knowing that you have a plan in place to support yourself during retirement.

There are several factors to consider when planning for retirement, including your age, current financial situation, retirement goals, and life expectancy. It’s important to start planning early, as the earlier you start, the more time you have to save and invest.

Retirement planning involves making important decisions about your finances, such as how much to save, where to invest, and how to manage risk. It’s important to work with a financial advisor who specializes in retirement planning to help you make these decisions and create a plan that is tailored to your unique needs and goals.

Overall, retirement planning is an important part of your financial journey and can help you achieve a comfortable and secure retirement.

Advice for Retirement Planning

When it comes to planning for retirement, there are a few key pieces of advice that can help you make the most of your savings and investments.

First and foremost, it’s important to start planning early. The earlier you begin saving for retirement, the more time your money has to grow and compound. Even if you’re starting later in life, it’s never too late to begin planning and saving.

Another important piece of advice is to diversify your investments. Putting all of your savings into one type of investment can be risky, as market fluctuations can have a big impact on your retirement savings. Consider spreading your investments across a variety of asset classes, such as stocks, bonds, and real estate.

It’s also important to have a clear understanding of your retirement goals. How much money will you need to live comfortably in retirement? What kind of lifestyle do you want to have? By setting clear goals, you can more effectively plan and save for the retirement you want.

Finally, consider seeking the advice of a financial advisor who specializes in retirement planning. A professional advisor can help you create a personalized retirement plan that takes into account your unique financial situation and goals. They can also help you navigate the complex world of retirement planning and investment management, ensuring that you’re making the best decisions for your future.

Related content:

- The Importance of Retirement Planning and Saving

- How Much You Really Need to Be Financially Independent?

- Secure Financial Planning For Retirement

- Retirement Savings Tips and Planning for Your Future

- Retirement Planning And Saving And Investing Tips

The Future of Retirement

Retirement is changing rapidly. With advances in technology and medicine, people are living longer, healthier lives. As a result, retirement is no longer seen as a time to slow down and relax. Instead, it has become a time to pursue new interests and passions.

In the future, retirement planning will need to take into account these changing attitudes and expectations. People will need to plan for a retirement that may last 20, 30, or even 40 years. This means that retirement savings will need to be larger than ever before.

Another trend that is likely to impact retirement is the rise of the gig economy. More and more people are working as freelancers or independent contractors, which means they may not have access to traditional retirement benefits like a 401(k) or pension plan. This will make it even more important for individuals to take control of their own retirement planning.

Finally, the future of retirement will be shaped by changes in government policy. Social Security is already facing financial challenges, and this is likely to continue in the coming years. This means that individuals will need to rely more on their own savings and investments to fund their retirement.

Overall, the future of retirement is uncertain, but one thing is clear: individuals will need to take an active role in planning for their financial future. By working with a financial advisor and taking advantage of the tools and resources available, you can ensure that you are prepared for whatever the future may hold.

Investment Advice for Retirement

Investing for retirement can be a daunting task, but with the right advice, it can be a lot easier. Here are some tips to help you make the most of your retirement investments:

1. Start Early

The earlier you start investing for retirement, the better. It gives your investments more time to grow, and it allows you to take advantage of compounding interest. Even if you can only afford to invest a small amount each month, it’s better than nothing.

2. Diversify Your Investments

Diversification is key to a successful retirement portfolio. Don’t put all your eggs in one basket. Instead, spread your investments across different asset classes, such as stocks, bonds, and real estate.

3. Consider Your Risk Tolerance

Your risk tolerance is your ability to handle market fluctuations. If you’re comfortable with risk, you may want to invest more heavily in stocks. If you’re more risk-averse, you may want to focus on bonds and other fixed-income investments.

4. Keep an Eye on Fees

Fees can eat away at your retirement savings over time. Make sure you understand what fees you’re paying and how they impact your investments.

5. Work with a Financial Advisor

A financial advisor can help you create a retirement plan that’s tailored to your individual needs. They can also help you stay on track and make adjustments as needed.

Investing for retirement can be challenging, but with the right advice and a solid plan, you can achieve your retirement goals.

Investment for Retirement Planning

Investing for retirement is an essential part of retirement planning. By investing your money, you can grow your savings over time, which can help you achieve your retirement goals. Here are some tips to help you invest for retirement:

Diversify Your Portfolio

Diversification is key to successful retirement investing. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce your risk and potentially increase your returns.

Consider Your Risk Tolerance

Your risk tolerance is a crucial factor in determining your investment strategy. If you’re uncomfortable with risk, you may want to focus on more conservative investments, such as bonds or mutual funds. If you’re comfortable with risk, you may want to consider more aggressive investments, such as stocks or real estate.

Start Early

The earlier you start investing for retirement, the better. By starting early, you can take advantage of the power of compounding, which allows your investments to grow over time.

Maximize Your Contributions

Maximizing your contributions to your retirement accounts, such as a 401(k) or IRA, can help you achieve your retirement goals faster. Take advantage of any employer matching programs to maximize your contributions.

Seek Professional Advice

Working with a financial advisor can help you develop a retirement investment strategy that meets your unique needs and goals. A financial advisor can also help you monitor and adjust your investments over time to ensure that you stay on track to achieve your retirement goals.

Investing for retirement can be challenging, but with the right strategy and guidance, you can achieve your retirement goals and enjoy a comfortable retirement.

This week’s action steps:

Make your retirement planning checklist. Start looking for a financial advisor that can help you with understanding taxes and disbursements. Refer to related content on Guiding Cents.

See you next week with the next Newsletter!

How To Start A Money Making Blog In 2024: A Comprehensive Guide

Blogging has become an increasingly popular way to earn money in recent years, and 2024 is no exception. With the right strategy and approach, starting a money-making blog can be a lucrative and rewarding venture. However, it can also be overwhelming to navigate the blogging landscape and figure out where to begin.

Understanding the Blogging Landscape in 2024 is crucial to starting a successful money-making blog. With the rise of social media and the changing algorithms of search engines, it’s essential to stay up-to-date on the latest trends and best practices. By doing so, bloggers can ensure that they are creating content that resonates with their audience and is optimized for maximum exposure.

Choosing Your Blogging Niche is another critical step in starting a money-making blog. With so many niches to choose from, it’s important to select one that aligns with your interests, expertise, and target audience. By doing so, you can create content that is both compelling and valuable to your readers, which can lead to increased traffic, engagement, and revenue.

Key Takeaways

- Understanding the Blogging Landscape in 2024 is crucial to starting a successful money-making blog.

- Choosing Your Blogging Niche is an essential step in creating compelling and valuable content.

- Optimizing for Search Engines and Monetizing Your Blog are key components to generating revenue from your blog.

Understanding the Blogging Landscape in 2024

In 2024, the blogging landscape has become more competitive and dynamic than ever before. With the rise of social media and other digital platforms, bloggers need to be more strategic and creative in their approach to attract and retain readers.

One of the biggest challenges bloggers face is standing out in a crowded market. There are millions of blogs out there, covering every topic imaginable. To succeed, bloggers need to find a niche that they are passionate about and that has a potential audience.

Another important trend in 2024 is the increasing importance of visual content. Bloggers need to incorporate high-quality images, videos, and infographics into their posts to capture readers’ attention. They also need to optimize their content for mobile devices, as more and more people are accessing the internet on their smartphones and tablets.

In addition to creating compelling content, bloggers need to be savvy about marketing and promotion. They need to use social media, email marketing, and other channels to reach their target audience and build their brand. They also need to stay up-to-date on the latest SEO strategies and best practices to ensure that their content is discoverable and ranks well in search engines.

Overall, starting a money-making blog in 2024 requires a combination of creativity, strategy, and persistence. By understanding the current blogging landscape and staying on top of the latest trends and best practices, bloggers can succeed in building a loyal following and generating revenue from their content.

Choosing Your Blogging Niche

When it comes to starting a money-making blog, choosing the right niche is crucial. It’s important to select a topic that you are passionate about, but also has market demand and profitability potential. Here are some tips on how to choose your blogging niche:

Identifying Your Passion

The first step in choosing a niche is to identify your passion. Blogging about something you love will make it easier to create content consistently and keep you motivated. Consider your hobbies, interests, and skills to identify potential niches.

Analyzing Market Demand

Once you have identified your passion, it’s important to analyze market demand. You want to make sure that there is an audience for your niche and that people are actively searching for information related to it. Conducting keyword research and analyzing search volume can help you determine market demand.

Considering Profitability

While passion and market demand are important, profitability is also a key factor when choosing a niche. You want to make sure that there are monetization opportunities available, such as affiliate marketing, sponsored content, or digital products. Researching potential revenue streams can help you determine the profitability potential of your niche.

Here is a table summarizing the three factors to consider when choosing your blogging niche:

| Factor | Description |

|---|---|

| Passion | Choose a niche that aligns with your hobbies, interests, and skills. |

| Market Demand | Analyze search volume and conduct keyword research to determine if there is an audience for your niche. |

| Profitability | Research potential revenue streams to determine the profitability potential of your niche. |

By considering your passion, market demand, and profitability potential, you can choose a niche that is both enjoyable and profitable to blog about.

Setting Up Your Blog

When starting a money-making blog, setting up your blog is the first crucial step. In this section, we will discuss three essential steps to help you set up your blog: selecting a domain name, choosing a hosting service, and designing your blog layout.

Selecting a Domain Name

Choosing the right domain name is crucial to the success of your blog. Your domain name should be short, memorable, and relevant to your blog’s niche. It should also be easy to spell and pronounce.

To select a domain name, brainstorm a list of potential names that reflect your blog’s topic. Use a domain name registrar to check if your desired domain name is available. If it is not available, try to come up with variations of the name until you find one that is available.

Related content:

- Niche Blogging or Podcasting for Monetizing Your Passion

- How to Start a Blog and Monetize It

- How To Start A Blog And Make Money

- 7 Very Profitable Blog Niches for Big Money

- Affiliate Marketing Business Plan For Beginners

Choosing a Hosting Service

Choosing a reliable hosting service is important for your blog’s success. Your hosting service will determine the speed and reliability of your website. It is important to choose a hosting service that can handle your blog’s traffic and provides excellent customer support.

When selecting a hosting service, consider factors such as uptime, speed, security, and customer support. Compare different hosting services to find the one that best suits your needs and budget.

Designing Your Blog Layout

Your blog’s layout is the first thing your readers will see when they visit your website. It is important to design a layout that is visually appealing, easy to navigate, and reflects your blog’s brand.

When designing your blog layout, consider factors such as color scheme, font, and layout structure. Use a responsive design that is optimized for mobile devices. A clean and simple layout will make it easier for your readers to find the information they need.

By following these three essential steps, you can set up your money-making blog and start earning money from your passion.

Creating Compelling Content

Developing a Content Strategy

Before starting a blog, it is important to have a clear understanding of the type of content that will be published. This involves developing a content strategy that aligns with the blog’s niche and target audience. A content strategy should include topics that are relevant and interesting to the target audience, as well as a publishing schedule that is consistent and sustainable.

To develop a content strategy, bloggers can conduct research on popular topics within their niche and analyze their competitors’ content. They can also use tools such as Google Trends and social media analytics to identify trending topics and popular keywords.

Writing Engaging Posts

Creating engaging blog posts is essential for attracting and retaining readers. Bloggers should aim to write in a conversational tone that is easy to read and understand. They should also use headings, subheadings, and bullet points to break up the text and make it more visually appealing.

In addition to writing in a clear and concise manner, bloggers should also aim to provide value to their readers. This can be achieved by offering practical tips, sharing personal experiences, or providing in-depth analysis on a particular topic.

Incorporating Multimedia

Incorporating multimedia such as images, videos, and infographics can help make blog posts more engaging and shareable. Bloggers can use free stock photo websites such as Unsplash and Pexels to find high-quality images that are relevant to their content.

When creating videos, bloggers should aim to keep them short and to the point. They can also use video editing software such as Adobe Premiere or Final Cut Pro to add text overlays and transitions.

Overall, creating compelling content is essential for building a successful blog. By developing a content strategy, writing engaging posts, and incorporating multimedia, bloggers can attract and retain readers and ultimately monetize their blog.

Optimizing for Search Engines

Understanding SEO Basics

To start a money-making blog, it’s essential to understand the basics of Search Engine Optimization (SEO). SEO is the process of optimizing your website to rank higher in search engine results pages (SERPs). The higher your website ranks, the more traffic it will receive, which can lead to higher revenue.

One of the most critical factors in SEO is creating high-quality content. Search engines like Google prioritize websites that have high-quality, relevant, and informative content. Make sure to write content that is valuable to your readers and incorporates relevant keywords.

Another essential aspect of SEO is building backlinks. Backlinks are links from other websites that point to your website. The more high-quality backlinks you have, the more authoritative your website will appear to search engines.

Keyword Research

Keyword research is the process of identifying the keywords and phrases that your target audience is searching for. It’s essential to include these keywords in your content to ensure that your website appears in search results for those queries.

There are several tools available to help with keyword research, such as Google Keyword Planner, SEMrush, and Ahrefs. These tools can help you identify high-volume, low-competition keywords that you can target in your content.

On-Page Optimization

On-page optimization refers to the optimization of individual web pages to rank higher and earn more relevant traffic in search engines. It includes optimizing your website’s content, HTML, and other elements.

Some on-page optimization techniques include optimizing your page titles and descriptions, using header tags to structure your content, and optimizing your images with alt tags. It’s also essential to ensure that your website is mobile-friendly and has a fast loading speed.

By following these SEO basics, you can optimize your blog for search engines and increase your chances of generating revenue.

Monetizing Your Blo

Once your blog has gained a following, it’s time to start thinking about monetizing it. There are several ways to make money from your blog, and it’s important to choose the methods that work best for your niche and audience.

Advertising and Sponsorships

One of the most common ways to monetize a blog is through advertising and sponsorships. This involves placing ads on your blog or partnering with brands to promote their products or services.

To get started with advertising, you can sign up for an ad network such as Google AdSense or Mediavine. These networks will place ads on your blog and pay you based on the number of clicks or impressions.

Sponsorships, on the other hand, involve partnering with brands to create sponsored content. This can include sponsored posts, product reviews, or social media campaigns. When working with sponsors, it’s important to disclose the partnership to your audience and only promote products or services that align with your brand and values.

Affiliate Marketing

Affiliate marketing is another popular way to make money from a blog. This involves promoting products or services and earning a commission for any sales made through your unique affiliate link.

To get started with affiliate marketing, you can sign up for an affiliate program such as Amazon Associates or ShareASale. You can then promote products on your blog through product reviews, tutorials, or gift guides.

When promoting affiliate products, it’s important to be transparent with your audience and only promote products that you truly believe in. You can also use tools such as Pretty Links or ThirstyAffiliates to cloak your affiliate links and track clicks and conversions.

Selling Digital Products or Services

Finally, you can monetize your blog by selling digital products or services. This can include e-books, online courses, coaching services, or digital downloads such as printables or stock photos.

To sell digital products or services, you can use platforms such as Gumroad or SendOwl to handle payments and delivery. You can also use tools such as Teachable or Thinkific to create and sell online courses.

When creating digital products or services, it’s important to focus on providing value to your audience and solving their pain points. You can also use your blog to promote your products and services and drive sales.

Overall, there are several ways to monetize a blog in 2024. By choosing the methods that work best for your niche and audience, you can turn your blog into a profitable business.

Promoting Your Blog

Once you’ve published some great content on your blog, it’s time to start promoting it to attract readers and generate revenue. Here are some effective ways to promote your blog:

Leveraging Social Media

Social media platforms are great for promoting your blog and reaching a wider audience. You can share your blog posts on social media platforms like Facebook, Twitter, Instagram, and LinkedIn. Make sure to include a catchy headline, a brief description, and a link to your blog post. You can also use hashtags to increase the visibility of your posts.

Another effective way to use social media is to engage with your followers and other bloggers in your niche. You can join relevant groups and communities, participate in Twitter chats, and leave comments on other blogs. This can help you build relationships with other bloggers and attract new readers to your blog.

Networking with Other Bloggers

Networking with other bloggers in your niche can help you grow your blog and increase your reach. You can collaborate with other bloggers on guest posts, interviews, and round-up posts. This can help you reach new audiences and build relationships with other bloggers in your niche.

You can also attend blogging conferences and events to network with other bloggers in person. This can help you learn from other bloggers, share your experiences, and build relationships with potential collaborators.

Email Marketing

Email marketing is another effective way to promote your blog and build a loyal readership. You can use email marketing to send newsletters, updates, and exclusive content to your subscribers. Make sure to include links to your blog posts in your emails and encourage your subscribers to share your content with their friends and followers.

You can also use email marketing to promote your products and services. This can help you generate revenue from your blog and build a sustainable business.

In conclusion, promoting your blog is essential for attracting readers and generating revenue. By leveraging social media, networking with other bloggers, and using email marketing, you can increase your reach and build a loyal readership.

Analyzing and Adapting

Using Analytics Tools

One of the most important aspects of running a successful blog is understanding your audience and their behavior. This is where analytics tools come in handy. By using tools like Google Analytics, bloggers can track their website traffic, visitor demographics, and behavior on the site.

With this information, bloggers can gain insights into what content is resonating with their audience, which pages are most popular, and how visitors are interacting with the site. This can help bloggers make data-driven decisions about what content to create, what changes to make to the website, and how to optimize for conversions.

A/B Testing

A/B testing is another powerful tool for bloggers looking to optimize their website for maximum performance. By creating two versions of a webpage and testing them against each other, bloggers can determine which version performs better in terms of engagement, conversions, and other key metrics.

A/B testing can be used for a variety of elements on a website, including headlines, images, calls-to-action, and more. By continually testing and refining different elements, bloggers can improve the performance of their website over time.

Responding to Audience Feedback

Finally, bloggers should always be open to feedback from their audience. Whether it’s through comments, social media, or other channels, feedback can provide valuable insights into what readers are looking for and how to improve the website.

Bloggers should take the time to respond to comments and engage with their audience, showing that they value their feedback and are committed to providing high-quality content. By listening to their audience and making changes based on their feedback, bloggers can build a loyal following and establish themselves as authorities in their niche.

Frequently Asked Questions

What are the essential steps to create a profitable blog in 2024?

To create a profitable blog in 2024, it is essential to focus on a specific niche and create high-quality content that resonates with your target audience. You should also optimize your blog for search engines, promote your content on social media, and build a loyal following. Additionally, monetization strategies such as affiliate marketing, sponsored content, and digital products can help generate revenue.

Which blogging platforms are most effective for monetization this year?

WordPress, Blogger, and Squarespace are popular blogging platforms that offer various monetization options. WordPress is the most flexible platform and offers a wide range of plugins and themes for monetization. Blogger is easy to use and integrates with Google AdSense for advertising revenue. Squarespace is a premium platform that offers built-in e-commerce features for selling digital and physical products.

What strategies can beginners use to earn money from blogging?

Beginners can use strategies such as affiliate marketing, sponsored content, and digital products to earn money from blogging. Affiliate marketing involves promoting other people’s products and earning a commission on sales. Sponsored content involves partnering with brands to create content in exchange for payment. Digital products such as e-books, courses, and printables can be sold on your blog to generate revenue.

How can personal life experiences be monetized through blogging?

Personal life experiences can be monetized through blogging by sharing your story and offering advice to others who may be going through similar situations. You can also create digital products such as e-books or courses that offer guidance and support. Additionally, sponsored content and affiliate marketing can be used to promote products and services related to your personal experiences.

What are the fastest methods to achieve revenue from blogging in 2024?

The fastest methods to achieve revenue from blogging in 2024 are affiliate marketing and sponsored content. Affiliate marketing allows you to earn a commission on sales of products or services that you promote on your blog. Sponsored content involves partnering with brands to create content in exchange for payment. Both of these methods can generate revenue quickly, but it is important to ensure that they align with your blog’s niche and values.

How long typically does it take for a blog to start generating $1000 per month?

The time it takes for a blog to start generating $1000 per month varies depending on factors such as niche, content quality, and marketing efforts. Some bloggers may start generating revenue within a few months, while others may take several years. It is important to focus on creating high-quality content, building a loyal following, and implementing effective monetization strategies to increase your chances of success.

Real Estate Trends To Expect in 2024

As the year 2024 begins, many are hopeful for a better housing market after a challenging year in 2023. The previous year saw record-low home sales, one of the worst housing shortages in recent history, and the highest mortgage rates in over two decades. However, the housing market in 2024 is expected to show some potential for improvement, with the possibility of stabilized or even lower mortgage rates, a rise in accessory dwelling units, an increase in remote work, and the availability of real estate crowdfunding and private equity funds.

Despite the potential for improvement, the U.S. housing market continues to face challenges. The persistent low housing inventory remains a major issue, with the U.S. needing to supply around 3.2 million more homes to meet demand. This is due in part to a construction lag following the 2008 housing crash, as builders built homes at a slower pace to avoid getting stuck with inventory they couldn’t sell. Additionally, recent supply and labor shortages, along with higher interest rates, have made building more expensive.

The resale market isn’t much better, with existing U.S. homes for sale falling to a 13-year low of 3.79 million in October 2023. The high mortgage rates, reaching over 8% for the first time since 2000, have priced many out of the market. Many homeowners are also refusing to sell and give up their fixed low-rate mortgages, further constraining housing supply, also known as the “lock-in effect.”

However, assuming mortgage rates fall, housing sales could pick up, making homes more affordable and freeing up existing homes held captive by the lock-in effect. The consensus among experts is that mortgage rates will decline gradually across 2024, landing somewhere between 6.1% and 6.6% by the end of the year. Despite this, high home prices and low housing affordability will still be major challenges in 2024, with the median home sales price as of Q4 2023 being $431,000.

Nevertheless, the rise of accessory dwelling units (ADUs), remote work, and crowdfunding opportunities provides potential silver linings for real estate investors in 2024. Investors can capitalize on the trend of loosening zoning regulations to allow a wider variety of residential housing, such as ADUs, to increase housing supply. The demand for housing outside of urban areas and the demand for coworking spaces inside urban areas may also increase due to the rise of remote work. Additionally, real estate crowdfunding and private equity funds offer alternatives for investors to get exposure to residential real estate without the high upfront cost and hands-on management. As a real estate investor in 2024, now may be the time to double down on creative investing strategies that take advantage of these opportunities.

Related content:

- Investing in Real Estate Rental Properties and REITs

- Investing in Real Estate Crowdfunding

- What an Interest Rate Hike Means for Homebuyers

- The Impact of AI on Real Estate Sales

- Real Estate Trends To Expect in 2024

Frequently Asked Questions

What is the expected growth rate of the real estate market in the next five years?

The projected growth rate of the real estate market over the next five years is expected to be moderate. According to recent market reports, the growth rate is expected to be around 3-4% annually. However, this projection may vary depending on several factors, including the overall state of the economy, interest rates, and government policies.

How will commercial real estate change in the near future?

The commercial real estate market is expected to experience significant changes in the near future. With the rise of remote work and e-commerce, there is a growing demand for flexible office spaces, warehouses, and distribution centers. Additionally, the use of technology in commercial real estate is expected to increase, with more companies adopting smart building technology and the Internet of Things (IoT).

What are the indicators of a potential housing market downturn?

Several indicators can suggest a potential housing market downturn, including a decrease in home sales, an increase in foreclosures, and a rise in mortgage delinquencies. Additionally, a decrease in housing prices and a slowdown in new construction may also indicate a downturn in the housing market.

What factors are contributing to the current trajectory of Florida’s real estate prices?

Several factors are contributing to the current trajectory of Florida’s real estate prices, including population growth, low interest rates, and a strong economy. Florida’s desirable climate and lifestyle also attract many retirees and second-home buyers, driving up demand and prices in certain areas.

Is now a strategic time to purchase a home considering the economic forecast?

The answer to this question depends on individual circumstances and goals. For those who are financially stable and looking to invest in a home for the long term, now may be a strategic time to purchase a home. However, those who are uncertain about their financial future or planning to move in the near future may want to wait and monitor the market.

What are the trends in residential property sales in major Florida cities like Miami?

In major Florida cities like Miami, residential property sales are experiencing steady growth. According to recent data, Miami’s real estate market is expected to continue growing, with an increase in both sales volume and prices. Additionally, the luxury market in Miami is also experiencing growth, with high-end properties selling quickly and at record prices.

50/30/20 Budget Rule: How to Manage Your Finances Effectively

Managing your finances can be a daunting task, but with the help of the 50/20/30 budget rule, it can become much simpler. Popularized by U.S. Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan, this rule divides your after-tax income into three categories of spending: 50% on needs, 30% on wants, and 20% on savings.

By following this intuitive and straightforward rule, you can create a reasonable budget that you can stick to over time, helping you to meet your financial goals. The 50/20/30 rule is designed to help individuals balance paying for necessities while being mindful of long-term savings and retirement, making it an effective template for managing your money.

50%: Needs

To ensure you are meeting your basic survival needs, it is recommended that you allocate 50% of your after-tax income towards necessities. This includes expenses such as rent or mortgage payments, car payments, groceries, insurance and health care, minimum debt payments, and utilities. If you find yourself spending more than 50% on needs, it may be necessary to cut back on wants or downsize your lifestyle. Consider options such as carpooling or taking public transportation, cooking at home more often, or moving to a smaller home or more modest car. By prioritizing your needs, you can ensure that you are meeting your basic living expenses without overspending.

30%: Wants

When it comes to your spending, wants are all the things that you don’t necessarily need, but that make life more enjoyable. This category includes optional expenses like going out to eat, attending sporting events, and traveling for leisure. It also includes upgrade decisions, such as buying a more expensive steak or purchasing a luxury car.

Examples of wants include new clothes or accessories, tickets to events, vacations, and the latest electronic gadgets. If you find that you’re spending too much on wants, it may be worth reevaluating your priorities and finding ways to cut back.

When it comes to wants, it’s important to find a balance between enjoying life and being financially responsible. You can still indulge in your wants, but it’s important to do so within your means. Consider setting a budget for your wants and sticking to it, or finding ways to enjoy the things you love without spending as much money.

20%: Savings

Allocating 20% of your net income to savings and investments is a sound financial strategy. It is recommended that you keep at least three months’ worth of emergency savings in case of unexpected events such as job loss or medical emergencies. Once you have established your emergency fund, focus on saving for retirement and meeting other long-term financial goals.

There are various ways to save and invest your money, including:

- Creating an emergency fund

- Making IRA contributions to a mutual fund account

- Investing in the stock market

- Setting aside funds to buy physical property for long-term holding

- Making debt repayments beyond minimum payments

If you ever need to use your emergency funds, it is important to prioritize replenishing the account with additional income. By following these practices, you can ensure a secure financial future for yourself.

Importance of Savings

Savings play a crucial role in achieving financial stability and security. The 50-20-30 rule is a helpful guideline to manage your after-tax income, with a focus on creating an emergency fund and saving for retirement. By prioritizing an emergency fund, you can be prepared for unexpected expenses, such as job losses or medical emergencies. Once the emergency fund is established, it’s important to continue replenishing it.

Saving for retirement is also essential, especially as people are living longer. By calculating how much you will need for retirement and starting to save at a young age, you can ensure a comfortable retirement. It’s never too early to start saving, and even small contributions can add up over time.

Despite the high levels of debt in the United States, it’s important to prioritize savings to achieve financial stability and security. By following the 50-20-30 rule and focusing on emergency funds and retirement savings, you can take control of your finances and secure your future.

Benefits of the 50/30/20 Budget Rule

Following the 50/30/20 rule can provide numerous benefits for your financial well-being. Here are some of the advantages you can expect:

- Ease of Use: The 50/30/20 rule provides a simple and easy-to-understand framework for budgeting. You can allocate your income without the need for complex calculations, making it accessible for even the least financially-savvy individuals.

- Achieve Financial Balance: By using a budget, you can manage your money in a balanced way. You can ensure that your essential expenses are covered, have money for discretionary spending, and actively save for the future. This way, you can save for your future, meet your current needs, and still have some fun with your finances.

- Prioritize Essential Expenses: The 50/30/20 rule ensures that you prioritize your fundamental needs without overspending or taking on excessive debt. By allocating half of your budget towards essential expenses, you can guarantee that your basic needs are met.

- Emphasize Saving Goals: Allocating 20% of your income to savings can help you establish an emergency fund, prepare for retirement, pay off debt, invest, or pursue other financial goals. Consistently saving this amount can help you build sound financial practices and create a safety net for unforeseen costs or future goals.

- Promote Long-Term Financial Security: By continuously setting aside 20% of your income for savings, you prioritize your financial future. This savings can help you accumulate wealth, meet long-term financial objectives, and provide financial security for you and your family in the short or long-term.

Remember that the 50/30/20 rule can be applied by anyone, regardless of income. However, it’s important to note that those with lower income or living in areas with a higher cost of living may need to adjust these percentages accordingly. By following these guidelines, you can achieve financial stability and security for your future.

How to Adopt the 50/30/20 Budget Rule

Track Your Expenses

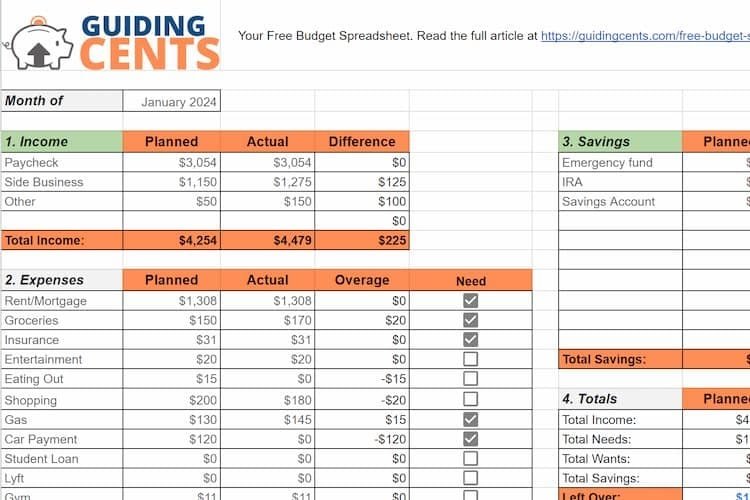

To effectively adopt the 50/30/20 budget rule, it is important to track your expenses. This will help you understand your spending habits and determine how well they adhere to the 50/30/20 breakdown. You can achieve this by classifying your expenses into needs, wants, and savings for a month or two. This will give you a clear picture of how far off your budget you are starting from. You can easily track your expenses using spreadsheet solutions such as Microsoft Excel.

Understanding Your Income

Understanding your income is key to adopting the 50/30/20 budget rule. You need to know your gross income and net income, as federal income taxes reduce what you take home. Knowing what you earn and what hits your bank account each pay period will help you establish the correct budget amounts for the three categories.

Identify Your Critical Costs

Identifying your critical costs is crucial when adopting the 50/30/20 budget rule. These costs include non-negotiable expenses such as rent or mortgage payments, utilities, groceries, transportation expenses, insurance premiums, and debt repayments. Since these expenses may take up the largest portion of your budget, it’s important to be mindful of them. You have the least amount of flexibility once you commit to these expenses. For instance, locking into a rental agreement may require a six-month or 12-month requirement.

Automate Your Savings

Automating your savings is a great way to simplify the process. You can set up monthly automated payments from your checking account to your investment or savings accounts. This guarantees that your funds increase steadily without requiring manual labor. Automating your savings also makes it easier to regularly review your budget to ensure it aligns with your lifestyle and financial objectives as there is less administrative burden to manage your savings.

Maintain Consistency

To successfully adopt the 50/30/20 budget rule, consistency is key. Stick to your spending strategy over time and resist the urge to go over budget or depart from your percentage allocations. Like any other form of budget, this plan is often most successful when there are clear guidelines that can be leveraged every month. Be mindful to reset your spending limits each month and strive to maintain consistency from one period to the next.

Example of the 50/30/20 Budget Rule

If you are looking for a simple and effective way to manage your finances, the 50/30/20 budget rule can be a great option. This budgeting method suggests allocating 50% of your after-tax income to essential expenses, 30% to discretionary expenses, and 20% to savings and debt repayment.

To apply this rule, start by tracking your expenses for a month. Use a budgeting app to automatically categorize your expenses into needs, wants, and savings. Then, calculate your monthly after-tax income, which will serve as the basis for allocating your budget.

For example, if your after-tax income is $3,500 per month, you would allocate $1,750 (50%) to cover your essential expenses like rent, utilities, groceries, transportation, and student loan payments. You would then allocate $1,050 (30%) to discretionary items like dining out, entertainment, and clothing. Finally, you would allocate $700 (20%) each month to retirement and savings.

Once you have set up your budget, it is important to remain disciplined and consistent. Consider setting up an automatic transfer from your checking account to your savings account on your payday to make saving effortless.

As your income or expenses change, it is important to reevaluate your budget and adjust as needed. For example, if you are promoted and your income increases, you may want to allocate more to savings or discretionary expenses. If you find that your transportation expenses are higher than expected, you may want to consider carpooling or using public transportation to reduce costs.

By following the 50/30/20 budget rule and regularly evaluating your progress toward your goals, you can take control of your finances and prioritize your financial well-being.

Related content:

- Strategies for Savings and Investing in a Volatile Market

- Is It Better to Buy a New or Used Car?

- 10 Ways To Get Out Of Debt This Year: Expert Tips

- Easy Ways To Earn Free Amazon Gift Cards

- How Much You Really Need to Be Financially Independent?

Can You Adjust the Percentages in the 50/30/20 Rule to Fit Your Needs?

Yes, you have the flexibility to modify the percentages in the 50/30/20 rule to better suit your financial goals and circumstances. For instance, if you live in an area with a higher cost of living, you may need to allocate more than 50% towards necessities. Alternatively, if you have ambitious retirement saving goals, you may need to adjust the 20% towards savings and investments. Remember, the 50/30/20 rule is a guideline, and you can modify it to fit your unique needs.

Should You Include Taxes in the Calculation of the 50/30/20 Rule?

The 50/30/20 rule usually excludes taxes since it focuses on allocating income after taxes. It’s important to consider your after-tax income when applying the rule. If you choose to factor in taxes, make sure to use gross income and accurately forecast your taxes.

How to Budget Effectively with the 50/30/20 Rule

To successfully budget with the 50/30/20 rule, you need to keep track of your expenses, prioritize necessary expenses, be mindful of your wants, and consistently allocate savings or debt repayment within the designated percentage.

| Category | Percentage |

|---|---|

| Essential Needs | 50% |

| Wants | 30% |

| Savings/Debt Repayment | 20% |

- Keep track of all your expenses

- Prioritize your essential needs such as housing, food, utilities, and transportation

- Be mindful of your wants and allocate 30% of your budget towards them

- Allocate the remaining 20% towards savings or debt repayment

- Regularly evaluate your spending and adjust accordingly

Can You Use the 50/30/20 Rule for Long-Term Goals?

Yes, you can use the 50/30/20 rule to save for long-term goals. Set aside a portion of the 20% for savings specifically for your long-term goals, such as a down payment on a house, education funds, or investments. This rule is designed to help you prioritize your savings goals.

The Bottom Line

Following the 50-20-30 rule can give you a clear plan for managing your after-tax income. By limiting your wants to 30%, you can allocate more funds towards important areas such as emergency savings and retirement. It’s important to enjoy life, but having a plan and sticking to it will help you cover your expenses and save for retirement while doing the things that make you happy. Remember, unexpected expenses can arise at any time, so having emergency savings is crucial. By following this rule, you can ensure that you’re taking care of your finances while still enjoying life to the fullest.